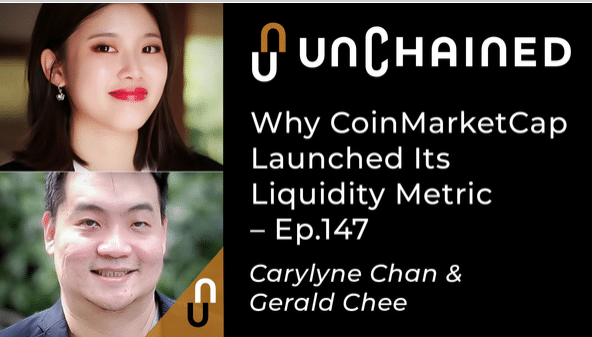

Carylyne Chan, chief strategy officer at CoinMarketCap, and Gerald Chee, head of research, discuss the history of CoinMarketCap, why the founder Brandon Chez initially focused on circulating supply to calculate market cap, how the ICO craze has changed the way CoinMarketCap defines circulating supply and how the kimchee premium on the Bitcoin price in Korea at the end of 2017 is influencing the future direction of the website. We cover why CoinMarketCap is branching out into other areas such as metrics, blockchain explorers, hosting conferences and more, how the site has made money historically, the demographics, geographical distribution and behaviors of users on the site, and how CoinMarketCap’s web traffic is 90% correlated to the Bitcoin price.

We talk about the fake volume problem, how CoinMarketCap decided to address it with a new liquidity metric, the new Data Accountability and Transparency Alliance they formed, and why they are working with some of the exchanges identified by Bitwise as being the most egregious in faking volumes, and how those exchanges fare when it comes to CMC’s new liquidity metric. We also cover some of the other ways companies have tried to address the fake volume issue, how CoinMarketCap tries to identify the “true price” for any cryptocurrency (and why USDT makes this hard), and what the circulating supply of Ripple should be.

Thank you to our sponsors!

Kraken: https://kraken.com/

CipherTrace: http://

Episode links:

CoinMarketCap: https://

Twitter: https://twitter.com/

Carylyne Chan: https://twitter.com/carylyne

Gerald Chee: https://www.linkedin.

History of CoinMarketCap: https://blog.coinmarketcap.

Incident in which CoinMarketCap shaved $100 billion off the total market cap of crypto assets when Chez decided to remove South Korean exchanges from its calculations: https://www.wsj.com/articles/

CoinMarketCap’s new interest for crypto loans page: https://www.

Bitwise report on fake trading volume: https://www.sec.gov/

The 10 exchanges Bitwise says have real volume: https://www.

CryptoCompare Q3 Exchange Benchmark Report: https://www.cryptocompare.com/

DATA: https://coinmarketcap.

Messari benchmarks: https://messari.substack.com/

Messari report on Ripple’s “circulating supply”: https://messari.io/article/

Ripple’s response to Messari report: https://www.coindesk.com/xrp-

Transcript:

Laura Shin:

Hi, everyone. Welcome to Unchained, your no-hype resource for all things crypto. I’m your host Laura Shin. If you enjoy Unchained or Unconfirmed, my other podcast, which now features a weekly news recap after every interview, please give us a top rating, review, in Apple podcast or wherever you listen to the show.

Crypto.comCrypto.com. Get their app and buy crypto at true Cost with no fees or markups. Get a metal MCO Visa Card with up to 5% back on ALL your spending. Want more? Download the Crypto.com App today.

KrakenKraken is the best exchange in the world for buying and selling digital assets. It has the tightest security, deep liquidity and a great fee structure with no minimum or hidden fees. Whether you’re looking for a simple fiat onramp, or futures trading, Kraken is the place for you.

CipherTraceCipherTrace cutting-edge cryptocurrency intelligence powers anti-money laundering, blockchain analytics, and threat intel. Leading exchanges, virtual currency businesses, banks, and regulators themselves use CipherTrace to comply with regulation and to monitor compliance.

Laura Shin:

Today’s guests are Carylyne Chan, Chief Strategy Officer at CoinMarketCap, and Gerald Chee, Head of Research there. Welcome, Carylyne and Gerald.

Carylyne Chan:

Hey, Laura. Thanks for having us.

Gerald Chee:

Hey, Laura. Nice to be here.

Laura Shin:

So, there’s probably no need for a huge introduction, but why don’t we start with the most basic question, which is, what is CoinMarketCap?

Carylyne Chan:

Yes, so a CoinMarketCap is basically the place you go to when you want to find information about cryptocurrencies and crypto exchanges, so last year we had about 125 million users and 3.6 billion page views, ending the year with those numbers so I think it’s been a really interesting ride from when CoinMarketCap started in 2013 up until today in the last six years.

Laura Shin:

And how did you each come to work at CoinMarketCap and what do each of you do there?

Carylyne Chan:

Sure. I will start, and then Gerald can go. Before CoinMarketCap I founded and sold accompanying the artificial intelligence space, so I really like emerging technologies. Someone told me to read more about blockchain tech at that point, so I’d heard about Bitcoin before, in 2013 and game 2015, so I was very interested, and that’s how I got into it, and I somehow managed to meet the founder of CoinMarketCap. So, I believed in a vision that he wanted to bring forth and that was to showcase the crypto revolution to the world and so I decided to join the team. So, right now at CoinMarketCap, I started doing marketing and now I’m the chief strategy officer there and basically helping to shape that vision into something that we can execute and also to bring CoinMarketCap to more people around the world.

Laura Shin:

Carylyne, before we moved to Gerald I just need to know, you said somehow you just happen to meet Brandon Chez, the founder of CoinMarketCap, which doesn’t happen to pretty much anybody.

Carylyne Chan:

Many people, yes.

Laura Shin:

So, how did that happen?

Carylyne Chan:

It is interesting to me because it happened through seven degrees of connection so it was like someone put out an email chain and someone wanted to look for someone who could help someone, and so forth and then it somehow ended up in my inbox so I…when I went to New York for an event I just decided to ask Brandon if you would like to meet and he agreed, so it was interesting for me, at that point, to meet him.

Laura Shin:

Wait, and was it that you were looking for a job or that he was looking to hire?

Carylyne Chan:

No, I think he was actually looking to expand to Asia and I happened to be in Beijing at that time so I wanted to have a conversation with him about that, like how I could help him there or whether there was anything that we could collaborate on so that was why we met in New York.

Laura Shin:

Okay. All right. Well. We’re gonna talk about we’re gonna talk more about this mysterious Brandon Chez in a little bit, but Gerald, why don’t you tell us what it is that you do at CoinMarketCap and how you came to work there.

