Stablecoins have emerged as a popular type of cryptocurrency in the crypto lending markets, enabling tokenholders to earn interest in the centralized and decentralized crypto lending markets while remaining largely unaffected by crypto market volatility.

This guide will teach you how to earn interest on stablecoins in the CeFi and DeFi lending markets.

What Are Stablecoins?

Stablecoins are cryptocurrencies whose value is pegged to a traditionally stable asset, such as the US dollar or gold, to maintain price stability.

Stablecoins combine the best of the traditional and crypto-finance worlds by offering the price stability and brand recognition of traditional assets, such as the US dollar, and the accessibility and programmability of cryptocurrency.

Do Stablecoins Pay Interest?

Unlike fiat currency held in a bank account, stablecoins don’t pay interest natively when you hold them in your crypto wallet. To earn interest on your stablecoin holdings, you must deposit them in either a centralized lending platform or a decentralized lending protocol.

How to Earn Interest on Stablecoins

Let’s take a look at how you can earn interest on stablecoins on centralized (CeFi) and decentralized finance (DeFi) platforms.

DeFi Lending

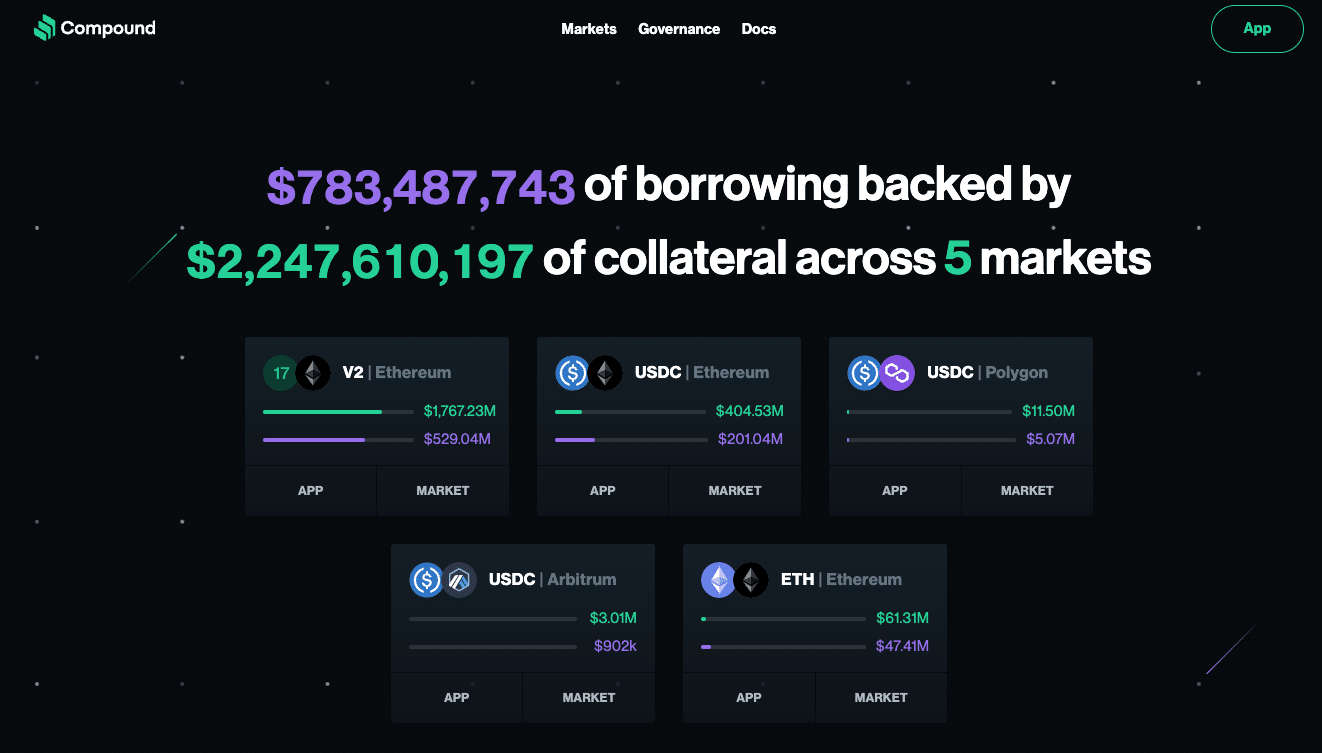

DeFi lending protocols have no central authority and rely on smart contracts to manage the lending pools. You only need to connect your crypto wallet to the lending protocol and deposit your coins to start earning interest in the DeFi markets.

