Crypto markets have long been defined by “alt-seasons”, where tokens outside of industry giants bitcoin and ether outperform the market as investors roll their gains into higher beta assets. Prior alt-seasons occurred during the DeFi summer in 2020, the COVID rally in 2021, and even the memecoin craze from last year.

Since the re-election of Donald Trump there has been another alt-season—this time in the form of tokens being packaged into spot ETFs. The assets include XRP, the native token of the eponymous $155 billion XRP Ledger blockchain, $9.3 billion HBAR (Hedera Hashgraph), $29 billion ADA (Cardano), $9.3 billion LTC (Litecoin), $39.2 billion DOGE (Dogecoin), $7.6 billion DOT (Polkadot), and $90.5 billion SOL (Solana).

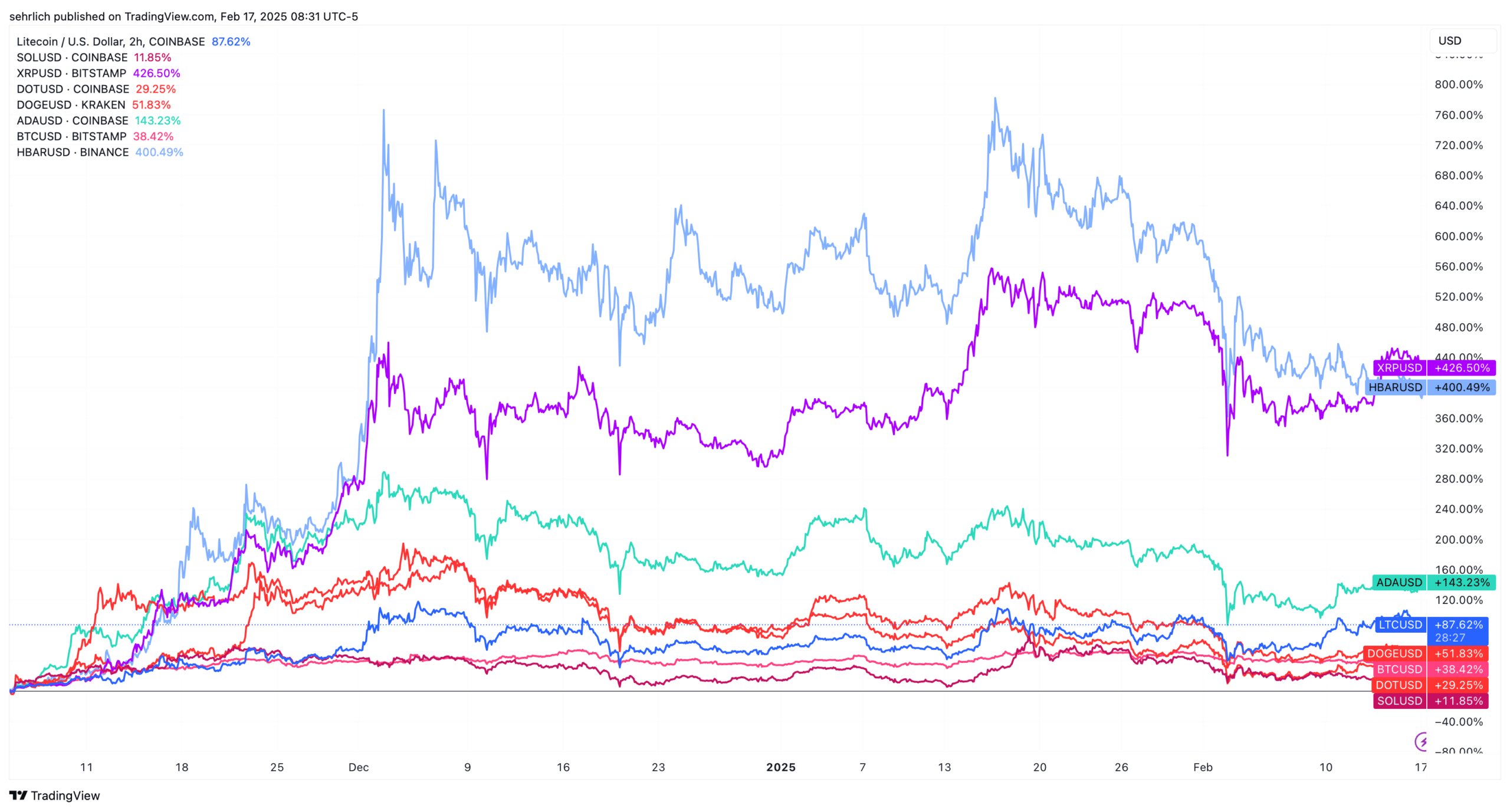

Each of these tokens has seen large gains since the election. XRP and HBAR lead the way with 426% and 400% jumps respectively on the back of newly filed ETF applications. XRP’s price has also been helped because of growing expectations for a quick resolution of its ongoing lawsuit by the SEC, direct overtures by Ripple Labs CEO Brad Garlinghouse to the White House, and Ripple’s efforts to get XRP included in any potential national strategic crypto stockpile or reserve.

But alt-seasons do not last forever, and aside from some additional timely public statements from key figures behind these projects—Cardano founder Charles Hoskinson has also been making public pleas to the administration—there is relatively little rationale behind most of these tokens seeing such a massive surge. Despite these gains, the tokens are still down an average of 60.7% from their all-time highs during COVID. If you take out Solana, whose token surged on the back of a massive amount of activity from the memecoin craze last year and whose growth seems sustainable, the tokens are still down an average of 65%. The long-term trend for them may still be down.

Some industry insiders believe investors are looking past fundamentals when evaluating these ETFs. “I think that long-term investors in projects like XRP, to me, aren’t so much justifying today that the valuation is appropriate,” says Ryan Rasmussen at Bitwise Asset Management, whose firm has applied to list funds tracking XRP, Solana, and Dogecoin. “I think what they’re doing is expressing a vision that blockchain technology will be disruptive to many different markets. And so it’s not so much the cashflow or revenue that they generate today justify the current valuation.”