Gerald Chee:

Sure. Right. So, before CoinMarketCap I started my career as a trader. I was trading bond futures, derivatives, creating market neutral strategies at a prop trading firm, so what I did was arbitrage between bonds in the US versus bonds in Australia, bonds in Germany, and stuff like that, right, so that was how I started off as a trader I entered this the cryptocurrency space about one-and-a-half years ago, sometime in late 2018, when I was looking at Bitcoin futures as a trading product, so that’s how I saw it founded Hashtag Capital with three other people.

We started trading Bitcoin futures as our main way of generating income and one of our LPs was Brandon Chez himself, so we were doing a pretty good job, and he was having some problems with his site, in terms of pricing algorithms, as well as the volumes that we are seeing, inflicted volumes, so he kind of asked us, hey, you guys are doing a pretty good job in this trading space. Could you also help me in this way, because we also had…with our infrastructure, in place we had algorithms and pricing methodologies that took it all into account to get better pricing for our trading strategies. So, he acquired us, Hashtag Capital. The four of us went on board the CoinMarketCap team, five months ago, sometime in late July 2019, and we have been there since.

So, what I do at CoinMarketCap is basically try to fix the problems that surface on the site in terms of pricing and in terms of inflated volumes. Yeah.

Laura Shin:

Oh, okay. Yeah, we’re gonna talk a lot about those issues later on, but first let’s talk a little bit more about the history of CoinMarketCap, which Carylyne alluded to a little bit. You mentioned that the site got started in 2013. How did it get started and what was the initial mission?

Carylyne Chan:

Yes. So, I think it really started as a side project for Brandon, so he wanted a way to value all kinds of cryptocurrencies, so he saw they were quite a few of them coming up and he wanted to compare them versus Bitcoin, compare them versus each other, and so he built the projects on the site, and so I think he really grew out of that in the last couple of years, from 2013 when he what really wanted to just solve his own problem until today where I think that mission has grown bigger. Where we really want to help to bring more discoverability and more efficiency to the consumer markets.

Laura Shin:

And what had Brandon been doing before?

Carylyne Chan:

He was a developer.

Laura Shin:

But not in the trading space right? He didn’t have a financial background.

Carylyne Chan:

No. Yeah.

Laura Shin:

Okay. ]Yeah. Well. Can you also explain how Brandon decided to focus on market cap and how he defined that as a circulating supply?

Carylyne Chan:

Yeah, so I think that when we started Brandon really wanted a quick way for people to understand what they were comparing and so he borrowed the market cap term from traditional finance and he also borrowed volumes. He also borrowed public float, but in the context of crypto he actually popularized the term circulating supply, so I think with those in mind I think the rationale was that people understand already what market cap volume and public float were they would be able to quickly get a sense of what he was trying to present on the site and I think that made it really intuitive for people to understand the numbers that they were looking at.

Laura Shin:

And even from the start, I feel like, the phrase circulating supply was a little bit difficult in the sense that it wasn’t always a clear definition for each of the coins. Can you talk about why it was difficult to use that term for the calculations?

Carylyne Chan:

Yeah. I think when we look at supply right now, today, there have been changes over time, right, so for example with supply how we define it right now is anything that is freely tradable by users, basically if you are able to buy it off the open market you would be able to count that into supply, whereas if it was being locked up or it was privately allocated, things that were not possible for anyone to get their hands on, it would be not circulating, therefore, they would not be part of the circulating supply, so I think over the years some things have changed. For example how do you account for state tokens, for example? Those tend to be challenges that the team faces, so I think something that we’re also working on, other than the current definition, which is our team looking at the blog explorers, ensuring that we check with the team multiple times, what they are being used for, where the tokens are, which wallets they’re held, Rich List and so forth.

Going forward we will also be doing more research to verify that more quantitatively, so Gerald, I think if you want to also add on.

Gerald Chee:

Yeah. Sure. So, from our studies of liquidity and whatnot, in terms of the new liquidity metric, we also see correlations between how it could apply to circulating supply because in our minds everything that’s circulated should be on the open market and using our new liquidity metric we can actually see what’s available in the open market and use it to kind of discern whether the numbers reported by the token project is accurate or not, so that’s something that we are looking into in terms of data metrics, and that’s something that we’ll be excited to launch in an in a near future if there is something there.

Laura Shin:

Yeah. I had a question for this that we’ll probably get to a bit later because it gets a little bit in the weeds, but why don’t we just talk about at least one example now, because when I started thinking about this metric…the focus of using this metric for this website it felt like…it definitely made sense for bitcoin where the circulating supply really was just determined by the monetary policy of bitcoin where you had this kind of rapid inflation at the beginning but then it tapers off pretty quickly, and it’s all just determined by the software, but then it sort of felt like once we hit the ICO era it definitely became apparent how the focus of circulating supply didn’t make as much sense, and here’s just one example, which is that…so for instance, right after the Gnosis crowd sale I wrote about the token, and they did what was called a Dutch reverse auction, where they were intending to sell…they just wanted to sell…or sorry.

They just wanted to raise 12.5 million dollars, but then due to FOMO they ended up selling only 4% of their tokens at 29 dollars a piece, and so that little chunk was the 12.5 million, but then when it exchanges the price jumped from 29 dollars to more than 300, so then suddenly the market cap for this brand new project was 140 million dollars, but then the things is, that was just based on the 4.2% that they had sold, right, so if you looked at the total amount then suddenly Gnosis would’ve been worth four billion dollars when it had barely even done anything, and so it just felt like, at that point, anybody coming to CoinMarketCap would’ve made a bad decision based on this concept of what the market cap was there, which was based on this circulating supply, so in general do you feel like it was during that time that…during the ICO craze when this became apparent that there were downsides to using this metric, and at that time did you guys consider changing the emphasis on circulating supply?

Carylyne Chan:

Yes. So, I think at that point in time we did notice that there were things that could be improved and I think it’s true for many of the things on the site, and I’m sure we’ll talk more about the other things that we will continue to improve, but specifically for supply I think that there were many instances, like the one that you mentioned for Gnosis, and the supply methodology has actually evolved over time but has kept the same understanding, which is basically the best approximation for the number of assets that are circulating a market in the general public’s hands, so instead of using metrics like total supply, or things like that, I think what we’re trying to do is basically to show that best approximation, and I think with what Gerald was saying using more of that data-driven metric, maybe using a combination of liquidity and other metrics we would be able to better solve for this problem in the future in a way that’s fairer and also more transparent to the end-user.

