The recent approval to list spot Ethereum ETFs in the US has come in the midst of multiple ongoing legal battles between crypto companies and the U.S. Securities and Exchange Commission (SEC) regarding Ethereum’s native token ether (ETH).

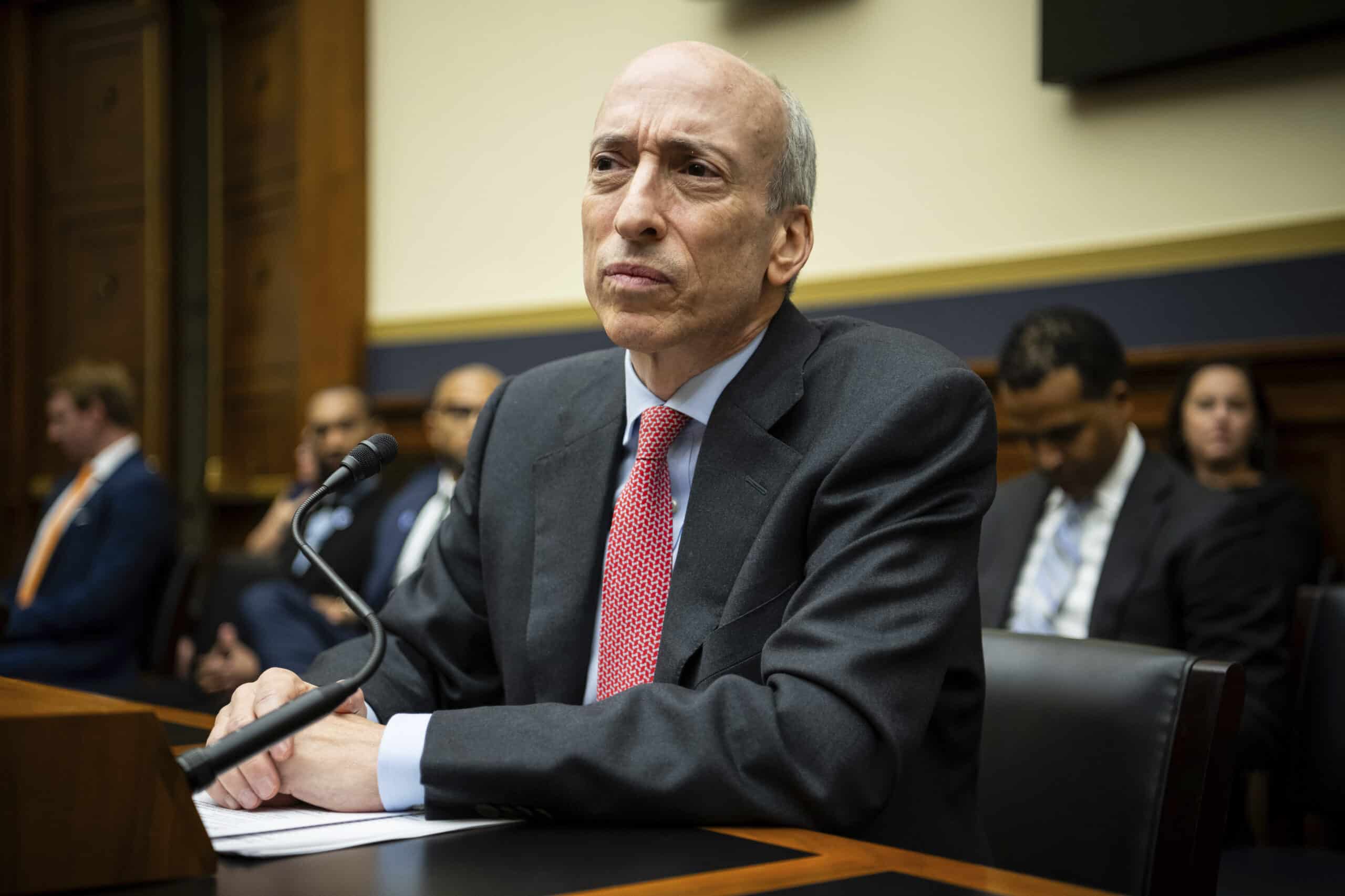

The greenlight for spot ether ETFs could bolster those crypto companies in their ongoing battles with Gary Gensler’s commission, however, the approvals have still left room open for the SEC to make an issue out of transactions involving ether, if it wants to.