Another point for retail buyers to consider: institutional investors are unlikely to come along for the ride, at least right now. Speaking about the retail-heavy flow that accompanied spot bitcoin and ether products last year as a precedent for these upcoming products Rasmussen said, “That did surprise us because retail investors have been able to access bitcoin through centralized exchanges like Coinbase, Gemini, Kraken, etc., for years. I think the reason is because traditional investment firms or wealth management firms have to go through long due diligence and review processes for new products.”

These are going to be tough sells for traditional brokerages, who are still trying to wrap their heads around the bitcoin and ether products that have brought in $121 billion and $8.7 billion respectively, even after they begin the due diligence. “I would not even remotely even look at some of the other ones from an investment perspective,” said an investment advisor at a Wall Street bank on the condition of anonymity. “I hate to use the word scam, but they’re just scams. You’re buying something hoping that there’s somebody else that you’re going to sell to at a higher price.”

“Maybe Solana and XRP could garner some assets, significant levels,” says Bloomberg Intelligence ETF Research Analyst James Seyffart. “But for the most part, the interest in everything else just doesn’t seem to be as strong.”

Here are some key facts about each of the potential ETFs.

XRP: No ‘There’ There

The XRP Ledger is one of the world’s oldest blockchains, having launched in 2012. Initially pitched as a competitor to the Swiss banking collective SWIFT, the backbone of the global interbank payment network, it has struggled to make an imprint. As a result Ripple Labs has made a number of pivots. The last year has seen the firm launch stablecoin and various tokenization offerings. It has also incorporated NFTs, is adding smart contracts to its original payments-focused platform, and has a decentralized exchange.

In terms of financial performance, the network only earned $1.15 million dollars in fees last year. Its 2023 total was $583,000. By comparison, Ethereum earned $1.99 billion in fees and Bitcoin came in second with $922 million. In fact, the XRP Ledger was one of 20 Billion-Dollar Crypto Zombies named last year by Forbes.