Laura Shin:

All right. Yeah, I feel like maybe that’s more of a trading emphasis or something rather than this issue about what the coin is worth overall but…so we’ll talk a little bit more about that later on, but one other thing I wanted to ask about during this like kind of historical…just to cover the history of CoinMarketCap. I feel like one of the moments when CoinMarketCap became most infamous was in January 2018 when Brandon, just without warning, decided to remove the activity of Korean exchanges from the prices on the site and that basically slashed…or it ostensibly slashed a hundred billion dollars off the total market cap for cryptocurrencies. At that time that was that just like a unilateral decision by him, or did he do that in consultation with anybody, and what was behind the decision, and how did you know that decision-making process happen?

Carylyne Chan:

Yes. So, I think in January last year we noticed that some of the South Korean exchanges were skewing the site’s average figures, so there was something that what people call kimchi premium, so we actually excluded the exchanges in our price calculations due to the divergence in prices for the rest of the world.

Laura Shin:

But when you say skewing, why did you use that verb rather than…because why is it skewing rather than just part of what the price should be?

Carylyne Chan:

Yes. So, the main reason why it was skewing was because it was not reflective of free-market prices in the sense that unless you have access to a South Korean KYC verified account you would not be able to arbitrage on the difference, so it was not actually something that you could act on even if you knew that this was part of the global average, so that was the reason why those numbers were excluded from the numbers that we were sharing on the site, and I think in hindsight we definitely should have communicated better. We should definitely have given notice and I think we actually learned from that lesson to give a lot of advance notice after that for changes that were made to the methodology, or any changes to exclusions in the data.

Laura Shin:

And so, at this point, since there is not much of a chemistry premium if any, I presume that Korean exchanges…are they factored back into the CoinMarketCap data or not?

Carylyne Chan:

They are, and they have always still been listed on the site.

Laura Shin:

Oh, but I mean are they factored into the total market cap or not?

Gerald Chee:

In system market cap I think that is not a factor of the price of the occurring exchanges because we factored circling supply into the price as a factor of Bitcoin there in itself, so whether we include the Korean exchanges or not it’s not a factor, but I do know that we do have those prices in now in our rates as well right now.

Laura Shin:

Okay, so if the kimchi premium emerges again then what will you do?

Gerald Chee:

So, I think we are trying to devise a way how to best aggregate prices across different jurisdictions, so, for example, we have the US exchanges, we have the European exchanges, we have the Korean exchanges, and maybe even Chinese exchanges, right, so in terms of how we aggregate prices, what we plan to do in the future is to devise a way how we can use every jurisdiction for itself. Let me let me give you an example, so for the US exchanges we are now looking at…for the regular exchanges we have Kraken, CoinBase, Gemini, and so on, right, so in terms of value of Bitcoin in USD terms these exchanges will probably be the most relevant to kind of discern the value of Bitcoin in terms of USD.

However, if you now look at the Korean exchanges, you’re now looking at Bithumb, you’re now looking at Upbit, and these are the exchanges that would be relevant for any Korean user that want to use…they want to find the price of Bitcoin in Korean Won. The same could be applied for the Japanese exchanges. If we find that there are capital controls and maybe even a Chinese exchanges if the OTC desk appears to have better info for debt pricing, vis-a-vis the Renminbe. So, given that solve data that we have, because we are actually listing all the exchanges around the world we think that we can have a best price index for every single jurisdiction, and hopefully, that could materialize in the near future.

Laura Shin:

Okay, so let me make sure that I understood this. So, essentially, you’re…if something like the kimchi premium happens again then you won’t erase the data, but it will be primarily in Korean Won or something, and so in that way, it’s compartmentalized from the other currencies. Is that what you were saying?

Gerald Chee:

Correct. So, our aim is to be able to discern where capital controls exist, where different currencies are differently reflected in terms of pricing, and kind of like give the users in the country the best solved price index for the use case, because if a Korean citizen wants to trade in Korean Won and doesn’t want to know that the price of Bitcoin in CoinBase, for example, then we would try our best to cater to that use case and try to personalize that use in the future.

Laura Shin:

Okay, and then just to compare it to what you were doing before, where when he removed the Korean trading from the website and it slashed a huge amount off the total market cap for cryptocurrencies, that’s because that was being averaged into the total value of Bitcoin and US dollars. Is that what the difference was?

Gerald Chee:

Yes, that’s correct. So, essentially what happened was because people in Korea wanted you to buy Bitcoin more than the people in the States and globally…so what happened was there was kimchi premium and that caused prices to go a lot higher in the Korean exchanges and that difference was…you could not take action on that because in order to arbitrage the difference between both exchanges you will need a Korean bank account and a US bank account, right, so to execute the arbitrage so we felt that because the arbitrage could not be executed by most users we decided to remove that kimchi premium altogether from our price aggregation calculation.

Laura Shin:

Okay, Okay, this is super, super, super, super interesting how all of this can affect this very influential data website. All right. So, just a little bit more in the history. One thing I was curious about was you guys had this conference recently and Brandon did do an interview on stage but he did it where he was masked, and in shadow, and his voice was anonymized by a microphone, but why go through all the effort when his name is out there? It’s not like Brandon as a pseudonym, it’s his real name.

Carylyne Chan:

Yes, it is his real name. I think…

Laura Shin:

So, it’s like he’s l trying to be anonymous but he’s not anonymous.

Gerald Chee:

Yeah. I think he’s not necessarily trying to be anonymous more than he’s trying to be private, so we respect that philosophically, if people want to retain their privacy that we would let them do that, and Brandon has always been pretty adamant that he would not like to be exposed personally, especially with the conference recently that happened in November 2019. This was the first time that we had our conference so he appeared on stage to host a fireside chat with Sunny King, who is actually anonymous and who is the inventor of Proof-of-Stake, so both of them were in masks and they have their voice modulated, but at the same time they managed to get their points across.

I think that they still managed to remain influential and managed to still share their ideas on stage and I think that’s how they prefer it, so we believed that if he would like to be private, just as Sunny would like to be private, or any other anonymous creator would like to be private, it’s probably best for them to do that because then they can do their best work without having to worry about the fact that they might be discovered ,or people might stalk them, or anything like that.

Laura Shin:

All right. So, now we’re talking a little bit more about how CoinMarketCap has changed over time. I feel like for a long time it was just Brandon alone and now you have, what is it, like somewhere in the ballpark of 50 employees?

Gerald Chee:

We have about 30 employees now, globally.

Laura Shin:

Oh, 30. Okay.

Gerald Chee:

Yes.

Laura Shin:

Okay, and so for a long time CoinMarketCap also was pretty limited in its scope to price, or market cap data, exchange volume, and now just if I look back at all the different announcements of all the new things you guys are doing, you’re branching out until like metrics, you’re organizing an industry alliance, you’re doing blockchain explorers, you had this new conference. What was the mission originally and how has it changed over time to what it is now?

Gerald Chee:

Yeah. I think when it started Brandon really wanted to solve the problem of how do you compare crypto against each other, and I think as the site became more popular over time what happened was CoinMarketCap became bigger than that. Right now it’s in a position to lead with its influence of his voice, so that’s actually led to us to realize that we need to do more and that’s why we have the industry alliance, that’s why we’re doing more in terms of putting out accurate data, making sure that everything can be displayed in a way that crypto markets are more discoverable, more efficient. So, example of that, for example, is recently we launched a product called Interest by CoinMarketCap, which is a way for you to figure out where to earn or borrow crypto, and as a result of that we’ve actually seen providers that are listed on the same page starting to look at how they can make their yields better so that they can continue to be more efficient and more competitive against the others now that they are all being put on the same page, so things like that.

As we aggregate more information, as we add more content to site I think the mission for us to make things more discoverable, more efficient globally will become way more important because we will keep growing our distribution channels, we’ll keep growing our amount of content that we have and hopefully that will actually drive the industry forward.

Laura Shin:

And historically, how has the site made money and how has that changed over time?

Gerald Chee:

Yeah. The site has always made money from advertising, so we have the banner that you see at the top of the page and banners around the site, and right now we are also experimenting with native advertising as well, so, for example, you have the blue buttons that you see on the cryptocurrency detail pages. We also have a mobile app now so that’s also another avenue, and our second revenue stream is actually the data, so we have a crypto API that we provide as a software subscription service, so we see exchanges, we see wallets, we see products that are using the data from us as part of their own products or offerings, and right now we also had the conference, which is our third revenue stream.

Laura Shin:

And do you have any demographics on your users or site visitors, whether it’s geography or age? Yeah.

Gerald Chee:

Yes. So, I think that data is actually quite interesting for us. When I look at the data most of our users are in the 25 to 34 age range, and about 60 to 70% of them are male, so that’s kind of the demographics of the site. In terms of geographical numbers, the top for us last year was the US, followed by some European countries, for example, Germany, Netherlands, UK, and then fifth place was Vietnam, and I think the other interesting numbers was Turkey was tenth, and we see a country like Venezuela was 33, things like that, and we actually had about 100 North Korean users last year on the site, too.

Laura Shin:

Wait. Really?

Gerald Chee:

Yeah.

Laura Shin:

I wonder if all 100 of them are Kim Jong Il, but interesting. Interesting. Although I guess, you’re counting unique users, so now I’m stuck on that because that’s fascinating. The Vietnam thing was super interesting, too. I don’t feel like I’ve heard that much about trading there, but I did know, obviously, Turkey and Venezuela. What it what are like the behaviors that visitors exhibit on the site, like can you, by their behavior, segment them out into like the people who are just kind of like compulsively checking the price versus people who are doing more sophisticated research versus…that kind of thing?

Gerald Chee:

Yes. So, for the most part, most people do compulsively check the site, so I think the average is something like two to five times a day depending on who the user is, sometimes, even more, so I think though the curve is around the two to five times a day mark, so that, we can tell, is still the most popular way of interacting with the site, so about 30% of all the page views are from the main page, but 70% are the longtail pages, so basically people clicking in. So, from about two years before to now we actually see the number of pages that people look at increase over time, so I think it used to be something like 1.7 pages, now we’re up to you about 3.2, 2.7 or so, so depending on which period, so I think that has actually been quite encouraging because we can see that people are actually drilling down to see more, and also people are interacting with the tabs on the detail pages more, looking at analysis that we have added, looking at just news, social and so forth, on the site that we’ve added within the tabs.

So, I think it’s actually a good thing and it has informed a bit of our thinking around adding more content within those tabs and allowing users to have a deeper experience, because then you know for the other people who are really trying to go deeper and understand more about the space we should be the one place that they should be able to get that information without having to leave the page for that.

Laura Shin:

Yeah, I’m definitely in the longtail group because I’m writing this book right now and I’m doing a lot of research, so I’m in one of your categories, and I heard you mentioned in another interview that CoinMarketCap’s web traffic is 90% correlated to the Bitcoin price. Actually, I’m not sure how old that interview is so is that still true, and if so, has that changed over time like is that more common in a bull market versus a bear market, or is that consistent between the two, and do you think that’s a problem?

Gerald Chee:

So, I remember running these numbers, so we run it once a year at the end of the year, so early on 2013, 2014, 2015 they were all consistently 99% so when I ran the numbers at the end of 2018, last year, it was 90% which means it’s gone down a little bit, so I’m sure we will do another one at the end of this year. So, I find that it would actually be…Well. Gerald, you had something.

Gerald Chee:

Yeah. Sure. I can answer that because based on my…I’ve done some studies as well on my site, statistical analysis. It’s actually quite interesting, right, because from what I’m seeing I think our traffic is correlated to the volatility of Bitcoin not so much the absolute returns of Bitcoin, and that’s interesting because we realize that when there’s a big bear market, or when it’s a big bull move on the same day we will see a lot of traffic coming in to check the price of Bitcoin because that’s what people are interested in. The movement of price in terms of how…the absolute move of price, whether it’s up and down. When price moves, we get traffic and that’s something that we have observed.

Laura Shin:

Interesting. All right. So, I know everybody’s wondering about this fake volume issue, so we are gonna talk about that after a quick word from the sponsors who make this show possible.

Cipher TraceWill the world follow France and advocate banning privacy-coins? Will government-backed stable-coins become the new fiat? Are distributed and peer-to-peer exchanges just a flash in the pan? The answer is maybe. Virtual currencies can flourish and create a new, private and more versatile economy. But that grand vision can’t happen without keeping crypto clean —AND that requires support of governments and accountability for bad actors. Privacy Enhanced Compliance using cryptographic controls has the potential to preserve anonymity without compromising legitimate investigations. CipherTrace is working on this vision of the future. Sign up stay up to date on the Privacy Enhanced Compliance initiative and receive authoritative Crypto AML reports quarterly. https://www.CipherTrace.com/KeepCryptoClean Kraken

Today’s episode is brought to you by Kraken. Kraken is the best exchange in the world for buying and selling digital assets. With all the recent exchange hacks and other troubles, you want to trade on an exchange you can trust. Kraken’s focus on security is utterly amazing, their liquidity is deep and their fee structure is great – with no minimum or hidden fees. They even reward you for trading so you can make more trades for less. If you’re a beginner you will find an easy onramp from 5 fiat currencies, and if you’re an advanced trader you’ll love their 5x margin and futures trading. To learn more, please go to kraken.com.

Crypto.comCrypto.com sees a future of cryptocurrency in every wallet. Have you seen the MCO Visa Card? A metal card, powered by crypto. Loaded with perks including up to 5% back on ALL your spending and unlimited airport lounge access. They pay for your Spotify & Netflix too! What’s not to love? With Crypto.com, not only can you spend your crypto, but you can grow it too! Earn up to 6% per year on the most popular coins like BTC, XRP, LTC and up to 12% per year on Stablecoins like PAX or TUSD. Just a few taps before you start receiving interest every week. Join the over 1 million others and download the Crypto.com App today.

Laura Shin:

Back to my conversation with Carylyne Chan and Gerald Chee of CoinMarketCap. So actually, before we get to fake volume, I do want to ask one other question, which is just to understand how CoinMarketCap works. What is the typical process for a coin or token to get listed, both in terms of what the submitter has to do and then what coin market cap has to do to get it listed?

Gerald Chee:

Sure. I think there are actually two different tracks. One is if you’re a project, one is if you are in exchange, so for the project’s what you have to do is basically submit through a form that we have on the site which is coinmarketcap.com/requests, same thing for exchanges but you go to different tracks, so for most of the projects and exchanges that lives in our site we actually encourage everyone to look at the methodology page because it tells you specifically what the listings team was looking for. So, what happens is after you submit this form it asks…as you’re submitting this form it asks you things like what this project is about, it asks you for uniqueness, attraction, your community, things like that, so these are all things that the team is looking for on top of the requirements, which is you must have a functional site, it is a crypto, it is traded publicly, and it has a representative from the exchange set from the project that we can actually speak to if we need to clarify, so that’s the requirements for your projects, so I find it’s pretty straightforward.

Some people who have said it takes a long time it turns out usually that they have not provided all the information that the team is looking for, and so I would say for all listing requests you should try to put as much information as possible in that forum so that there is less back-and-forth because every time you reply it goes back to the end of the queue, so that’s for projects, and then for exchanges there are some other requirements that are needed. For example, they must submit a summary endpoint for their API, they must be in operation for at least 60 days, they must have order book data that they can submit to us now, and also a system status page that shows all the coin listings or details, and so anyone that is actually submitting on the behalf of the exchange, if they have the exchange email, will be prioritized. So, I think we have all of these the idea is that we are trying our best to list everything that comes on the site as long as they pass these requirements, and so we want to make sure that we can get everybody on the page.

So, recently we actually had an update to the methodology to include something called untracked listings, so even if you don’t have markets that we are currently tracking, whether you’re a project or exchange, we can still make sure that we put you up as a listing on this site so that you have a page that you represent on CoinMarketCap and later on we’ll add your markets as well.

Laura Shin:

And you wrote this blog post where you mentioned the most common customer complaints and it was kind of funny, frankly. First was remove exchange x because it is faking volumes. We will talk about this. I know everybody wants us to talk about this. Sorry. There’s just a lot of exposition first. Second, project x is a scam please de-list it otherwise you are aiding and abetting these crooks. Three, please remove our pairs on exchange x because we do not want our project to be associated with wash trading, and then complaint four. Exchange x has stolen my funds. Please issue an alert. So, when you receive these complaints do you try to verify them, especially for project x is a scam. I did notice that, for instance, Centra Tech, which the SEC called fraudulent is not even listed anymore in the site, and then I just wondered like you know would there have been any point in preserving the history of the trades, because it looks to me like you just took it down?

Gerald Chee:

Yeah, so we definitely try not censor any information. I think that’s, actually, quite key to the philosophy, so for all of the requests that come in, the team actually goes through them one by one and tries to verify every single one that happens, so, for example, you talked about the scam. So, I think scam is one that is really difficult because we’re not trying to please any of the projects or exchanges, but we know that we should definitely look into it or issue alerts where necessary so things like that the team actually goes through, has gone to talk to local police. They have talked to local authorities to help to verify some of this information that has been submitted for those that have been called a scam, but for the team as well they have all seen many projects which are not scams that people have called scams, and at the start people even called Bitcoin a scam, so the team is pretty cautious about not making those assumptions.

So, where there are regulatory alerts, or warnings, that have been issued what they do is to put out an alert saying it’s been put on this watchlist and please be careful with your funds, and the same thing for many of the others, like we have received complaints that is really hard to withdraw funds from this exchange so be careful putting your funds into this exchange, things like that, so I think instead of…

Laura Shin:

So, for the Centra Tech one did you just decide to remove it because it was called fraudulent by the SEC?

Gerald Chee:

Centra Tech, I don’t know specifically for that, but there are usually two ways. One is they no longer had any volume so the team had to delist them based on our delisting policy or the other would be…I think that’s probably the most…that’s probably what happened, and then because we usually don’t even…we don’t take projects down because people do want to see them for posterity they want to see the history of the project, so our delisting criteria does have that, and also unless it was verified as a scam, in which case we would take them down as well so that nobody would be exposed to that. Yeah.

Laura Shin:

Okay. All right. So, let’s talk about this Bitwise report. This report came out in April and it said that 95% of Bitcoin trading was fake and most of the real trading was just on 10 exchanges, and they even launched this website, bitcointradevolume.com, that shows trading volume only on those 10 exchanges. So, before the report came out was CoinMarketCap aware that such a huge percentage of trading could potentially be fake?

Gerald Chee:

I think we started to notice the volume inflation problem last year, so we definitely were already looking at solutions to this even before the report came out, and what we really wanted to avoid doing in the solution, or in our brainstorming off the solution, was to not do something similar to that, which is to label something as a good or bad exchange because I think that’s binary. Bitwise, for example, has also noted those that have inflated volumes might also have real liquidity on them, so that’s one thing that we avoided, and the second thing we wanted to avoid was to use an unscientific kind of correlation, for example, web traffic and volumes, because you could but an API key, or to also avoid things like simplistic ways of looking at volumes, like fixing order book depth percentage instead of going down to the root cause of the problem.

So, we noticed that and we were actively trying to solve it by looking at the root cause of the problem, but the main point is we wanted a solution that could be really objective and would be applicable to thousands of assets, because I don’t think we’re in a position to say we can only focus on 10 exchanges or 10 of the most so-called important projects in the space. So, for us, everything that we think about has to be applicable to the thousands of office projects that we have ton the site, and the hundreds of exchanges that we have on the site, and so that’s why I took on quite a long time because we had to backcast a lot of data to get to a solution that we currently have.

Gerald Chee:

Yeah. Okay. I have something to add. All right. So, I think when Bitwise launched their report as well as their matrix they kind of had the focus of trying to convince the SEC that volumes in Bitcoin markets was only limited to the top 10, and the way they did that was to use data points from the exchanges, from the order books, to distill the difference between a legitimate exchange and the illegitimate exchange, and to do that they focused very heavily on the Bitcoin market pair, Bitcoin USD market pair, and they used that as the baseline to decide whether exchange was wash or not. So, the problems with that methodology was that they had to kind of distill the methodology and show the report in terms of the orders being placed on the market, the trade sizing, the times where orders got executed. They did a pretty good job in trying to distill all these different market data points but the moment they released a report all the people responsible for the wash trading could see what they were doing, and it’s actually counter game their metric and that kind of make the report irrelevant for the next run they try to do it.

So, that’s something that we also read in-depth and we consider that sort of methodology, but we felt that if you could do something so in-depth and yet when you release the report people could read it and say hey, this is what they’re doing. Let us try to counter game it by doing something totally different, and that creates a problem that the wash ring will still be there because the way they excluded exchanges and market pass was very systematic and people could read that methodology and counter game it. So, that’s something that we also bore in mind when we designed our liquidity matrix, to try to not let something as easy as that be game. Yeah.

Laura Shin:

Right, and it also sounds like maybe because their report really was focused on trying to persuade the SEC about a bitcoin ETF that in a way it’s sort of…their purpose was just different from yours because theirs was more targeted to this one regulator and you’re serving this kind of global audience. So, one thing that came out of it, of course…and I actually just…not knowing that you had been working on it before the report it looked to me like your new liquidity metric was maybe in response to their report, but I mean it just sounds like it was in response to the fact that this was a problem, this fake volume was a problem.

So for you, when you were working on this fake volume problem, how did you define the problem? Did you see it the same way that Bitwise did where…the wash trading and all that, and if so…or can you just describe how you saw that problem, and then now also talk about your new liquidity metric and how it addresses that issue?

Gerald Chee:

Sure. Let me try to run through the top process behind the whole liquidity and volumes matrix. So, I think the first starting point of any discussion in this whole problem is the reason why we use volumes for ranking market pairs and exchanges. For A, because volumes has been the de facto matrix that has been used in traditional financial markets and it’s for a good reason, right, because in traditional financial markets there is heavy real clear oversight and it’s very difficult for any trader, or anybody for the matter, to wash trade, because that is illegal and they will be arrested for it, and fine for that, so that is not the same for the cryptocurrency space because we have a dichotomy of either you have your regulator in the US, for example, or you’re not.In Seychelles or Malta, and the amount of regulatory oversight for these two exchanges are completely different and A, you have very strict anti-war shredding measures, B, you don’t, right, but the fact that matter is all these exchanges in the cryptocurrency space matter because they are what makes the bitcoin markets.

It’s decentralized and it’s something that we have to live with. So, if that’s something that we have to accept that volumes could potentially be faked because there is a lack of regular site from exchanges that are located elsewhere of the US, we then need to think about hey is volumes the right metric to use, right. To go down to the basics, what is the use of volumes if subvolumes are mainly used to determine whether there’s trading interest, so you see the top 10 active stocks on the stock market, you see the top 10 active bonds in the space so that that is one use case for volumes.

The second use case for volumes will be, essentially, to determine liquidity because, for most parts, most traders want to trade on markets that are liquid and the best way. without looking at the actual order book, would be to look at volumes if everything was all regulated, so that’s what I did last time when I was trading. If I don’t find a market that was active and that had good liquidity, I’ll look at the volumes reported. However, the same cannot be said once you have this regulatory…this regulatory environment and that’s why we thought about this whole problem at large, right. So, the reason why we use volumes on our site is to distill the liquidity that exists on exchanges and market pairs.

So, if we wanted to really define what liquidity meant we then needed to design a matrix that measured liquidity and not volumes, so that is what we cannot start, and the problems behind showing liquidity as a matrix is that A, it’s always changing because all the orders its…we’re trying to track transactional data that is not done yet, so, on one hand, you have volume status that tracks transactional data between two traders. On the other hand, you have the order book with these orders that are not yet executed in the markets, so those orders can always be canceled, can always be replaced, but the truth of the matter is, in every single market what really matters is not volumes per se but it’s how liquid markets are, so the more liquid a market is the more traders you could assume to be trading on there and the less slippage you get for trading there, so that creates the kind of environment that we want to encourage, right.

Liquidity is something that we want to encourage people to promote their exchanges and that’s how we decided that liquidity asymmetry is best used to serve the interests of both traders, and retail users, and everyone in the space at large.

Laura Shin:

All right. Yeah. One other thing that you guys also announced roughly in the same period was the Data Accountability and Transparency Alliance, which has a convenient acronym, which is DATA. What does that group do and what kinds of problems are you trying to solve with that?

Carylyne Chan:

Yeah, so in May of this year, we launched the DATA alliance. So, what we really wanted to do with DATA is to talk about these issues that we were facing, so part of that, obviously, was the volume problem, so what we did with the partners that came on was we asked them for their thoughts on the problem and when we did our first round table with the DATA alliance we actually presented the first version of our liquidity metric there, so we talked about the components that would go in there and we actually got some really good feedback that made it into the final version of the liquidity metric that we see today, so I think that…one thing would be to provide feedback on things that would impact all of us, but also at the same time with the DATA alliance it goes beyond that because we realized that people…like the fact that people were trying to inflate or change the numbers on their end means that we just need more transparency, or more accountability as a whole, in terms of the industry for our data, so taking responsibility for that.

I think we wanted to just rally people around this cause that we cared about, which is transparency and I hope that with more and more people joining us we would be able to get a mass of people who cared about this problem and could solve this problem with us, so one thing would be to do these roundtables, but also we’re working on a number of other initiatives. For example, something that we could do to unify tickers, so you know like the famous example that everyone cites is there are three or four different projects, Crypto assets that actually have the same ticker, so with that in mind we’re trying to see whether there’s a way for us to unify things like that so that people cannot take advantage of the fact that some assets have the same tickers and try to pass them off as something else, for example, so that’s another transparency issue that we’ve noticed. So, in the future, we’re also looking at whether the alliance can do things like fund projects that are focused on transparency or fund other initiatives that are aligned with our philosophy around transparency, and accountability, and data.

Laura Shin:

Well. I couldn’t help but notice that some of the exchanges who partnered with you on this DATA alliance are some of the same exchanges that the Bitwise report showed where some of the most egregious when it came to fake volumes, and then, on the other hand, some of the exchanges that they cited as having real volume such as CoinBase, or Kraken, which I should disclose is a sponsor of the show, and Bitstamp are actually not a part of the DATA alliance, so how did you go about choosing those members?

