Crypto spot trading provides traders with a way to trade and invest in digital assets. Especially new crypto traders prefer spot trading over margin or derivatives trading as it offers a simpler trading experience, and you actually own the digital assets you buy.

This guide will teach you about spot trading in crypto and how it works.

What is Spot Trading in Crypto?

Spot trading in crypto is the process of buying and selling digital currencies and tokens at current market prices. The goal is to buy at prevailing market prices and then sell at a higher market price to generate a trading profit.

Unlike margin or futures trading, where traders bet on the upward or downward movement of cryptocurrency prices, spot trading allows traders to buy and sell the actual cryptocurrencies, providing ownership to buyers.

Having said that, spot trading shouldn’t be confused with investing or HODLing, as the aim of a spot trader is to make gains in the short term by regularly buying and selling cryptocurrencies to capitalize on price movements.

How Spot Trading Works in Crypto (With Screenshots)

The simplest way to engage in spot trading is to use a centralized exchange (CEX) or a decentralized exchange (DEX) to place the trade. CEXs often come with a simpler experience than DEXs, which makes them appealing to beginners.

Spot trading allows you to buy cryptocurrencies, such as Bitcoin (BTC) and Ether (ETH), with your local currencies or trade across several cryptocurrency trading pairs.

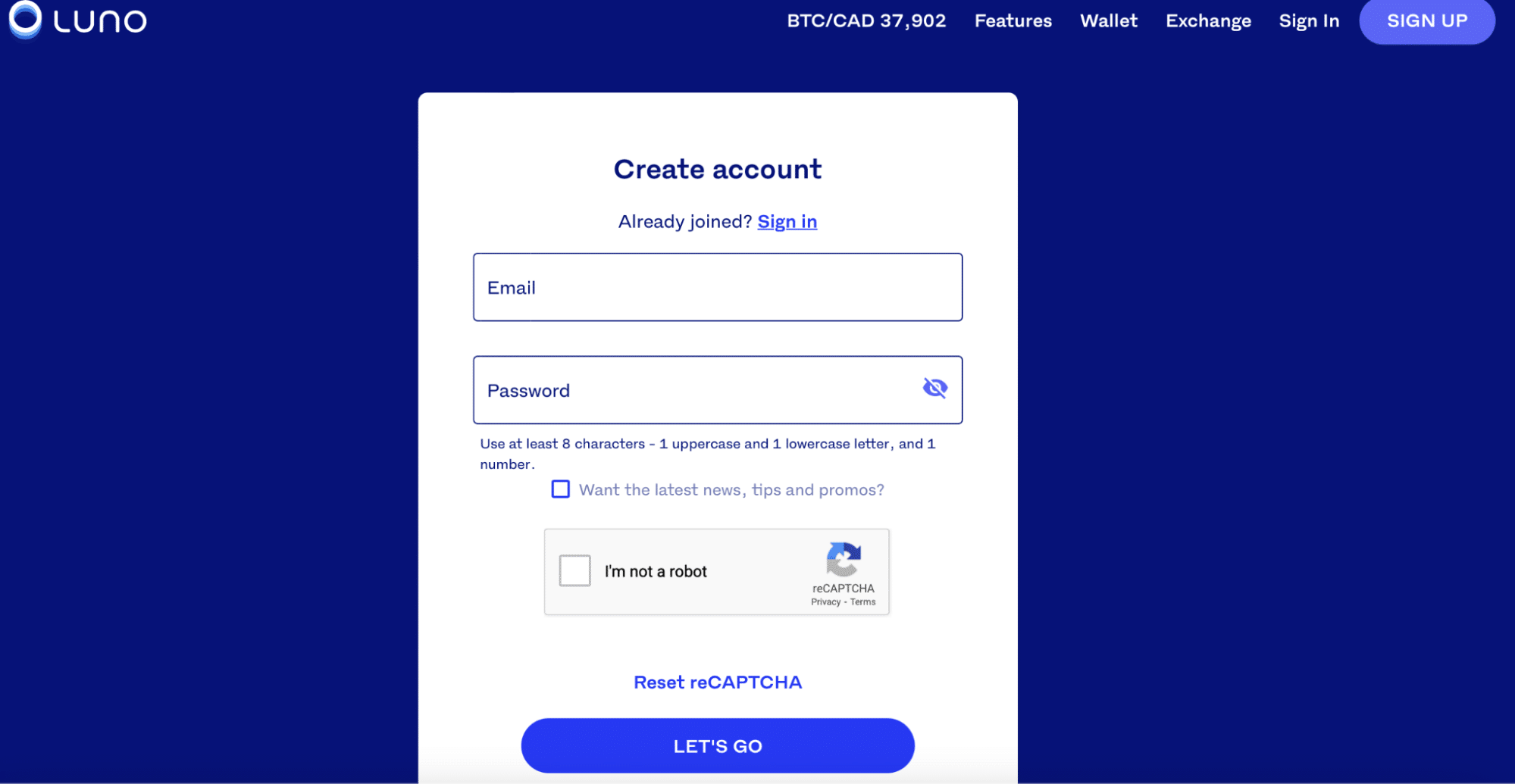

To trade crypto on the spot market, choose an exchange and set up an account. For this example, we chose the centralized exchange, Luno.

