In 2022, the Ethereum blockchain transitioned from proof of work to proof of stake.

Proof of stake is common in crypto and involves validators “staking” — or depositing — their cryptocurrency on a blockchain to help secure the network. In return, they’re eligible to receive a share of newly minted coins. The sticking point in Ethereum, however, is that each individual can only deposit Ethereum tokens (ETH) in 32-ETH increments (around $52,000 as of February 2023) to participate. That is a lot of capital to lock up indefinitely!

That’s where liquid staking comes in. Essentially, liquid staking services give you derivative tokens in exchange for your ETH. The service stakes the ETH on your behalf and generates a yield; it takes a percentage of any rewards as a commission. In the meantime, you can use the derivative tokens, which simulate ETH, to generate additional income through decentralized finance (DeFi) applications. Thus, you have the best of both worlds. Or, you might say, you can have your stake and ETH it too!

Step 1: Choose Your Liquid Staking Platform

Liquid staking is popular. Here are the most-used liquid staking platforms:

| Name of Platform | Tokens | APR* | Market Share** |

| Lido | stETH | 4.8% | 75% |

| Coinbase | cbETH | 3.89% | 16% |

| Rocket Pool | rETH | 7.4% or 4.86% | 5.5% |

| Stakewise | sETH2, reTH | 5.68% | 1.3% |

| Frax Finance | frxETH, sfrxETH | 7.39% | 1.1% |

*Annual Percentage Rate: As of Monday, Feb. 6. Note that these values change frequently.

**Sourced from Dune Analytics and @ThorHartvigsen

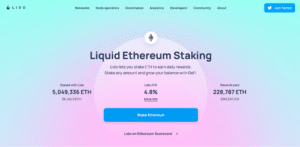

- Lido: Built by Ethereum veterans, Lido has become by far the most popular liquid staking platform, capturing nearly 75% of the market. While its liquidity is an attractive feature, its popularity poses centralization risks. Lido’s stETH token tracks ETH 1:1 and offers an APR of 4.8% before charging a relatively standard commission of 10% on your earnings. (For example, if you stake 100 ETH, you can hypothetically earn 4.8 ETH and pay 0.48 ETH in commission for a net yield of 4.32 ETH.)

- Coinbase: As the largest crypto exchange, it is little surprise that Coinbase quickly shot up to second position despite being a newer entrant into liquid ETH staking. It offers the lowest reward (3.89% APR) and the highest commission (25%) on this list. Moreover, unlike many competitors, it takes custody of users’ private keys during the staking process. Despite these issues for individuals, Coinbase is well-placed to capitalize on any increase in institutional capital in the space.

- Rocket Pool: The ability for users to run their own nodes makes Rocket Pool arguably the most decentralized option on this list. For those willing to put up 16 ETH, it offers a high 7.4% APR, but you can also get started with just 0.01 ETH for a 4.86% APR. At 15%, its commission is on the higher side.

- Stakewise: What distinguishes Stakewise is its dual-token model. It offers sETH in exchange for the staked token and rETH for staking rewards. The model has interesting applications, such as easily utilizing your rewards without affecting the principal, but the accompanying complexity is often challenging for new users. It offers 5.68% APR with a 10% commission.

- Frax Finance: Frax has recently enjoyed rapid growth thanks to its high APR (7.39%). The catch? It uses a complicated mechanism that newcomers to DeFi might find challenging. The process also involves two tokens — users first need to deposit ETH to mint the stablecoin frxETH and then swap it for sfrxETH.

Step 2: Set Up Your Ethereum Wallet

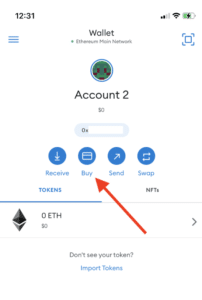

Once you’ve zeroed in on your choice of platform, the next step is hooking up an Ethereum wallet. If you don’t have one yet, we recommend MetaMask, the most widely used Ethereum wallet in the world (30 million users as of March 2022), which works across both smartphones and home computers.