But that is not the only number that should matter for potential ETF buyers.

XRP’s rapid price movement since the election created a windfall for Ripple Labs. According to its Q4 2024 XRP Markets Report, the company now has 4.485 billion in XRP worth $12.2 billion that it can sell today. More staggering, it has 38.9 billion units arriving the coming years from a pre-planned escrow worth $106.7 billion. This treasury can be considered a massive sell wall that will need to be overcome in order to continue moving the price upward.

Outlook: The SEC recently acknowledged an ETF application filed by Grayscale and the New York Stock Exchange to trade a spot XRP ETF. This important step will lead to the start of a critical 240-day period at the end of which the SEC will need to give a final decision on whether to let the product begin trading. However, the SEC’s suit against Ripple Labs will need to be concluded before the product can begin trading.

Solana: From FTX Casualty to Phoenix

Many investors left Solana for dead after the collapse and conviction of FTX kingpin Sam Bankman-Fried, who called himself a self-described “fan boy” of the token in a 2021 interview with Forbes. However, while the token tanked at the time of FTX’s collapse in 2022, it has had a resurgence in the last two years. In 2024 the blockchain network earned a massive $750 million in fees—beating every chain other than Bitcoin and Ethereum, and it is riding a second tailwind in the form of a self-inflicted crisis by its chief rival Ethereum.

