April 4, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

DeFi protocol Inverse Finance suffered a $15 million exploit this weekend.

-

Ronin replaced compromised validators and announced plans to bolster its security after last week’s $600 million hack.

-

Bored Ape Yacht Club’s Discord was hacked on Friday.

-

New SEC guidance is telling exchanges to treat customer crypto holdings as liabilities.

-

OpenSea rolled out the ability to purchase NFTs via credit cards.

-

Axie Infinity’s latest upgrade was pushed back a week after the Ronin hack.

-

A phishing scam targeting Trezor wallet users is circulating.

-

Tweet DAO is selling the right to tweet from its Twitter account – with no restrictions on what can be tweeted.

-

More than 90% of all BTC has been mined.

-

Tezos upgraded its blockchain to a new consensus algorithm.

- Popular P2E game DeFi Kingdoms launched on an Avalanche subnet.

Today in Crypto Adoption…

-

Senator Ted Cruz introduced legislation prohibiting direct Fed control of a potential CBDC.

-

An NBC News survey showed that 1 in 5 Americans have used or traded crypto.

- CME Group is considering launching futures contracts tied to Solana and Cardano.

The $$$ Corner…

-

The NFT collection Pudgy Penguins was sold for $2.5 million.

-

Fractal, an NFT platform led by Twitch co-founder Justin Kan, has raised $35 million.

- Crypto bridge Wormhole is looking to raise funds from a token sale at a $2.5 billion valuation.

What Do You Meme?

What’s Poppin’?

Why These 4 Tokens Are Moving

The crypto market has been green over the past few weeks. For example, each token (excluding stablecoins like USDC and USDT) in the top 10 by market capitalization increased in price over the previous seven, fourteen, and thirty days.

The quality performance of crypto was not confined to the top ten by market capitalization. In fact, only four of the top hundred tokens by market capitalization experienced a decrease in price over the past 30 days, according to data from CryptoRank. And, despite a short-term decrease, two of those tokens, Juno Network (JUNO) and Osmosis (OSMO), are still top ten performers YTD, with JUNO up 177% and OSMO increasing 44.8% since January 1st, 2022.

Let’s take a look at four tokens that were directly impacted by the events of this weekend:

The First Three: LUNA, FXS, CVX

Terra, the smart contract blockchain home to the algorithmic stablecoin UST, has been busy in 2022. This weekend, just weeks after announcing the intent to purchase billions of dollars worth of bitcoin to build a forex reserve of BTC to help UST keep its peg, Terra announced the launch of a new liquidity pool that will tie UST with three other major stablecoins, USDC, USDT, and FRAX.

The new project design is called “4pool,” and aims to concentrate stablecoin liquidity on every major chain via Curve. Notably, Frax and Terra are the largest holders of CVX, a governance token that can be utilized to make 4pool more liquid. “The 4pool ethos is the realization that ‘stablecoin pegs are stronger together than competing against each other.’ That’s why Terra and Frax have decided to support this new DeFi primitive on all chains through Curve Finance’s deep stableswap technology,” explained Terraform Labs’ ezaan in a governance proposal.

FXS, the governance token of Frax, has nearly doubled in price, shooting from ~$23 on April 1st to an all-time high of $42.60 on Sunday afternoon. LUNA, the native token of Terra, also hit an all time high this weekend of $117.

CVX, the governance token that Terra and Frax will be using to funnel liquidity to 4pool has also been a winner recently and is up 123% over the past 30 days.

The Fourth: ZIL

Zilliqa’s native token is up 288% over the past month. The major catalyst for ZIL’s price movement appears to be driven by its March 25th announcement of Metapolis, a metaverse as a service platform built atop Zilliqa’s layer one smart contract tech stack that merges physical and digital UX via NFTs and other crypto technology. As described by Aparna Naryanan in a December blog, Metapolis is “a cutting-edge extended reality (XR metaverse)- an amalgamation of AR and VR – and is powered by Zilliqa’s scalable and secure blockchain platform.”

Metapolis launched over the weekend in Miami.

Judging by the token price response to the Metapolis launch, it appears that investors were underwhelmed by the event – as ZIL’s price has dropped from over $.18 to around $.15 nineteen hours between the April 2nd launch and the writing of this newsletter.

Recommended Reads

-

BitMEX founder Arthur Hayes on why Ethereum could hit $10,000 this year:

-

Vitalik Buterin on why maximalism isn’t always a bad thing:

-

Gitcoin founder Kevin Owocki on the evolution of web3 and open-source software:

On The Pod…

Bridge Hacks Have Caused ~$1 Billion in Losses. Here’s Why Bridge Security Is Tricky

Arjun Bhuptani, founder of Connext and bridging expert, breaks down the Ronin bridge exploit that led to a hacker stealing $600 million+ and discusses different bridge designs that could limit future attacks. Show highlights:

-

how a hacker was able to drain more than $600 million from Ronin bridge

-

the difference between DeFi hacks and the Ronin bridge exploit, which was a social-engineering based attack

-

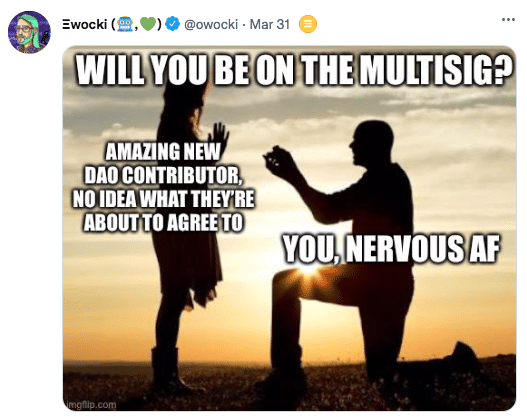

why multisig bridges are susceptible to social engineering attacks

-

why Arjun believes the Ronin hacker is a sophisticated entity

-

whether Sky Mavis will be able to reimburse users

-

the different attack vectors for cross-chain bridges

-

what Arjun thinks about different bridge designs

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians