Arbitrage trading is a strategy used in financial markets where traders profit from small price discrepancies in an asset across different exchanges. The same strategy can also be applied to the crypto markets. This guide will help you understand what crypto arbitrage trading is, how it works, and the risks it entails.

What Is Crypto Arbitrage Trading?

Crypto arbitrage trading is a way to profit from price differences in a cryptocurrency trading pair across different markets or platforms.

Arbitrage traders aim to profit from the price differences by buying the cryptocurrency at a lower price in one market and simultaneously selling it at a higher price in another market.

Though this trading strategy started with traditional assets, it has become commonplace in the global crypto markets because cryptocurrencies are traded across several exchanges and countries worldwide. This makes cryptocurrencies potentially lucrative for arbitrage and allows traders to benefit from price discrepancies across these exchanges.

Imagine that BTC/USD is trading at $30,000/30,100 on Coinbase and at $30,200/$30,300 on Crypto.com. An arbitrage trader could quickly buy 1 BTC on the Coinbase exchange for $30,100 and simultaneously sell it on Crypto.com for $31,200, making a profit of $100.

How Does Crypto Arbitrage Trading Work?

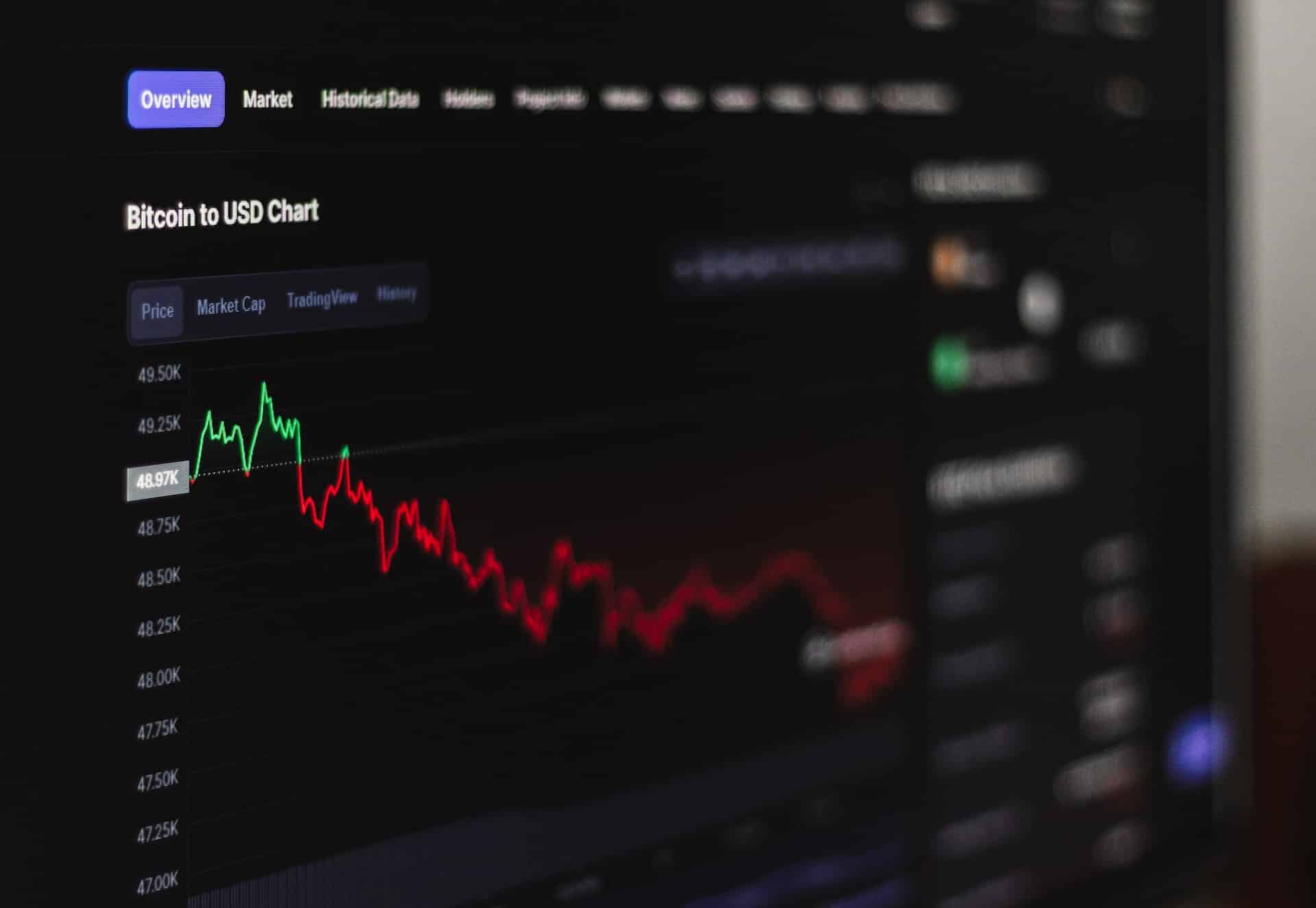

Crypto arbitrage trading involves making money from price differences of cryptocurrencies between different exchanges. Traders or, more commonly, algorithmic crypto trading bots monitor the prices of cryptocurrencies across various platforms and regions, seeking instances where the same cryptocurrency is priced differently on other exchanges.

When such a price gap is identified, traders move swiftly to gain on the opportunity.

Arbitrage trading is possible because of how exchanges determine cryptocurrency pairs’ prices. The common way prices are discovered on most exchanges is through an order book, which lists buy and sell orders for a specific crypto asset. Depending on the exchange, buyers and sellers might bid different prices, resulting in mismatched prevailing prices across exchanges.

An arbitrage opportunity arises when a significant price difference is detected for a specific cryptocurrency. You can then calculate the potential profit by considering trading fees and other associated costs. The last step in the process is to buy the cryptocurrency on the exchange where the price is lower and simultaneously sell on the exchange where the price is higher. In most cases, trading bots take care of this trading approach as they can determine arbitrate opportunities faster and execute trades quicker.

Types of Crypto Arbitrage Strategies

