Tokenization platform and BlackRock’s transfer agent Securitize revealed Monday that BlackRock’s USD Institutional Digital Liquidity (BUIDL) Fund paid out nearly $1.7 million in monthly dividends to its holders on Ethereum, a roughly 38% increase from $1.2 million in the previous month.

The Wall Street heavyweight’s payout on Monday appears to have occurred through one transaction, which had a network fee of just over 0.034 ETH, worth about $131.55, where 11 wallet addresses received on average 151,735 BUIDL tokens, according to onchain data from blockchain explorer Etherscan.

An address, which starts with 0x568, received 20,802 BUIDL tokens, the least among the cohort of receiving wallet addresses, while one of Ondo Finance’s crypto wallets labeled on Etherscan as “OUSD Instant Manager,” appears to be the largest recipient, obtaining 700,280 BUIDL tokens, roughly 42% of the total dividend pot this month. Ondo Finance, a tokenized RWA platform, currently holds 49,999,999 BUIDL tokens, making it the fourth-largest holder of the fund.

“BUIDL is a foundational asset in the development of a variety of new financial products as we have seen Ondo and others who leverage BUIDL as the underpinning of their core product,” said Securitize co-founder and president Jamie Finn, in an email to Unchained. “Tokenization is currently in a massive growth phase with lots of new RWAs coming to market.”

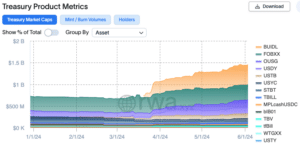

The total value of all tokenized treasury product tokens circulating in the crypto ecosystem currently stands at $1.45 billion, a more than 12.5% increase since the start of May. BlackRock’s BUIDL fund, which has a market cap of $462.5 million, accounts for almost a third of the current total value, according to data from real-world assets analytical platform rwa.xyz.

Learn More: What Are Tokenized Treasuries? A Beginner’s Guide

The seven-figure payout comes two months after Securitize Markets submitted an application “on behalf of BlackRock” to be a service provider for Arbitrum’s Stable Treasury Endowment Program (STEP), which aims to diversify 35 million ARB tokens into real-world assets backed by Treasury bills and money market instruments.

BlackRock’s activity onchain and in governance forums highlights how institutional presence has since evolved from mere interest to active participation in the crypto ecosystem.

When reached for comment, Blackrock declined due to restrictions on their communications around BUIDL.