Cryptocurrency pair trading is a popular trading strategy in the crypto markets that enables traders to potentially generate trading revenue regardless of whether the market goes up or down. Read on to learn what crypto pair trading is and how it works.

What Is Crypto Pair Trading?

Before we delve into crypto pair trading, it is useful first to know what a trading pair is.

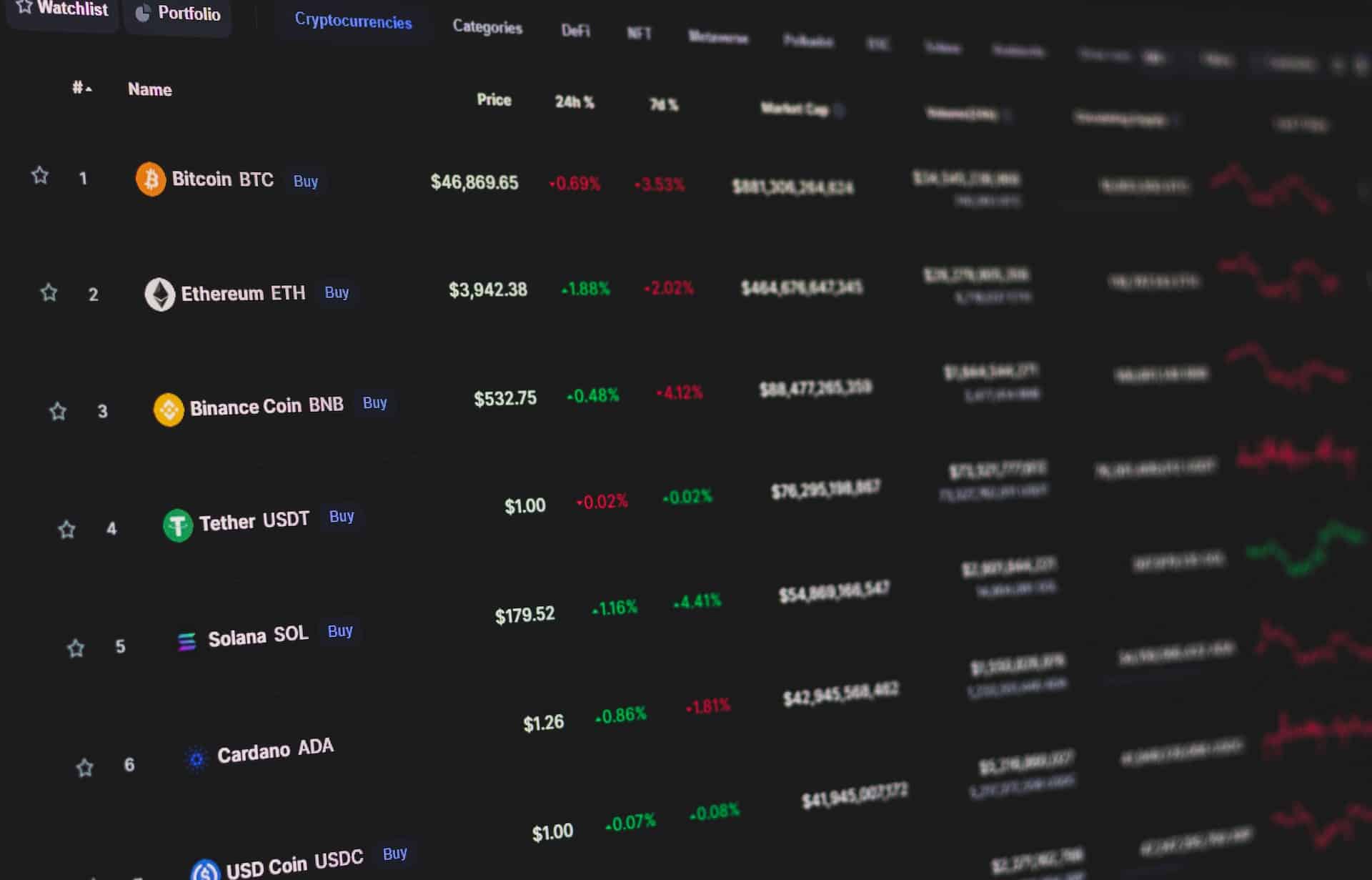

A trading pair is simply a set of two crypto assets that can be traded for each other on an exchange. For example, one of the most popular cryptocurrency pairs is BTC/USDT, which enables traders to trade their BTC for USDT.