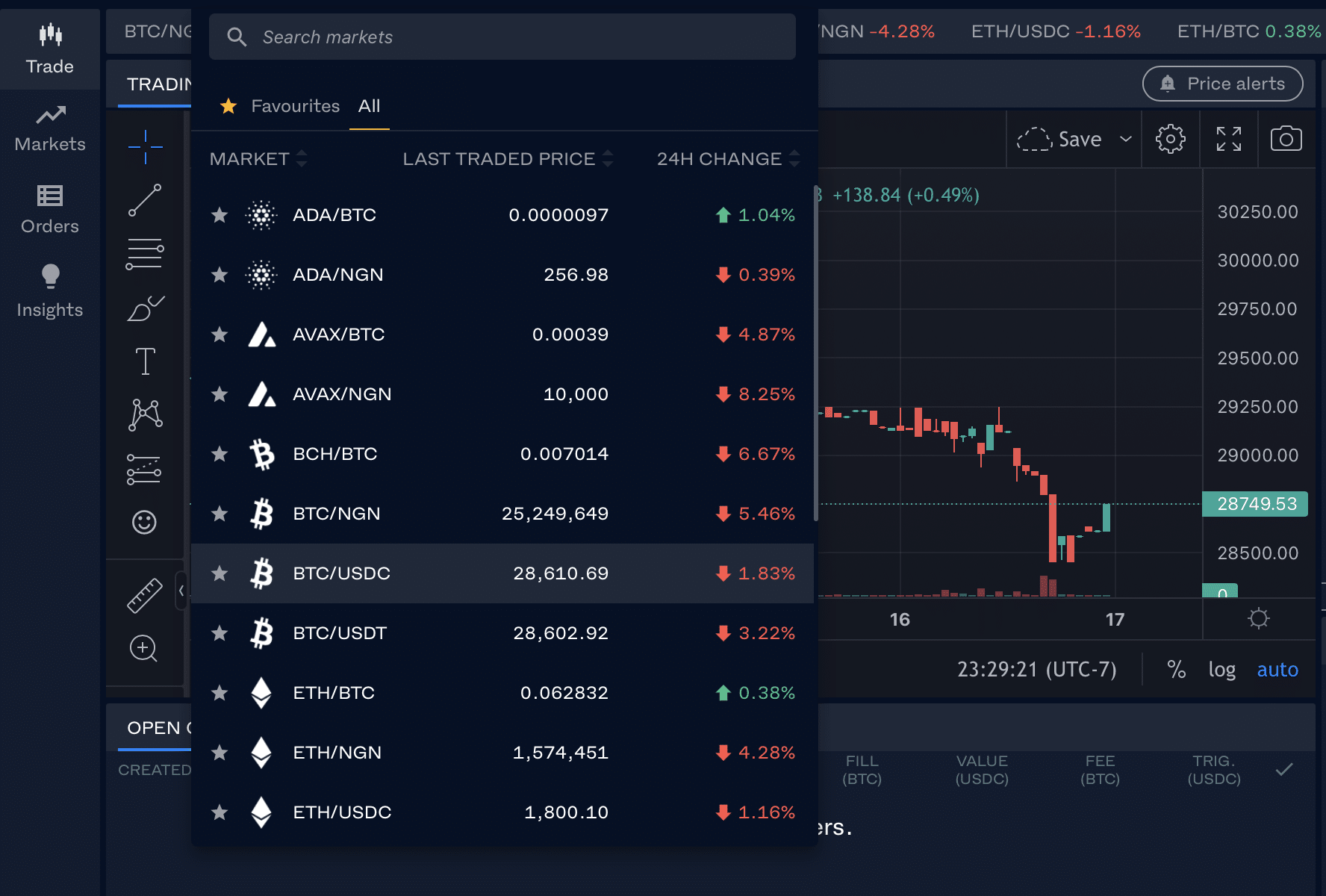

You will then need to deposit fiat currency or transfer crypto from another wallet to the exchange. Then, choose the cryptocurrency pair you want to trade.