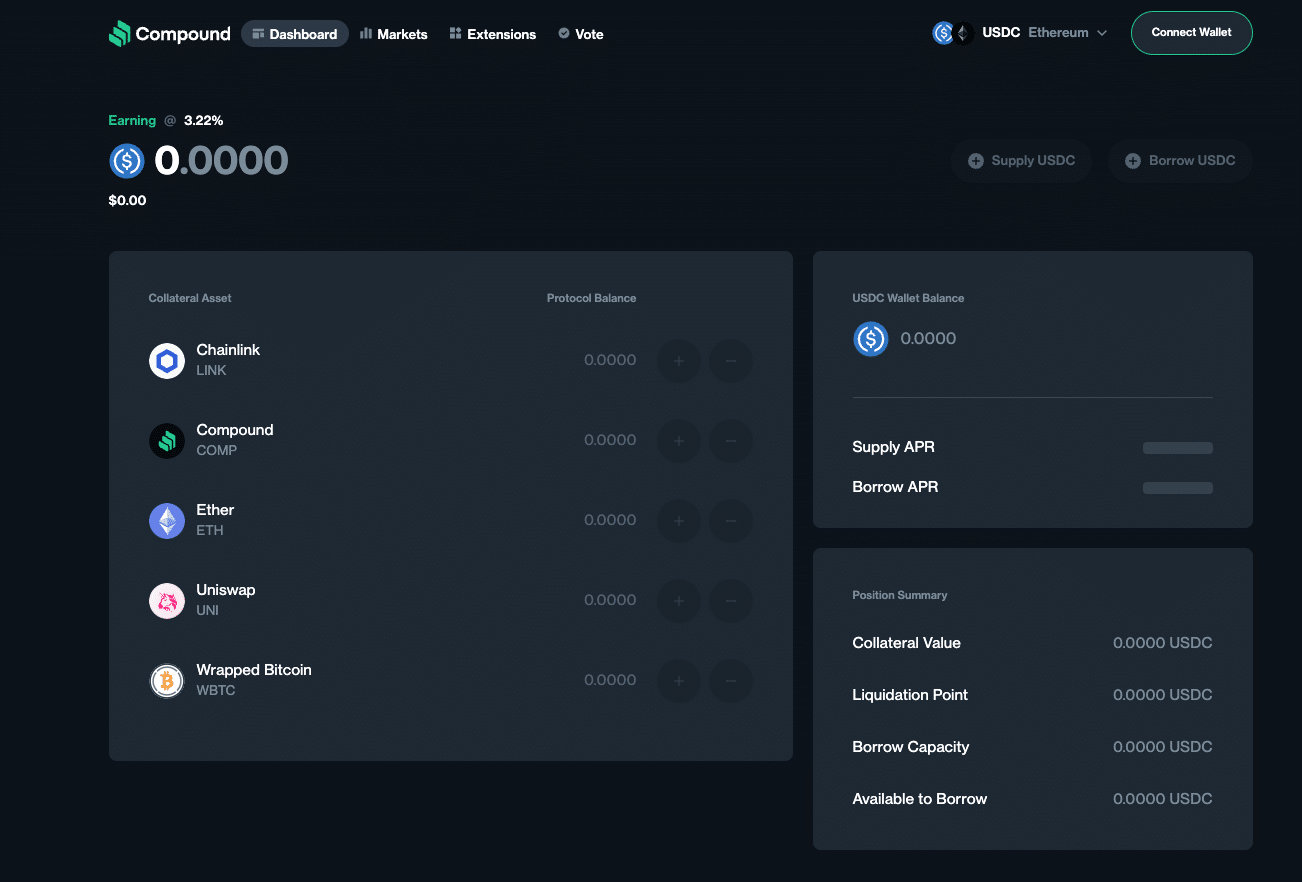

We will use Compound as an example to illustrate how you can earn interest on a DeFi lending platform in the following steps:

- Go to compound.finance.

- Select the App icon.

