In the four days since spot ether exchange-traded funds (ETF) started trading, the price of Ethereum’s native cryptocurrency has moved similarly to BTC’s after the SEC approved spot bitcoin ETFs. However, experts say it will be harder for ETH to continue on the same path as BTC did in the weeks following its own spot ETF, when it hit an all-time high.

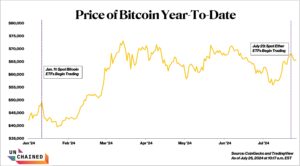

After the Jan. 11 launch of spot bitcoin ETFs, the price of BTC sunk more than 21% by Jan. 23 to around $38,500. But then it steadily rebounded, in part due to the success of those ETFs and resulting demand for bitcoin, and hit an all-time high of about $73,000 by March.

Read more: Ethereum Supply Growth Raises Concerns Amid Launch of Spot ETH ETFs

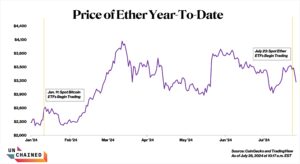

Similarly, when the trading of spot ETH ETFs started, ETH was trading around $3,500 and has since slumped as low as $3,086, a more than 10% drop, before settling at $3,319, data from TradingView shows.

Why History May Not Repeat

Whether ETH will ultimately follow BTC’s price trajectory remains to be seen, but Andy Chen, who is on the research and investment team at early-stage investment firm Superscrypt, predicted that ETH’s price will continue to decline — at least in the short-term.

While bullish long-term, Chen told Unchained on Telegram that the news of the spot ETH ETFs has mostly been priced in. “Most people that were bullish about the ETH ETF got exposure via the [exchange-traded products] like the Grayscale [Ether trust] that were trading at a discount, so they will likely dump,” Chen said.

Read more: Ethereum ETFs Record $1 Billion in First Day Volume and $107 Million Inflows

Kelly Ye, a portfolio manager for venture firm Decentral Park Capital portfolio manager, agreed. She noted that the BTC spot approval came after years of back and forth between the SEC and fund companies, and also established a precedent for the approval of a spot crypto ETF. As a result, “BTC spot approval is more fundamental” compared to the ETH ETF approval, Ye said. And while the ETH approval was still a surprise, it was “more on the timing rather than whether it can be approved or not,” Ye added.

Ye also pointed out how ETH’s own rally during the two months after spot bitcoin ETFs were approved makes it harder for ETH to surge. ETH almost doubled from $2,165 on Jan. 23 to $4,084 on March 13, when BTC peaked in price.

Not Digital Gold

Other experts expect ETH to recover eventually, but noted that ETH’s rebound may take longer and may not be as high, noting that ETH is not as easy a sell to investors as BTC.

“We’re bullish on ETH ETF flows in the medium term, as it’s a great way for traditional fund managers to invest in a proxy for blockchain technology,” Seth Ginns, head of liquid investment at investment firm CoinFund, wrote in an email to Unchained. “But that’s a more complicated pitch than [BTC’s] digital gold, so ETH’s rebound may take longer than BTC.”

Read more: ETH Drops Under $3,200 as Spot Ether ETFs Record $133 Million Outflows

Similarly, Jacob Martin, the general partner of early-stage investment fund 2 Punks Capital, told Unchained that, unlike BTC, ETH isn’t pitched as “money” or “digital gold,” making it harder for the regular person to wrap their mind around. As a result, “the bias is towards BTC,” Martin said.

“We expect BTC to be over $100K soon, and ETH will likely go up a lot when that happens, but it may go up less than BTC as institutions come up the learning curve,” Ginns said.

Decentral Ye’s added that she expected ETH ETF inflows to be roughly 20-30% of BTC’s ETF inflows, proportional to the difference in their market caps. While ETH’s inflows have been encouraging in the first few days of trading, it is “too early to see whether [ETH’s] flow can meet this expectation,” Ye said.