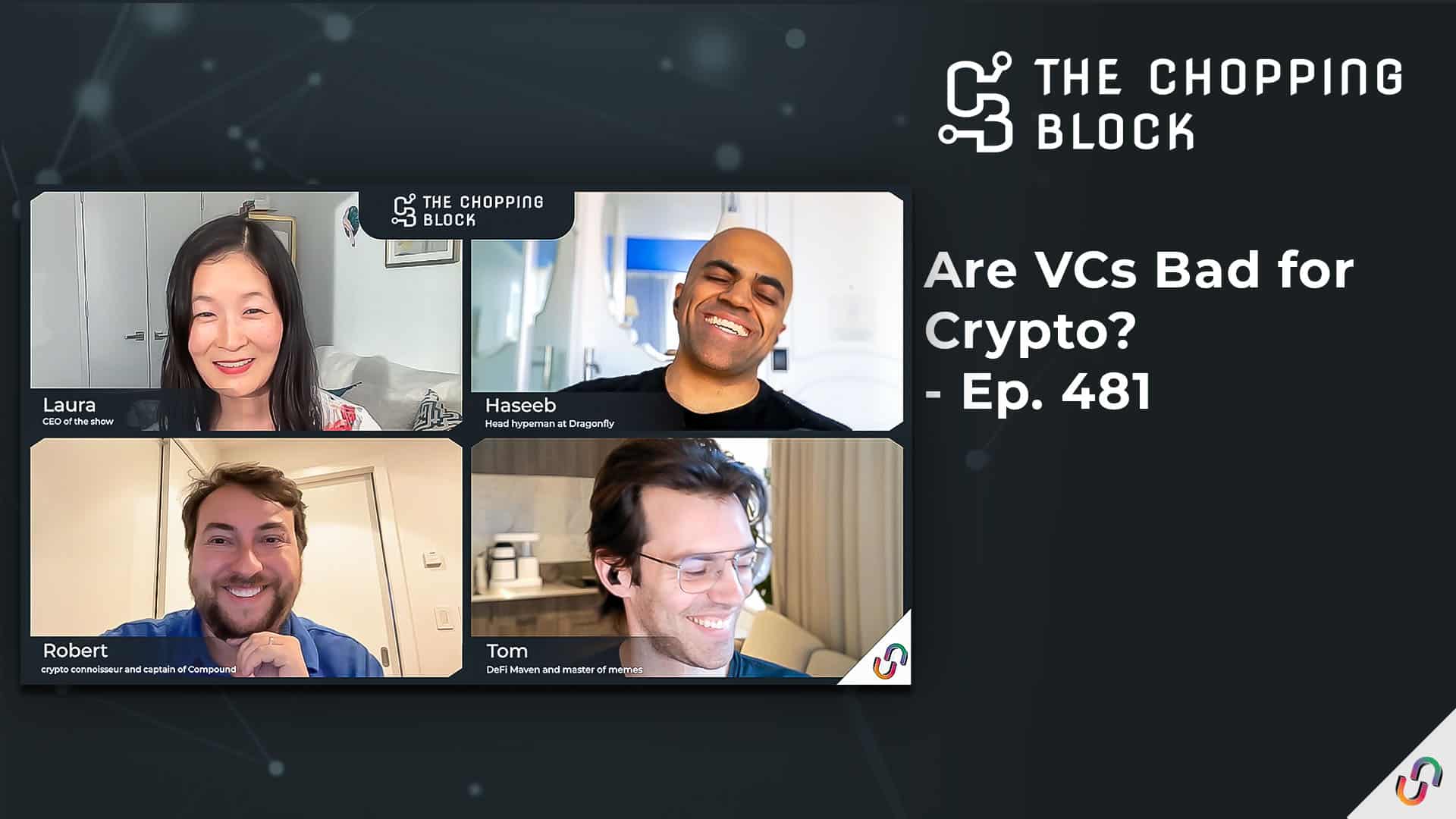

Welcome to “The Chopping Block” – where crypto insiders Haseeb Qureshi, Tom Schmidt, and Robert Leshner chop it up about the latest news. In this episode, they’re joined by Unchained’s Laura Shin to debate FTX revival rumors, what the U.S. Treasury got wrong about DeFi, and whether VCs are antithetical to crypto’s core principles.

Listen to the episode on Apple Podcasts, Spotify, Overcast, Podcast Addict, Pocket Casts, Stitcher, Castbox, Google Podcasts, TuneIn, Amazon Music, or on your favorite podcast platform.

Show highlights:

- how much ETH is getting unstaked and deposited after Shapella

- the market reaction following the successful implementation of the upgrade

- whether FTX could reopen after its massive collapse

- why Robert thinks rebooting the exchange is a “terrible” idea

- whether FTX could do the same thing as Bitfinex and issue a debt token for creditors

- how the U.S. government misunderstands decentralized finance, in stark contrast with regulators from other parts of the world

- whether DeFi front-ends should be subject to the Bank Secrecy Act

- whether VCs go against the principles of crypto

- the difference between democratizing finance and democratizing fundraising

Hosts

- Haseeb Qureshi, managing partner at Dragonfly

- Robert Leshner, founder of Compound

- Tom Schmidt, general partner at Dragonfly

Guest

- Laura Shin, author, and CEO of Unchained

Disclosures

Links

Shapella:

- Previous coverage of Unchained on the upgrade:

- Unchained:

- Nansen: The Shanghai Upgrade Dashboard

- CoinDesk: What’s Next After the Ethereum Shanghai Upgrade Known as Shapella

FTX:

Treasury Report: