Not Ethereum 2.0 but 1.5?

This week saw Jack Dorsey’s Square become the second publicly listed company to invest its assets in Bitcoin. Dorsey said the investment is a step towards the company’s desire for a more inclusive future.

In the world of crypto exchanges, the ongoing story of the charges against BitMEX continues to unfold with a significant leadership shakeup. And, the CEO of Coinbase has said that 5% of employees have so far opted to take advantage of the company’s severance package to those who did not wish to be a part of the company in light of its new apolitical mission statement.

And, we have a look at what may be in store for future crypto market structures, as well as some exciting graphs charting the movement in DeFi over the past month, and a new documentary about “Crypto Startup School.”

On Unchained, we look at whether Solana can grab market share from Ethereum with Serum in a conversation with Anatoly Yakovenko and Sam Bankman-Fried. And on Unconfirmed, writer Chris Harland-Dunaway describes what he uncovered reporting a long investigative piece on Tron founder Justin Sun.

This Week’s Crypto News…

Square Purchases $50 Million in Bitcoin

Jack Dorsey’s Square has become the second publicly-listed company to invest in Bitcoin, purchasing 4,709 BTC for a total of $50 million. The move follows MicroStrategy’s announcement in August that the company had allocated 90% of its assets to the cryptocurrency. Square said in its statement that “cryptocurrency is an instrument of economic empowerment and provides a way to participate in a global monetary system, which aligns with the company’s purpose.” Square’s CFO, Amrita Ahuja, said, almost in a side-eye moment at Coinbase CEO Brian Armstrong, “For a company that is building products based on a more inclusive future, this investment is a step on that journey.”

Square also published a Bitcoin investment white paper in which it open sourced the process behind its purchase to help others considering doing something similar. In it, the company describes using an over-the-counter bitcoin liquidity provider so as to maintain privacy and not have the price slip with its large trade, points to its open source documentation for its bitcoin cold storage and explains its crime insurance policy, among other things.

These investments in bitcoin by two publicly traded companies come at a time when a traditional 60/40 portfolio is in jeopardy of not providing sufficient returns, writes Steve Ehrlich, the new director of research at Forbes Crypto. However, he says, Bitcoin may increasingly help diversify portfolios, especially as he says, “bitcoin has never been healthier.” He notes the 180-day volatility reached a 23-month low, and “it has been a record 74 days since bitcoin closed below $10,000.” He notes this is especially impressive considering these feats occurred despite the bad news of the third-largest crypto exchange hack in history and the indictment of the executives of top derivatives exchange BitMEX.

Leadership Changes as BitMEX Battles Fallout From Charges

BitMEX CEO Arthur Hayes and three other defendants named in lawsuits by the Commodities Future Trading Commission and the U.S. Department of Justice have stepped away from their executive roles at crypto derivatives exchange BitMEX. Vivien Khoo, chief operating officer of 100x Group, the parent company of BitMEX, has been made interim CEO of BitMEX.

Despite an exodus of nearly 30% of all Bitcoin on the exchange, and a high-risk warning issued by Chainalysis, a spokesperson for BitMEX insists that “it is business as usual for the BitMEX platform.” CoinDesk reports the exchange’s own Insurance Fund remains the largest such fund of any cryptocurrency derivatives exchange. Nonetheless, future and historical transfers from BitMEX will now trigger alerts in the Chainalysis transaction monitoring tool, KYT. Concerning the warning, Chainalysis said, “we consider an entity to be high risk if criminal charges have been brought against the entity or its owners/operators/leadership.”

The high-risk label by Chainalysis has been called a “death knell” for the exchange. Since charges were brought against BitMEX, more than 41,000 bitcoin has been withdrawn from the exchange. Nearly half of that BTC has migrated to Binance, with the rest moving mostly to Gemini and a smaller amount to Kraken (which, disclosure, is a previous sponsor of my show).

Delphi Digital partner José Maria Macedo made an interesting assertion about what the BitMEX charges could mean for crypto in a Twitter thread. Macedo suggests that while historically, anonymous teams in crypto are viewed as a risk, he says that, now, identity is an attack vector and that the future lies in embracing decentralization and pseudonymous on-chain reputation without relying on the legal system and social capital.