Carylyne Chan:

Yeah, so I think for us when we wanted to start with the DATA alliance the idea was to work with any exchange that really has shown us that they want to fix this problem, so part of it was you have to work with people who might be accused, or are doing it, because you kind of want to know what they’re thinking and how that affects them, so we actually took that into account that they submitted a very thoughtful response, and they gave us several solutions for how they would actually change it up as part of the process of working together on the alliance, so we were not filtering out specifically for what they were doing but rather the intent behind it, and I think it has worked out because we see some of the…that actually just on there they have provided really good feedback to us and it has affected it into the way that we were thinking about…the way that we thought about the volume problem at that point in time.

Laura Shin:

Yeah, and I’ll just name some of the ones that the Bitwise report named as being the most egregious, which were HitBTC, OKex, and Huobi, and those are the ones that are part of your alliance, but one thing that then I noticed was for your new liquidity metric…I guess you’re rolling it out in phases but at least you can see it now for exchanges and HitBTC is ranked first in liquidity, which like I said just a few minutes ago it apparently had some of the highest fake volumes, Huobi was third, and OKex was fourth, so then this made me question are they gaming the new liquidity metric?

Do you think they actually have that much liquidity and somehow Bitwise was wrong or is it…I mean it could be that since the report came out they’ve no significantly cleaned up the trading and also attracted real volume, but I just have to admit like given the backstory it looked suspicious, especially since HitBTC, at least at this moment, is number one but with like just a bit more liquidity than Binance. I don’t know. It just looks very oh how convenient. We’re ahead of Binance, which people should know is one of the ones with real volume, or that was said had real volume, so anyway.

Gerald Chee:

Yeah. I think a few points the question. I think the first point is HitBTC was number one. I did look at the order books and for the most part, they did have legitimate liquidity. However, I can’t say the same for volumes because that is always the question on everyone’s minds, right. So, in launching this whole liquidity matrix we wanted to shift the focus of the minds of traders, and people in the space, to kind of really distill what really matters and that’s what we believe is liquidity, so the reason why they are above Binance is mainly because they have a lot more market pairs. I think if you see on our site they’re listing 840 different market pairs, whereas Binance only has about 400, or 500 different market pairs, so the more market pairs you have, the more liquidity you’re providing to the space the higher you will be ranked on that simple metric, so that’s something that hopefully…yeah, it’s…for what it’s worth it’s…they do provide liquidity to the space.

Do they wash trade? I’m not too sure. I need a different solve metric altogether, but I mean we could take Bitwise’s word for that and say hey, they do wash trade, but the flip side is, is wash trading really that important or is liquidity for the space more important, and I would argue the latter not the former.

Laura Shin:

All right. Yeah. I also want to talk about one other way in which another data provider has tried to respond to this issue. CryptoCompare took a pretty different tack from CoinMarketCap, and granted I mean that the sites have been different for quite a while, but this summer they began releasing this exchange benchmark report where they not only place less emphasis on volume but they actually say that they don’t even directly include it when they do the ranking, and they focus primarily on legal/regulatory, security and data provision, and that means they include factors like insurance, the experience of the team, geography, and by geography they mean where the exchange is domiciled to take into account whether or not it’s in a jurisdiction with lower regulatory standards.

So, has CoinMarketCap ever considered including those kinds of factors when it ranks exchanges?

Carylyne Chan:

Yeah, so when we thought about a metric that makes sense for us I think what we were trying to optimize for was to make sure that we can first address the problem head-on at the root, and I think many of the other solutions, or ideas, that came out as a result of the volume inflation tried to skirt around the problem by either focusing on a specific set of exchanges, or some attribute that they deemed more important, like regulation and so forth, so I don’t think we are ruling out that I think it depends on who the market is targeted at, because for example if we were to compare, they might be using these benchmarks more because they’re pursuing the institutional market, where historically institutional markets will look for things like specific venues that you could trade at, like Nasdaq, or whatever, so those specific ones you would try to get a sense off, whereas I think for us we are trying to go for the global retail audience, and so they need to know specifically if I’m trying to trade an asset where can I trade it for the best price with the least slippage, and that would help them to determine where they would get the best outcome, whereas if we included other factors that were less data-driven based on every single…like the tens of thousands of market pairs that we have then that would probably be a separate product…or a packaging of a different product that we would target differently than the current audience that we have on the site.

Laura Shin:

All right. So, I actually want to also circle back to something that we touched upon briefly more toward the beginning when Gerald talked about how he came to work at CoinMarketCap. Obviously, that was through the acquisition, that you mentioned, of your company Hashtag Capital, and you talked about how you were focused on trying to offer a true price. So, I just wondered can you describe what are the problems that come up when you try to create a true price? I mean we talked about this a little bit when we talked about the kimchi premium, but I didn’t know if there were other issues, but I also was curious to know how you even define true price.

Gerald Chee:

Sure. I think that’s a very interesting question, right, so for the most part in terms of how pricing works in crypto…in the space it’s very unique because this is the very first time, we have an asset class that is truly decentralized in terms of its trading venues. For most equities in the US, it’s located in the New York Stock Exchange, and the futures is on CME. You have very centralized exchanges that kind of encapsulate all the liquidity of that asset class on exchange, so for the very first time we have multiple venues, hundreds of venues for a Bitcoin, for the matter, and how do you then discern the true price of Bitcoin visa vie all these different exchanges, so in terms of how people have done it.

So, let me give you a few examples of how people have done it. The derivative exchanges, for example, need a very robust price index because the perpetual stocks, for example, will be priced using the few exchanges that it selects, so, for the most part, most people select the user specs, such as CoinBase, Kraken, Gemini, Bitstamp, right, because this exchange is the most regulated ones and they could kind of say like hey, these are the most regulated ones. We trust the trades that are on there. Let us use these prices as the baseline for index. The problem is you kind of forget the entire universe of cryptocurrency exchanges, the Binance’s, the Huobi’s, the Okex’s.

Well. You already pointed out they may have questionable volumes, but the truth of the matter is they have very legitimate liquidity, very large pools of liquidity that we need to take into account in terms of getting the true price of volume. So, one problem in this whole equation is the exchanges on in the US price their Bitcoin in USD terms, and that’s USD that you can transact from bank to bank, right, because it’s the same ecosystem. However, most of the unregulated exchanges they price their Bitcoin in USDT and that’s a problem because USDT does not equate, for the most part, to USD but the point is USDT…Bitcoin USDT pairs should also matter because they are one of the most liquid pairs, Binance for example, Huobi for example. They all have very liquid market pairs, in terms of Bitcoin USDT.

So, the real question is how do you then factor that part in terms of how bitcoins priced visa vie, this entire ecosystem, and that’s why we are trying to solve because we believe that only if you include all these different exchanges and different market pairs for Bitcoin can you truly discern the true value of Bitcoin, and that’s why we’re trying to work towards.