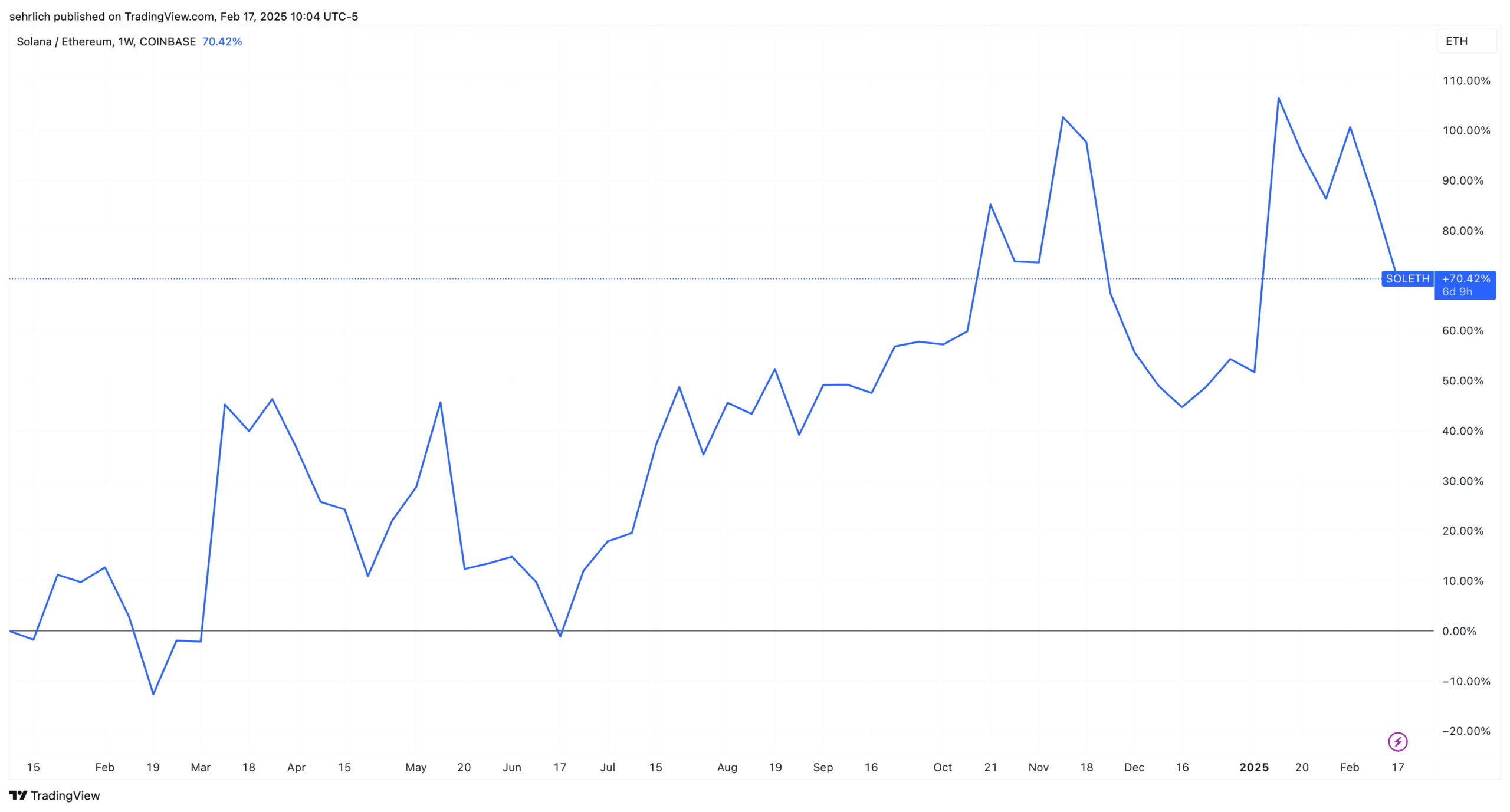

Since the beginning of 2024, Sol has gained 70.42% on ether.

A couple of key reasons mentioned by investors for this surge include a more user-friendly on-boarding process. It is a self-contained ecosystem—everything exists on the L1. In many cases people only need to use a single wallet and they do not have to keep track of which assets are on which L2s. Plus transactions on Solana only cost a couple of cents, making the blockchain become the natural home of the memecoin craze for over a year.

Outlook: The SEC has a final deadline of October 10th to make a final decision on the four Solana applications that have been submitted. Much like XRP, the SEC still considers Sol to be a security, so that hurdle will need to be overcome before any product can begin trading.

Litecoin: From ‘Digital Silver’ to Memecoin

Litecoin was launched in 2011 as an early Bitcoin fork designed to provide a faster and cheaper payments system. It produces blocks four times faster than Bitcoin, an average of one every 2.5 minutes against every 10 minutes for Bitcoin. It also has a hard limit on its token supply, but because it produces blocks 4x as fast as Bitcoin its supply cap is 84 million.

But actual usage of the platform appears to be minimal. In 2024 it only earned $371,000 in fees, which is actually down from its 2023 number of $388,000. In fact, people behind the project have somewhat embraced Litecoin as a memecoin. A November 13, 2024 tweet from the Litecoin Foundation’s official X handle, with 1.1 million subscribers humorously said that the token was now a memecoin.

Outlook: The applications from Canary and Grayscale have the best chance of trading first simply because those products have the closest final deadline of October 10, and it does not appear that the SEC considers litecoin to be a security.

Dogecoin: ‘So Much Wow’ Inflation

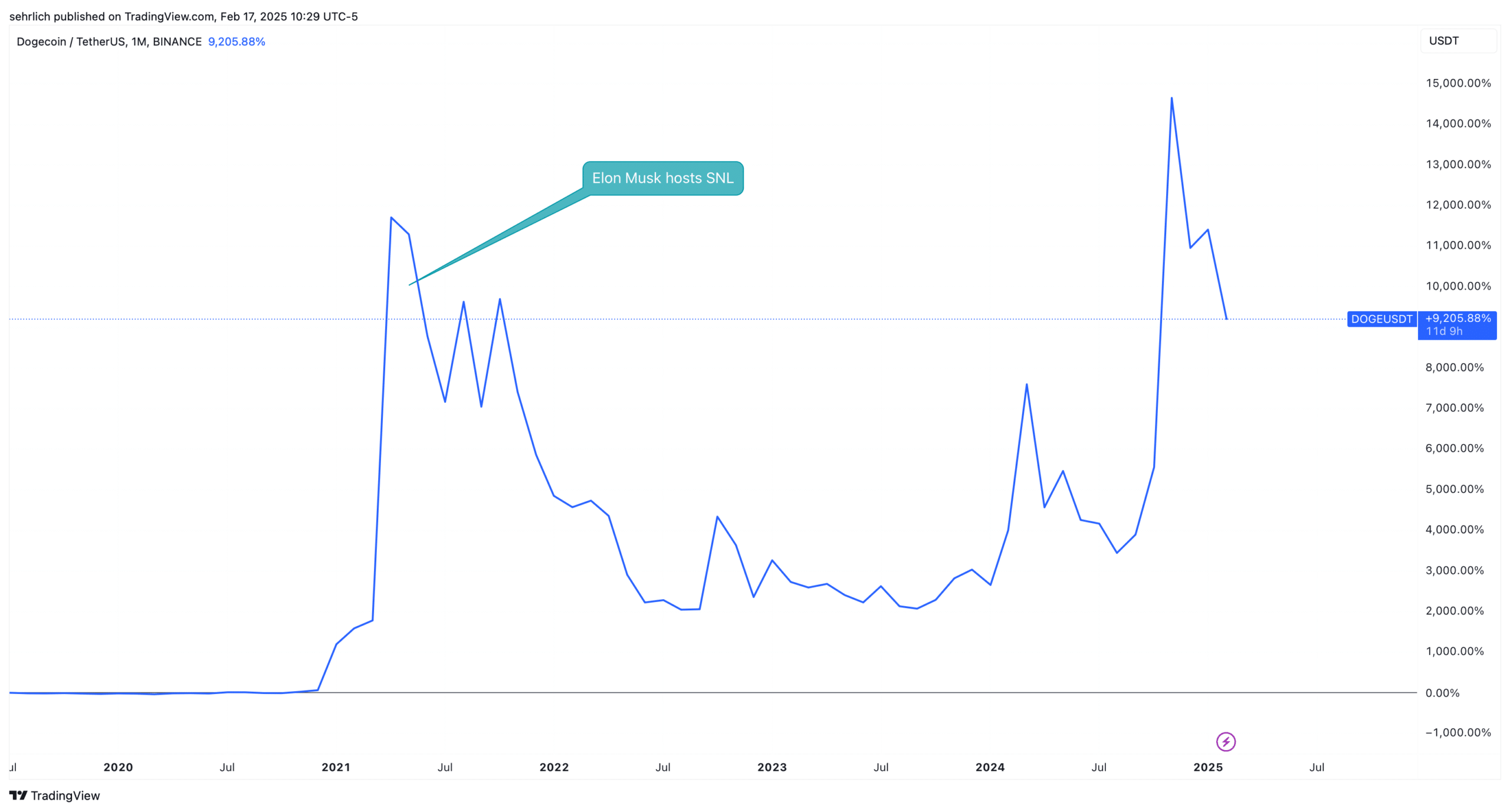

Dogecoin is an OG memecoin that launched in December 2013 based on a Shiba Inu dog whose thoughts are rendered in Comic Sans font. If there is a token that has professionalized the memecoin industry, this would be it. It first rode high during the COVID bubble in 2021, reaching an initial apex of $0.73 in May 2021 around the time that Dogecoin champion Elon Musk hosted Saturday Night Live and mentioned it during his monologue.

However, it started falling after Musk’s appearance and the token collapsed in 2022 along with the rest of the crypto market. It is on a tear again because of its name association with Musk’s Department of Government Efficiency and its reputation of being a grown-up memecoin.

