The average cost of a transaction on Ethereum is at its lowest level since Jan. 2020 (one gwei represents one-billionth of one ether and is the unit of ETH used to measure gas prices). The decline reflects the movement of activity from Ethereum’s base layer to its expansive array of Layer 2 solutions.

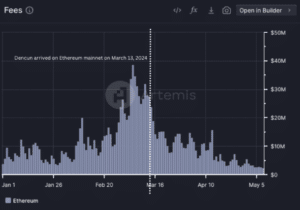

Moreover, the release of the Dencun upgrade, which significantly reduced fees for those layer 2 networks, has only intensified this trend of lower transaction costs. Gas prices on Ethereum have decreased about 92% from about 63 gwei on March 12, the day before the upgrade, to around 5 gwei at presstime, data from blockchain explorer Etherscan and analytics investment platform Ycharts shows.

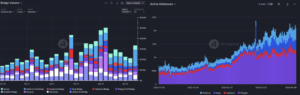

According to layer 2 watchdog platform L2Beat, the number of active and upcoming L2 projects collectively stands at 95. Over the past several months, users have significantly increased the amount of crypto assets they’ve bridged over to various layer 2 scaling rollups. And of the L2s, the top ones by total value locked—namely, Arbitrum, Optimism, and Base – have seen a spike in active daily addresses, signs of increasing user activity.

Read More: Vitalik’s New EIP-7702 Draws Early Support; Could Be Included in Ethereum’s Next Hard Fork Upgrade

“We can certainly see a trend upwards on EVM compatible chains of daily active addresses, which means users are going to cheaper alternatives. Looking at bridge data also confirms this, as bridge activity across Layer 2s has increased from ~$170mn per week to ~$300mn per week,” Andrew Van Aken, a data scientist at blockchain analytics firm Artemis, said in a Telegram message to Unchained.

Additionally, Ethereum has seen over $3 billion in net outflows of ETH over the past three months, per Artemis, with the majority of the flows going to L2s such as Arbitrum, zkSync, Base, Starknet, and Optimism.

The decrease in Ethereum’s transaction costs is “a reflection of the constant evolution of blockchain. Initially Ethereum served as the universal layer for all apps, from decentralized exchanges, to games, to trading memecoins, wrote Justin, CEO of decentralized perpetual futures platform Vest Exchange, in a Telegram message to Unchained. “However, with the advent of Layer 2 solutions and app chains, builders and users (and MEV bots) are realizing that there are tailored ecosystems for specific use cases. In return, we also see Ethereum to be transitioning moreso as a foundational security layer and for supporting more ‘passive’ protocols such as lending and LSTs.”

Ethereum Post-Dencun Upgrade

Dencun, the most recent Ethereum hard fork that brought several codebase changes, went live on mainnet on March 13.

While the number of transactions has remained stable at just over one million per day, the amount of fees paid by end users of Ethereum has plummeted since Dencun, per Artemis.

With less overall transaction fees, the amount of ETH burned has gone down as well. According to Ethereum analytics platform Ultra Sound Money, the amount of ETH issued in the past thirty days is more than the amount of ETH burned, one outcome of the Dencun upgrade.

“The new supply of ETH is now growing at the fastest daily rate since the Merge as fees burned plummeted as a consequence of the Dencun upgrade,” analysts at blockchain analytics firm CryptoQuant wrote in a report published on Wednesday.

The price of ETH reached a multi-year high of $4,000 on the day of Dencun, but has since dropped roughly 25% to around $3,015 at the time of publication, data from CoinGecko shows.