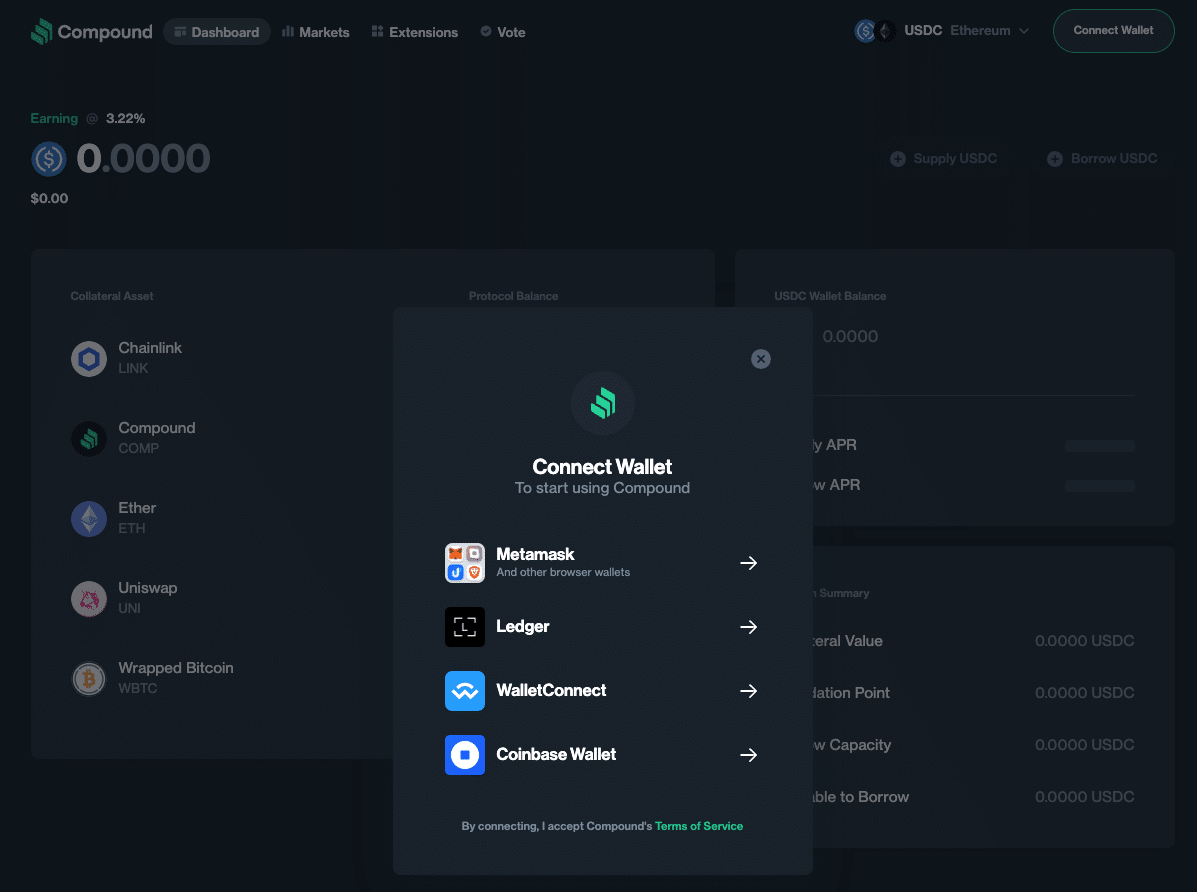

- Click the Wallet icon on the top right corner.

- Choose MetaMask (or another wallet of your choice) and connect your wallet to Compound.

- Click the stablecoin you want to earn interest on and choose the supply option to deposit coins into a lending pool.

- Confirm the transaction with your wallet and start earning interest immediately.

CeFi Lending

Centralized finance lending is similar to traditional financial platforms, where you must complete an onboarding process and a KYC check, and your funds are held with a central authority. The CeFi lending service provider takes control of the user’s assets and the borrower’s collateral for lending purposes.

In this example, we’ll use YouHodler to illustrate how you can earn yield on your stablecoin from a CeFi lending platform.

- Access YouHodler.com and create an account.

- Complete the KYC procedure.

- Click your profile on the top left and scroll down to security to add two-factor authentication.

- Open your crypto wallet and deposit your funds into your YouHolder account.

- Click on the start saving tab at the top of the wallet and choose your stablecoin to earn interest on.

- Agree to the savings reward agreement, and start earning interest on your coins.

DeFi vs. CeFi Stablecoin Lending: Pros and Cons

While lending stablecoins to earn interest while avoiding the high market volatility of crypto assets like BTC and ETH may sound very appealing, there are both benefits and drawbacks to lending stablecoins in the DeFi and CeFi markets. Let’s that a look at them.

DeFi Lending

Pros

- Fast and accessible with no credit checks needed.

- It’s a novel solution to providing funding for the unbanked population.

- Lending typically has high-interest rates compared to traditional saving systems.

- It’s non-custodial and gives users control over their funds.

Cons

- Interest rates can fluctuate quickly without warning due to market factors.

- The loans aren’t typically insured, and retrieving lost or stolen funds may be impossible.

CeFi Lending

Pros

- They have regulatory oversight that offers more stability and security for investors.

- Typically offer a wider range of services and assets.

- Allows users to remain in the crypto ecosystem while getting traditional finance benefits.

- Some platforms are insured and can compensate users in case of loss of funds due to hacks.

Cons

- Users have no control over their funds.

- In case of bankruptcy of the crypto lending platform, all funds may be lost.

The Bottom Line

While stablecoin lending can be a lucrative way to earn investment income in the crypto markets, it’s by no means a low-risk activity. Whether you are deploying capital in the centralized or decentralized lending markets, you need to be aware of the risks and only invest what you can afford to lose.