Something else for investors to consider: While Dogecoin uses a similar proof-of-work consensus mechanism to Bitcoin or Litecoin, it does not have a similarly capped supply. Dogecoin’s current circulation is 148,057,346,383 units, and it will emit another 5 billion units every year. At the current supply, this amounts to a 3.4% inflation rate. As the circulating supply increases over time the inflation rate will decrease, but it will never become a deflationary asset. As a point of comparison, Bitcoin creates 328,500 new units each year, and its current supply is 19.38 million tokens. This creates a rough inflation rate of 1.6%. And the last bitcoin will be mined in 2140.

Outlook: The SEC has never named Dogecoin in any of lawsuits against crypto firms, so it likely does not consider the token to be a security. The SEC has to make a final decision on offerings from Grayscale and Canary by October 18.

Cardano: Earns 99.8% Less Than Ethereum in Fees

Cardano is the brainchild of Ethereum co-founder Charles Hoskinson. It was launched in 2017 after his 2014 falling out with the Ethereum team as a native proof-of-stake blockchain that theoretically offers a similar value proposition to users of other multipurpose blockchains like Ethereum or Solana. In September 2024 the project released its Chang hard fork, designed to increase on-chain governance and remove decision-making authority from Cardano’s three founding entities—the Cardano Foundation, Input Output Global (IOHK) and Emurgo.