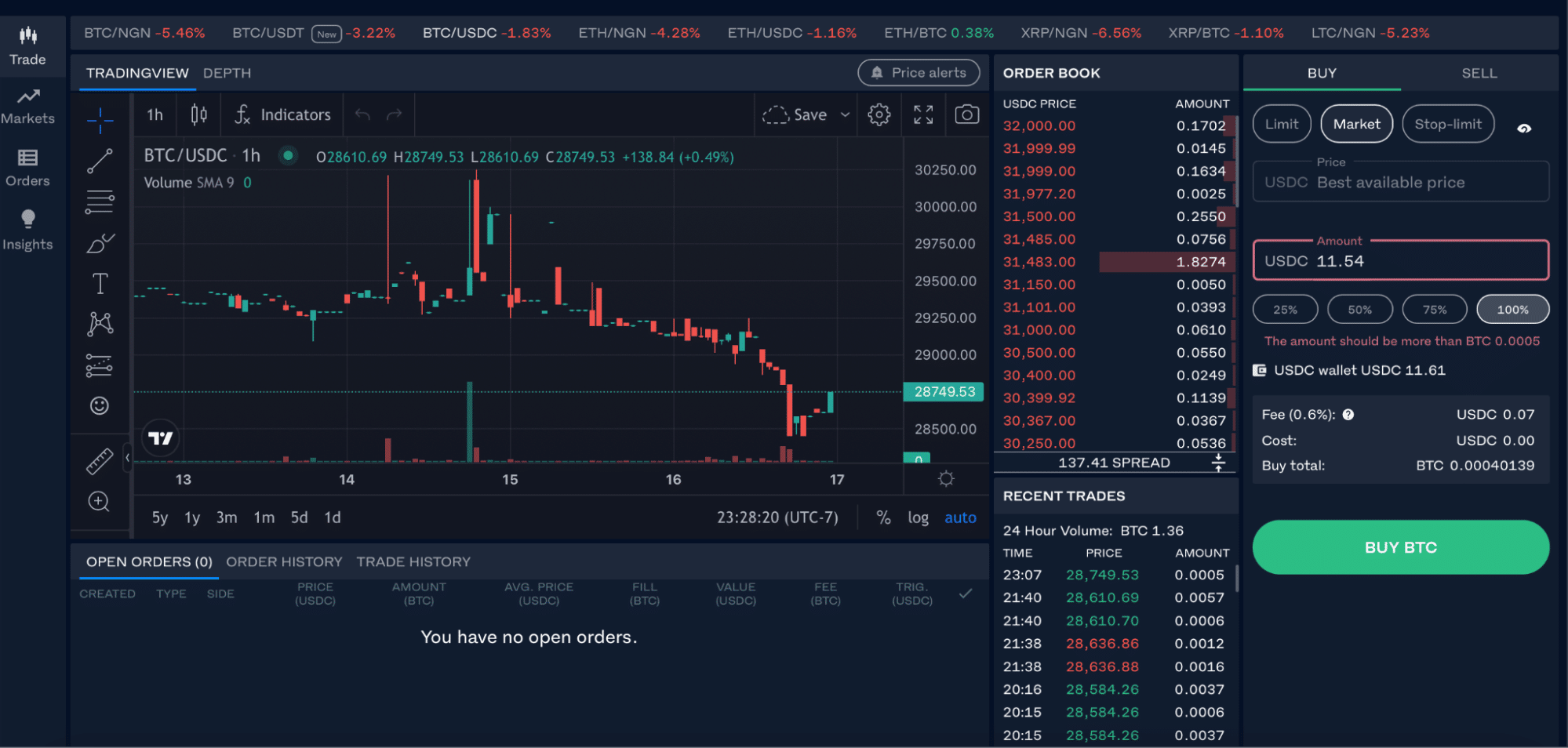

Select your preferred order type between market, limit, and stop limit. In this example, we are using the BTC/USDC trading pair.

Enter the amount you want to trade, and then click ‘buy’ crypto.

Finally, your buy order will be executed as soon as it matches with a sell order in the orderbook, and you will receive your BTC in your exchange account. Conversely, if you place a market order, your order will be filled within seconds, and the trade settles almost instantly.

Pros and Cons of Crypto Spot Trading

Crypto spot trading has several advantages and a few disadvantages.

Pros

- Coin ownership: Spot trading enables you to own the digital assets you purchase, which you can use for various purposes, such as for collateral to borrow other crypto assets or earn interest in decentralized lending pools.

- Simple to use: Spot trading is relatively straightforward, especially for those new to trading.

- Less risky: It’s less risky than margin and futures trading, which means your losses are limited to the capital you put in.

- More crypto options: Generally, there are more cryptocurrencies supported for spot trading than margin trading on cryptocurrency exchanges.

Cons

- Limited gains: Spot trading doesn’t offer leverage, which means you need to use your funds, which can limit potential gains (but also losses).

- Fees: Spot trading can involve various fees, including trading, withdrawal, and network fees for trading cryptocurrencies that can impact your overall profitability.

Crypto Spot Trading vs. Margin Trading: What’s the Difference?

The main difference between crypto spot trading and margin trading is that while you will need cash for spot trading, the latter allows you to borrow funds for your trades with the use of leverage.

But that’s not all. Here are some of the key differences between crypto spot trading and margin trading.

| Crypto Spot Trading | Margin Trading | |

| Asset Ownership | Allows you to buy and sell the actual cryptocurrency. | You don’t actually own the asset but rather bet on its price changes. |

| Leverage | Doesn’t use leverage for trading but instead requires actual capital funding, which limits potential gains. | Let’s you borrow funds from the exchange to increase your trading position size so that you can trade larger amounts with less capital. |

| Simplicity | Relatively straightforward, making it suitable for beginners or those who prefer less complex trading approaches. | More complex, as it involves more considerations, including monitoring margin levels and understanding liquidation risks. |

| Risk | Since there’s no borrowing involved, the risk of losing more than your initial investment is impossible. | The use of leverage increases the risk of greater losses, just as it increases the chance of potential gains. |

| Short-selling | Traders buy crypto at current market prices and cannot gain from short-selling. | Allows traders to profit from a decline in a cryptocurrency’s price by selling the asset first and then buying it back at a lower price. |

Spot crypto trading is an easy way to participate in cryptocurrency trading. However, like any other investment or trading approach, there are still risks involved, and you could potentially lose all of your capital. Finally, it’s important to research the cryptocurrency you are buying and only trade what you can afford to lose.