Laura Shin:

Wow. That sounds super fascinating. Super, super interesting, and so what does your technology do to get that truer price?

Gerald Chee:

Sure. So, in terms of how we kind of use it…how we use our true price algorithm. Imagine every single market pair as an equation, so, for example, you’re a Bitcoin USD on CoinBase as one equation, Bitcoin USD on Kraken, that’s another equation, Bitcoin USDT on Binance, that’s another equation, so you have essentially A over B, A over B, B over C, and all these equations have an answer and that is the actual price of the market. With all the different market pairs in a space you have many, many equations. Multiple, multiple equations and the truth of the matter is there is a mathematical formula to solve the…to use the solutions to all of these equations to arrive at an answer that best fits all the different assets that comprise the unknowns.

It may seem complicated but it’s a matter of solving many multiple simultaneous equations to arrive at the best answer for all these different assets, and we believe that’s the best way to find the true value of Bitcoin visa vie any other asset that you want to price it with.

Laura Shin:

All right. So, before we end here I actually wanted to circle back to the circulating supply issue, because I did refer to this controversy, or I hinted at it in the beginning, but Carylyne, you wrote a little history of CoinMarketCap and you talked about how even from the beginning when Ripple was added it started a controversy right away, and for a while to satisfy the different groups who are protesting you guys even had two versions of the site. So, what was that controversy about?

Carylyne Chan:

I think at that point in time people wanted to look at the different cryptos and XRP, at that point, there were some contests over total supply, circulating supply, and things like that, so I think that that battle still continues today, but for the most part if you look at XRP on the site they have what is currently in the hands of people and what is not, and we actually take that number instead of the total supply, so at that point because there was so much contesting over is XRP really a crypto, what is XRP’s true supply.

Brandon made the decision to actually spin off a different site, but later on, you realized that obviously it was unsustainable to keep two versions of the same site just because of one asset, so he put XRP back on the main site and it has continued the way that it is today.

Laura Shin:

Yeah, so let’s dive into the issues there because…so earlier this year Ryan Selkis of Messari did a report on Ripple where he stated that due to the lockups and other selling restrictions Ripple’s circulating supply was quite a bit lower than what was shown on CoinMarketCap, and later Ripple did state that his report was based on an incorrect calculation of market cap, but also said that even some of the assumptions he made around lock-ups were inaccurate. Although, I will say that I know through my own reporting that at least one of them was completely accurate, so I’m not sure which one of the points Ripple was contesting, but anyway.

At this point in time, does CoinMarketCap for instance…let’s just start with the first point that Ryan made, which was about Jed McCaleb’s allotment of XRP, which he is so restricted from selling that it’s basically kind of like totally locked up, so does CoinMarketCap include the amount that Jed has in the circulating supply or not? What do you do with these irregular types of situations?

Carylyne Chan:

So, I think we had something similar where people asked, do Satoshi’s wallets count in the circulating supply of bitcoin, so I think the team does deal with situations like that for the most part, and…

Laura Shin:

But do you know how they’ve decided it?

Carylyne Chan:

Yeah, so I think as long as it is possible to sell it, they were included, so that was the decision that was made. So, back to the main…

Laura Shin:

But in the case of Jed, where legally he’s restricted then would those we counted or not?

Carylyne Chan:

As he is able to sell them, they would become circulating and they would be part of the numbers that they can…the team can verify on the Explorer, in which case they would be counted in circulating.

Laura Shin:

Oaky, so essentially CoinMarketCap excludes them at the moment because the amount that he can sell is like zero point whatever, or zero point zero you know. That kind of thing.

Carylyne Chan:

Yeah, and I think…in fact, when we talk about the origin story of XRP on CMC, I think it was less about supply and it was more about concentration of power, rather like centralization, so people were protesting XRP because they said it was centralized as opposed to the fact that the supply numbers were not as expected. I think that was something that actually took some time to develop as a story.

Laura Shin:

Oh, I see. Okay, so they actually weren’t taking issue with it, so that was more like a thing Ryan did. Okay, I see. Well. All right. We talked a little bit about the kind of traffic you see on your site. Based on the trends you’re seeing in the site traffic, or the way the activity is changing on the site, where do you think the space is headed in the near term?

Carylyne Chan:

Yeah, I think we have some theories there about what would happen, and obviously none of them we can verify at this moment, but for example we do see that over time it’s possible that there will be more concentration of assets, and maybe we will concentrate to the top few hundred instead of the top few thousands, it’s possible, so I think that that’s just part of the natural evolution of this space. That’s something that we’ve noticed. I think the second is, people are interested, also, in crypto or even slightly non-encrypted things like Libra. So, the moment that we put Libra up on the site we got lots of hits. It was like the top crypto that was…top asset I was research on that day, so I think as more and more of these types of assets come on the site we do see more mainstream interest in them beyond just the more traditionally crypto-asset structures that we are used to, and the third would be around institutional and also pricing.

So, we talked a lot about liquidity, we talked a lot about how to price different assets and I think that because of the fact it’s so critical for someone to be able to provide that kind of accurate pricing algorithm, and things like that, so the institutional space we do see people coming to us and actually asking us how we might be able to help with some of these solutions, and so in totality we see a greater maturing of the space as compared to even just two years ago where it was more of a craze, and now people are actually really looking at derivatives, really looking at yields, really looking at ways that they can price markets better, looking for more professional ways, basically, of charting and also interacting, and buying, and selling crypto.

Laura Shin:

All right. Well. We will see whether your predictions play out. Thank you both, so much, for coming on Unchained. Where can people learn more about you and CoinMarketCap?

Carylyne Chan:

So, go to coinmarketcap.com. We have a ton of stuff in the navigation bar. If you’ve never clicked on that bar before, it has a resource in there that would be really helpful, so I check out lots of our new products there, and you can also find us on social with the handle @CoinMarketCap across all socials.

Laura Shin:

Great. All right. Well. Thank you both, so much, for coming on Unchained.

Carylyne Chan:

Thank you, Laura.

Gerald Chee:

All right. Thank you, Laura.

Laura Shin:

Thanks, so much, for joining us today. To learn more about Carylyne and Gerald, and CoinMarketCap check out the show notes inside your podcast player. If you’re not yet subscribed to my other podcast, Unconfirmed, which is shorter a bit noisier and now features a short news recap, be sure to check that out, also find out what I think are the top crypto stories each week by signing up for my email newsletter at unchainedpodcast.com. Unchained is produced by me, Laura Shin, with help from Fractal Recording, Anthony Yoon, Daniel Nuss, and Josh Durham. Thanks for listening