Newfound Clarity for ETH?

Ether has faced scrutiny from the agency on multiple occasions. In March, Fortune reported that the Ethereum Foundation had received subpoenas after transitioning to a proof-of-stake model in September 2022. This transition, according to sources familiar with the SEC’s investigation, provided the agency “with a new pretext to attempt to define Ethereum as a security.” While software company Consensys filed a lawsuit against the agency, challenging the SEC’s determination that ether is a security after receiving Wells notices.

The SEC’s current chair Gensler has been famously vague on whether ether’s status is a security or a commodity — recent investigations by the agency have pointed to the agency believing ether to be a security. (Technically, since tokens themselves cannot be securities the way that oranges in the famous Howey test are not inherently securities, the matter is whether transactions involving tokens implicate securities laws.) Now with the spot ether ETF approvals, the SEC has made ether’s status as a commodity much clearer via its issuance order for the Ethereum ETFs products, referencing the funds as “commodity-based trust shares.”

An SEC spokesperson declined to comment on the status of ether and whether it is a security or a commodity.

Read More: The U.S. vs. Crypto: Jake Chervinsky on Crypto’s Legal and Regulatory Status

A Boon for Crypto Companies in Their Battles Against the SEC

For companies currently under SEC scrutiny, such as Consensys, Uniswap Labs, and Coinbase, this recent clarity could provide a strategic advantage.

“I would expect Consensys and others who are in the middle of enforcement matters/investigations with the SEC would point to this and say that the SEC, in approving this, has implicitly acknowledged yet again that ether is a commodity, that is inconsistent with it being a security and as a result that the SEC should not be able to pursue an enforcement action alleging that ether was sold as a security,” said Sam Enzer, a partner at Cahill Gordon & Reindel, in an interview with Unchained.

Zachary Fallon, a partner at law firm Ketsal, explained in an email that the approval can be seen as a change in the SEC’s stance, which could influence ongoing and future actions against digital asset intermediaries, plus be used to the advantage of crypto firms caught in the SEC’s crosshairs.

Too Soon to Celebrate?

Meanwhile Ladan Stewart, partner at White & Case and who most recently led the SEC’s specialized crypto trial unit, believes that the ether ETF approvals will not cause any significant changes to the SEC’s current enforcement docket.

“If the SEC determines that ether is not a security and finally provides that clarity to the industry, we may see resolutions of some pending SEC investigations. The industry and the SEC staff will have more room to negotiate if ether is officially out of the SEC’s purview,” she told Unchained via email.

Stewart’s perspective highlights that while the approval of ether ETFs might reduce some regulatory uncertainty, it does not entirely eliminate the SEC’s capacity to pursue actions related to how ether is transacted.

The offers and sales of ether can still implicate federal securities laws even if ether itself is not a security, said Ketsal’s Fallon.

A core test for examining whether something is a securities transaction is the Howey Test, which is a four-prong test introduced in 1946. If the asset is an “investment of money in a common enterprise, with a reasonable expectation of profits to be derived from the efforts of others,” then it is considered a security. So each of these cases will need to be looked at on a case-by-case to see how ether was transacted.

Read more: The ‘Howey Test’ and the Debate Over Crypto’s Legal Status

The SEC Still Has Room to Maneuver

Enzer also points out that the ETF order was signed by the SEC’s Division of Trading and Markets under delegated authority. “This means the commission of the SEC could still revisit the determination,” he said, referring to the group of commissioners who lead the SEC, plus the chair. “The positive part is that the order implies that the division views ether as a commodity. However, this doesn’t necessarily mean the commission shares this view.”

One of the SEC’s Wells notice against Consensys cited issues with MetaMask staking, which partners with liquid staking providers Lido and RocketPool. The agency is yet to provide clarity on staking, or staked ether, and this could present another avenue for Gensler to pursue in the cases against crypto companies.

“From the coin’s perspective…that’s another indicia that under the Howey test, the investing public is anticipating profits based on the efforts of others,” said Gary Gensler, in a September 2022 interview with the Wall Street Journal, not referring to any one specific cryptocurrency at that time.

The SEC’s approval of spot ether ETFs signals a potential shift in regulatory sentiment. Whether or not this marks a permanent shift or a temporary one will depend on future political developments.

“It’s going to be interesting to see whether or not this reflects a sea change in how the SEC approaches enforcement or if it’s just a temporary thing while we’re moving into the presidential election,” Enzer said.