There are different types of strategies used in crypto arbitrage trading. Let’s take a look at some of the most common.

Triangular arbitrage: This strategy involves exploiting price discrepancies among three different cryptocurrencies traded in a triangular formation. For example, if there’s an arbitrage opportunity between BTC, ETH, and LTC, a trader could execute a series of trades to profit from the imbalances in their exchange rates.

Cross-exchange arbitrage: This method involves simultaneously buying and selling the same cryptocurrency on different exchanges. This can include moving assets between exchanges to take advantage of price differences.

Time arbitrage: It involves monitoring the same cryptocurrency on a single exchange to take advantage of price fluctuations within short timeframes. This strategy requires quick execution to capitalize on price movements in minutes.

Inter-exchange arbitrage: With this strategy, traders exploit price differences between trading pairs on the same exchange. Traders can identify correlated pairs and execute trades to capitalize on the mispricings.

Is Arbitrage Trading Risky?

Like any trading strategy, arbitrage trading also has risks. It’s possible to lose money due to slippage, trading fees, and unforeseen shocks in crypto price movements. Some of the risks to consider include:

Price Slippage: This is one of the most important considerations in arbitrage trading, particularly in fast-moving markets with high volatility. Slippage can lead to differences in the actual execution price and the expected price due to the rapid price changes between the time a trade is initiated and the time it is executed. If the price moves significantly between the moment a trader identifies an arbitrage opportunity and the moment the trade is executed, the expected profit might be smaller or result in a loss.

Transaction Fees: The accumulation of trading fees, withdrawal fees, and other overhead costs can impact the profitability of an arbitrage trade.

Execution Speed: Successful arbitrage trading relies on the quick execution of trades to capture price discrepancies. Delays in execution, whether due to technical glitches, slow internet connections, or exchange-related issues, can result in missed opportunities or losses.

Knowledge Gap: Like every trading strategy, successful arbitrage trading requires a deep understanding of the market and trading platforms. Without much experience, you might struggle to identify genuine opportunities or navigate the complexities of the process.

Arbitrage trading could be profitable with the proper understanding of how this strategy works and the right tool to execute it efficiently. But as always, do your own research and only deploy as much capital as you can afford to lose.