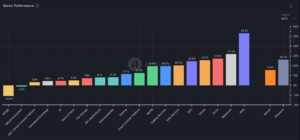

While memecoins have taken a large chunk of the crypto users’ mindshare, real-world assets have been the best-performing sector in the crypto ecosystem month-to-date.

According to data from blockchain analytics firm Artemis, the fully diluted market cap of the real-world assets sector composed of the governance tokens of three projects – Ondo Finance, Clearpool, and Maple Finance – has increased 53.5% since May 1 ahead of the following sectors: memecoins, decentralized finance, and oracles.

“Generally, investors are bullish [on] RWA post ETH ETF approval as they think about what that unlocks,” wrote co-founder of crypto investment firm Modular Capital, Vincent Jow, in a direct message to Unchained on X.

However, since Artemis’ chart is weighted by fully diluted market capitalization, RWA’s performance month-to-date is “heavily skewed by one token,” namely Ondo Finance’s governance token ONDO.

The three projects in Artemis’ RWA sector have a combined fully diluted valuation (FDV) of $12.2 billion and Ondo Finance is responsible for 97% of the sector with an FDV of nearly $11.9 billion. Clearpool’s FDV stands at almost $187 million while Maple’s FDV is roughly $147 million.

ONDO has risen over 54% in May to trade at $1.20 at presstime. CPOOL, the governance token for Clearpool that can be staked, has increased 25% to hover around 19 cents, while Maple Finance’s governance token MPL has jumped 24% to $14.67 in the same time period, per CoinGecko.

Read More: What Is Real-World Asset (RWA) Tokenization? A Beginner’s Guide

“Ondo also has a relatively small circulating market cap vs. fully diluted so that also skews the number,” Modular Capital’s Jow added. A protocol’s market cap is the number of tokens currently circulating multiplied by the price of a single token, while a project’s FDV is the theoretical market cap of the project if all tokens were circulating in the market.

The circulating market caps of Maple and Clearpool’s governance tokens are 78% and 60% of their FDV, respectively. In contrast, ONDO’s market cap, which sits at $1.7 billion, makes up less than 14.5% of its FDV.

In terms of total value locked, Ondo Finance remains the most popular parking spot of the three projects as crypto users have locked $470 million in total value into Ondo Finance, $4.6 million into Clearpool, and $1 million in Maple Finance, data from DefiLlama shows.

While Clearpool and Maple Finance’s TVL have remained relatively stable and have not seen substantial growth in May, Ondo’s TVL has grown by $117.85 million month-to-date from $352.67 million.

Ondo Finance’s Role in the RWA Sector

Ondo Finance is a tokenized real-world asset platform that has two flagship products: USDY for individuals and OUSG for people who meet specific “qualified purchaser” requirements. Per Ondo Finance’s documents USDY “is a tokenized note secured by short-term US Treasuries and bank demand deposits,” designed to act as a stablecoin with US dollar-denominated yield, while OUSG “provides liquid exposure to short-term US Treasuries with 24/7 tokenized subscriptions and redemptions.”

Ondo propelling the RWA sector to become the best-performing sector in May, according to Artemis, comes as Ondo Finance applied earlier this month to Arbitrum’s Stable Treasury Endowment Program which aims to diversify 35 million ARB tokens into stable real-world assets backed by Treasury bills and money market instruments.

Ondo Finance is also connected to BlackRock’s BUIDL Fund, which has a $473 million market cap. According to its documents, a “significant majority” of Ondo’s OUSG portfolio is currently in BlackRock’s BUIDL Fund.” Additionally, data from blockchain explorer Etherscan shows that Ondo Finance holds 10.5% of BUIDL.

CoinDesk reported in March 2024 Ondo was shifting $95 million of its assets backing the OUSG token from BlackRock’s iShares Treasury Bond ETF to Blackrock’s tokenized BUIDL fund.

“The performance of the RWA space is somewhat to be expected,” wrote Jim Hwang, COO at Firinne Capital, in a text message to Unchained. “We are starting to see real world and onchain finance merging which opens up the potential for both domains.”