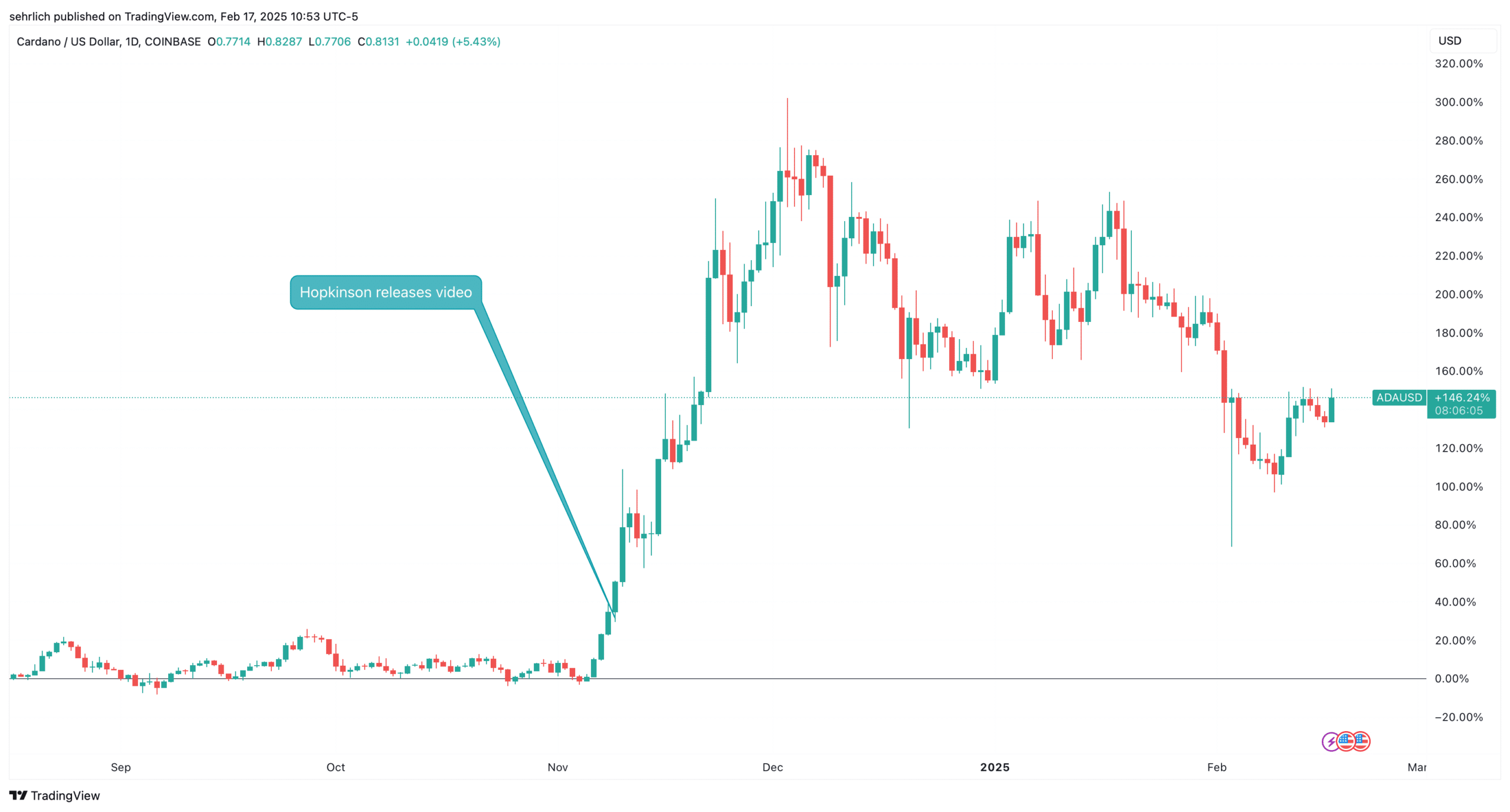

Still, it is difficult to separate the fortunes of the blockchain from its charismatic founder, who has a constant online presence and has made personal overtures towards the Trump Administration. In a November 9 video posted to X, he announced that he would be working with lawmakers on crypto policy in an unannounced role, and no such role has since been made public. Cardano’s price, which is down 74.1% from its all-time high, immediately shot up to what would become a 300% surge in a matter of a month.

Hoskinson’s outsize personality helps mask the fact that Cardano is just now finishing its key developmental stages and only earned $4.38 million in fees last year. This amounts to .2% of Ethereum’s $1.9 billion in fees last year.

Outlook: Grayscale and NYSE Arca have filed the S-1 and 19-b4 documents necessary for the SEC to convert Grayscale’s closed-end product into an ETF. Like Solana and XRP, the SEC considers Cardano to be a security, so resolution on this issue will need to be resolved before any product can list.

Polkadot: Down the Most From Its All-Time High

Polkadot is a Swiss-based blockchain project founded by the Web3 Foundation. Unlike L1 blockchains like Ethereum or Solana, Polkadot is considered to be a L0 blockchain, which utilizes dozens of parachains that can be used to support a wide range of applications.

Polkadot’s $7.8 billion blockchain also has a sister project called Kusama, which can be thought of as a testnet, and has a $325 million market capitalization on its own. Purchasers of Polkadot’s native DOT token receive Kusama tokens (KSM) for free.