Crypto pair trading is a trading strategy in crypto that entails simultaneously opening a long and short position on two highly correlated crypto pairs.

It’s a market-neutral strategy that lowers the risk of a trade by shorting one asset and going long another, allowing traders to reduce their risk in the volatile crypto markets.

How Does Cryptocurrency Pair Trading Work

Instead of identifying individual overperforming or underperforming cryptocurrencies, crypto pair trading tries to identify two highly correlated digital assets that are performing outside their historical range.

Once you identify a correlated trading pair, for example, ETH and BNB, the next step is to calculate a ratio or spread between the prices of the two cryptocurrencies. This is done by simply dividing the price of one crypto by the other on the pair, for example, ETH/BNB. This ratio is a representation of the relative value between the two assets.

You must establish the spread range to identify the trade’s potential entry and exit points. This is done by looking at the range within which the ratio has fluctuated in the past. When the ratio moves past the expected range, it indicates a good opportunity for opening a trade. If the ratio indicates that one of the trading pairs is overvalued compared to the other, buy the undervalued cryptocurrency and short-sell the overvalued one.

This strategy assumes that the ratio will return to its historical average. Therefore, traders close their positions when the ratio moves back to this mean by selling the undervalued cryptocurrency and buying back the overvalued one, thus making a profit.

Pair trading is a non-directional trading strategy. This means that you can apply the strategy whether the market is moving up or down. What matters is how the two correlated pairs perform against each other.

Crypto asset pair trading requires careful monitoring of market conditions and a robust understanding of the correlation dynamics between the selected cryptocurrency pairs. Most traders use a mix of technical indicators, statistical analysis, and historical performance to find potential trading opportunities.

The Pros and Cons of Crypto Pair Trading

As with any trading strategy, digital asset pair trading has unique pros and cons.

Pros

- The main reason why hedge funds, financial institutions, and other crypto market participants deploy crypto pair trading strategies is because it’s market-neutral. Crypto pair trading allows traders to potentially make profits regardless of the market’s direction – up, down, or sideways.

- It’s considered a low-risk strategy that appeals to traders with a low risk appetite in the volatile crypto market. It involves opening long and short positions, effectively hedging against market risks. It can help minimize losses if the entire market experiences a downturn.

- Pair trading allows traders to diversify their cryptocurrency portfolio by trading two correlated assets simultaneously. This can help reduce overall portfolio risk and exposure.

Cons

- Identifying two correlated assets requires a lot of knowledge and research. This entails keeping up with the latest news and trends for both assets, which can consume much time. Typically, you need a correlation of at least 0.80 for a pair trading to be successful. This can be very challenging to identify.

- Although crypto pair trading is deemed low risk, there are still risks involved (such as holding assets on exchanges).

- Crypto pair trading normally assumes that two trading pairs are correlated. However, the correlation may change over time. If the asset correlation breaks down, it can lead to losses.

Conclusion

Cryptocurrency pair trading is an effective trading strategy that relies on the belief that closely related digital assets will eventually return to a historical average after moving apart. It has the potential to generate profits regardless of market conditions.

However, it is important to carefully assess the correlation between the selected cryptocurrencies to avoid making incorrect assumptions that could lead to the strategy’s failure and incur losses. Moreover, you need to keep an eye on trading fees and consider the added risk of holding crypto assets on centralized exchanges if you are not trading on decentralized exchanges.