At presstime, crypto users had locked about $5.4 billion in total value in protocols and applications native to Solana, a nearly 250% increase since the first day of 2024, data from DefiLlama shows.

The top 16 projects on Solana by total value locked (TVL) have all grown their locked value in both the past 24 hours, seven days, and thirty days, with liquid staking provider Jito and restaking protocol Solayer leading the pack. In July, Jito’s TVL increased from nearly $1.7 billion to $2.1 billion, while Solayer’s has gone from $67.8 million to roughly $153.7 million.

According to Gurnoor Narula, a research analyst at venture capital firm Placeholder, outside of the price appreciation of SOL — which has jumped almost 66% since Jan. 1, according to CoinGecko — the rise in Solana’s TVL stems from Solana’s parallelization abilities which allow multiple transactions to get processed at the same time.

Read More: Solana Reaches a Near Two-Year High in Daily Transactions After Launch of Blinks

“A higher and cheaper [transaction per second] translates to a new class of applications that don’t have a large cost per interaction, hence the growth in memecoin trading, new user adoptions, etc,” Narula told Unchained. “Given that, Solana’s TVL will naturally grow with a lot of smaller accounts rather than a bunch of whales.”

Stablecoins Like PayPal’s PYUSD Growing

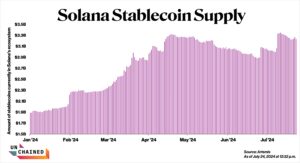

Helping bolster Solana’s TVL increase has been the influx of new capital entering the ecosystem — in particular, in the form of stablecoins. Specifically, people and entities are using key assets in traditional finance such as cash, US treasury bonds, and other cash equivalents to mint stablecoins on Solana, likely to conduct peer-to-peer and business-to-business transfers.

At the beginning of 2024, Solana’s supply of stablecoins, which consisted of USDC, USDT, and EURC, stood at $1.9 billion. Since then, the figure has jumped 71% to $3.2 billion, according to onchain data firm Artemis. FinTech giant PayPal rolled out its stablecoin PYUSD on Solana on May 29 and since then, PYUSD’s supply on the network has grown to $233.3 million.

Read More: Solana Has Cemented Itself in “Crypto’s Big Three,” Per Trading Firm GSR

“Stablecoins themselves are the greatest example of mass proliferation of tokenization we’ve seen and with Solana’s speed, it enables a new class of micro-interaction type applications for which stablecoins can be utilized as a medium of payment,” Narula added.

More Capital, More Activity

Rising network activity reflected in fees and weekly active addresses has also coincided with the increased amount of funds circulating within Solana.

Not only has Solana broken its all-time high in weekly active addresses, crossing the 10 million mark in July for the first time in its history, but the four-year-old network is also generating substantially more fees compared to the start of the year. In the first two months of 2024, Solana only had one day where fees exceeded $1 million, per Artemis. But in the close to five months since then, Solana has had 132 days when its fees surpassed $1 million, and only 13 days when its fees were below that figure.

“Solana has shown major adoption and continues to mature, overcoming technological growing pains and highlighting the potential of high-throughput, monolithic architectures,” wrote the Franklin Templeton Digital Assets team on X on Tuesday.

The price of SOL has risen in tandem with this year’s increase in activity on the network. Since Jan. 1, the price of SOL has jumped from $109.44 to $181.31, giving it a market cap of $84 billion at presstime.