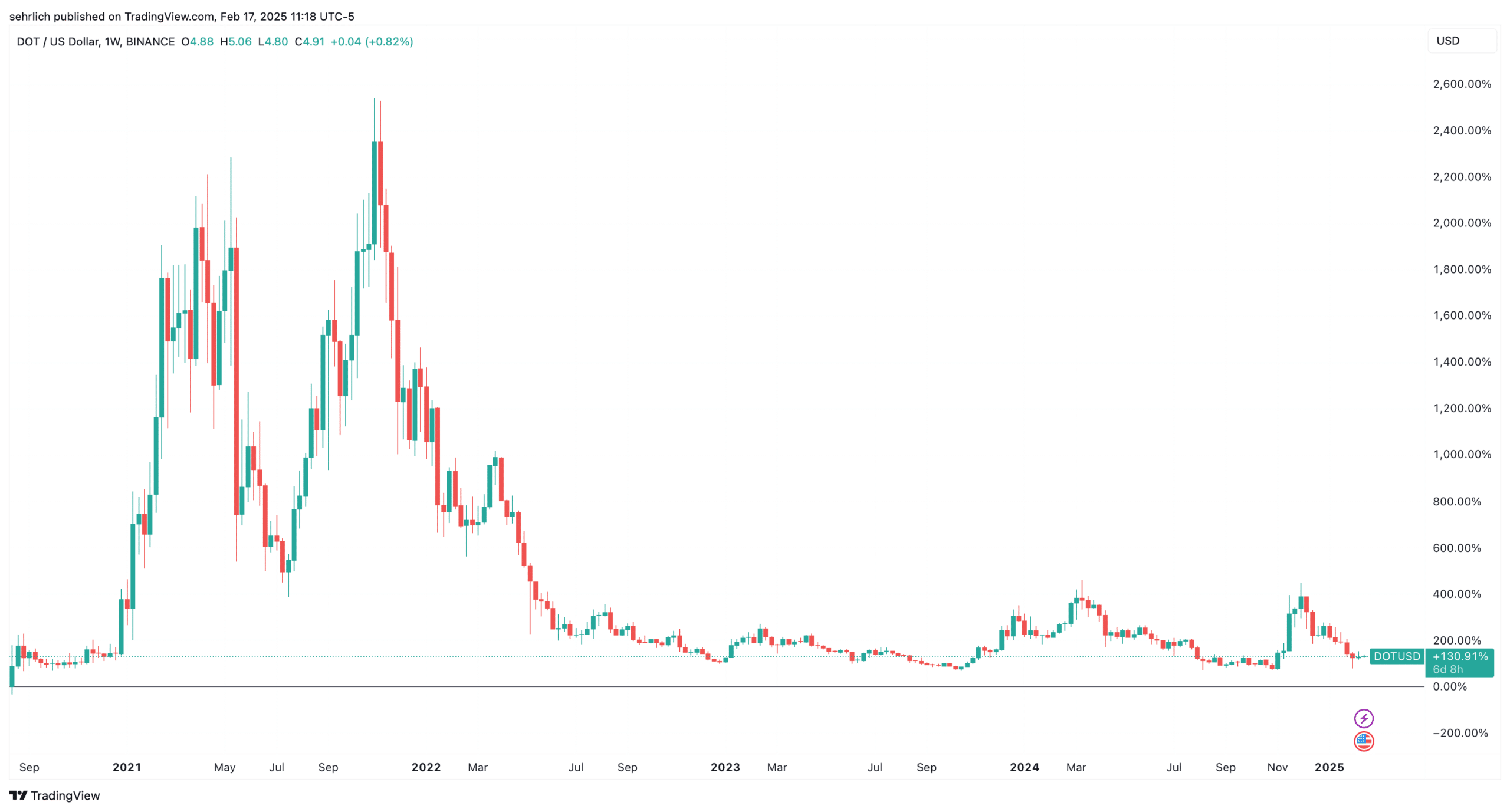

It is worth noting that of all the tokens with pending ETF applications, Polkadot has some of the most challenging economics to overcome. At its current price of $5.12 it is down 90% from its all-time high, the largest gap of any token. Additionally, the network brought in the second least amount of revenue in 2024 at $1.08 million of any other tokens looking to get ETFs.

Outlook: 21Shares is the only asset manager to apply to list a Polkadot ETF and a 19-b4 is yet to be filed. Polkadot has not been named in any SEC crypto suits, but it is unclear whether the agency would consider it to be a security.

Hedera Hashgraph: Governed Only by 30 Entities

Hedera is a permissioned proof of stake blockchain that is governed by 30 global entities on what is called the Hedera Council. Aside from popular crypto names like Chainlink Labs and BitGo, Hedera has managed to onboard several blue chip companies such as Dell, Google, IBM, Hitachi, Standard Bank, and Deutsche Telekom.

The permissioned approach, where only pre-approved entities are allowed to process network transactions, is designed to make blockchains more amenable to regulated companies. However, the project plans to become permissionless in the future.

Hedera earned the second-most revenue of any blockchain up for an ETF this year at $5.5 million. However, investors should exercise caution as it is up 313% over the past six months yet is down almost 25% so far in 2025.

Outlook: Canary is the only asset manager to apply to list an HBAR ETF and a 19-b4 is yet to be filed. HBAR has not been named in any SEC crypto suits, but it is unclear whether the agency would consider it to be a security.