To get started, download the app for Android, iOS, or Chrome, and follow the instructions to set up an account. Then load up your wallet with some ETH by pressing “Buy ETH” on the home screen of your wallet.

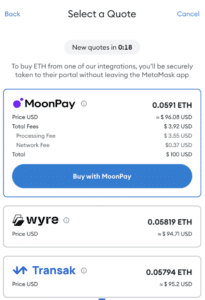

This will open a screen where you must select your region, the token you wish to buy (select Ethereum), the amount, and your payment method, which will vary depending on where you live. After you fill in these details, you will be asked to select a provider. If you have never used one, you must complete a KYC process.

Upon completing the transaction, your MetaMask wallet should display an updated balance.

Now let’s get to the good part.

Step 3: Use Liquid Staking to Put Your ETH to Work

For this article, we will be completing the process with Lido. Even if you choose a different provider, you should find the steps below helpful.

a) Go to the Ethereum Section of the Lido website, and click “Stake Ethereum.”

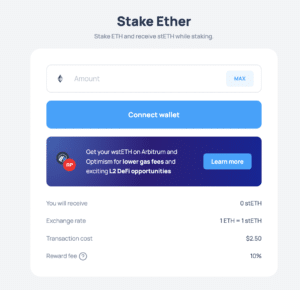

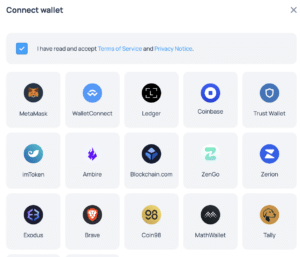

b) Go to “Connect Wallet” and select your wallet. For this article, we’ll assume it’s MetaMask.

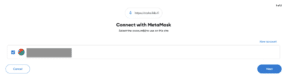

c) Your wallet will prompt you to connect to the Lido website. Select your wallet and click “Next.”

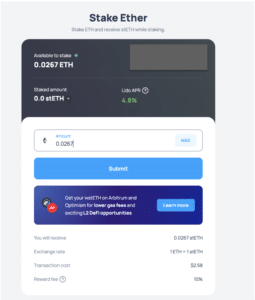

d) Select the amount of ETH you want to stake and click “Submit.” (Note: You will have to keep a small amount of ETH to cover gas fees.)

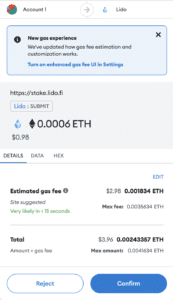

e) Click “Confirm.” The confirmation screen should appear after a few seconds.

Success!

Step 4: Use Your Liquid Tokens

If you complete these transactions, you can put these tokens to work and earn an additional yield, which can exceed 4% APR. There are various DeFi applications for your liquid tokens, such as using them as collateral to get loans on Aave or lending them on Maker. If the exchange rate for your liquid token suddenly shoots up in value, you can even sell it, although you’d give up your claim on the staked ETH and lose your deposit. According to Lido, the most popular way of utilizing stETH is by providing liquidity on Curve. You can read more about possible use cases here.

Step 5: Exchange Your Liquid Tokens for ETH

Redeeming your ETH is usually a straightforward process. Aside from Lido, the other platforms host a mechanism to convert your liquid token back into ETH. Lido recommends you do the exchange on Curve or Balancer. Remember that the amount you get depends on the exchange rate!

Conclusion

If you are bullish on Ethereum, liquid staking seems like a no-brainer. It allows you to get paid while you wait for the price to (perhaps) increase. However, there are several complexities here to consider. For instance, the exchange rate of your liquidity token could increase or decrease significantly. Moreover, these are also largely unregulated markets, so you need to carefully study the underlying structure and the team before committing significant amounts of your capital.