60 Employees Have Taken Coinbase’s Severance Package So Far

In a blog post published Thursday, Coinbase CEO Brian Armstrong revealed that 5% of Coinbase’s 1200 employees had so far accepted the severance package offered to those who disagreed with a recently updated mission statement that Coinbase was an apolitical company. Although the deadline to take the severance was Wednesday, Armstrong said the number would be higher after the company completes several other conversations. He wrote, “It was reassuring to see that people from under-represented groups at Coinbase have not taken the exit package in numbers disproportionate to the overall population.” An employee told CoinDesk that those choosing to leave are mainly engineers as opposed to customer-support staff.

Armstrong attempted to clarify that the company’s new stance doesn’t mean employees have to “pretend politics don’t exist.” Still, it remains unclear to many inside the company what counts as political and apolitical. Armstrong admitted that what could be considered as politics is “a blurry line.” Jill Carlson, an investor at Slow Ventures, wrote in a CoinDesk column that the real message Armstrong is sending is, “If you want to push a progressive social agenda in the workplace, this is not the company for you.”

Not Ethereum 2.0 But Ethereum 1.5?

In a post on the Fellowship of Ethereum Magicians forum, Ethereum creator Vitalik Buterin noted that Ethereum may scale in an unexpected way. According to the Ethereum 2.0 roadmap, scaling for applications is still years away. However, scaling is already in testnet for a number of layer 2 scaling options such as rollups, plasma and state channels, making those a more viable near- and mid-term solution.

This leads him to say that some popular apps whose data and applications live entirely on Layer 1, such as the Ethereum Name System, should be adapted to have their data such as accounts, balances and assets on layer 2. His conclusion is that if everyone moves to rollups, then that makes phase 2 of the transition to Ethereum 2.0 obsolete, and so Ethereum may instead be a “single high-security execution shard that everyone processes, plus a scalable data availability layer.” He writes, “This implies a ‘phase 1.5 and done’ approach to eth2,” as “by that point it will be easier to continue down that path than to try to bring everyone back to the base chain for no clear benefit and a 20-100x reduction in scalability.”

Whether or not Ethereum goes down this path remains to be seen, but one other interesting comment he made in this somewhat technical post is that focusing on rollups will leave more space for layer 2 protocols that can fund their own development with their own tokens.

DOJ Publishes Cryptocurrency Framework

On Thursday, The Department of Justice published an 83-page cryptocurrency enforcement framework detailing how it looks at cryptocurrency crimes, DeFi and its enforcement strategies. It categorizes illicit uses of crypto three ways: as 1) financial transactions that commission crimes; 2) money laundering and shielding transactions from tax reporting and other legal obligation; and 3) hacks or theft of cryptocurrency, particularly at exchanges. The agency indicated it also has its eye on DeFi, saying, “The ICO boom from a few years ago has given way to the exponential growth of Decentralized Finance markets in recent months — with all the associated complexities and difficulties for enforcers seeking to stay ahead of the curve and keep investors safe.”

What the Future May Hold for Crypto Market Structure

Arjun Balaji of Paradigm wrote an overview of the past and future of crypto market structure, recounting the 1.0 phase, from 2010 to 2017, in which peer-to-peer trading emerged on BitcoinTalk, Mt. Gox temporarily reigned, and OTC desks launched to serve some early institutional investors. He then covers how phase 2.0, from 2018 to now, has seen derivatives eclipse spot trading, OTC desks go electronic, lending firms emerge to provide $2 billion of Bitcoin and stablecoins on loan, and stablecoins function as reserve assets.He then says that we’re already in the early stages of moving to phase 3.0, which he believes will be more capital-efficient, bridging centralized markets with the ever-growing number of DeFi markets. He says that DeFi is disrupting centralized exchanges, but that throughput and high gas fees remain barriers to full-blown DeFi adoption. He believes that, as Layer 2 solutions come to fruition, we can expect to see the convergence of decentralized and centralized finance. This intersection of DeFi and CeFi will result in better DeFi interfaces, institutional DeFi support, and an attempt by major centralized exchanges to capitalize on CeDeFi, or centralized decentralized finance.

The Growth in DeFi in Charts

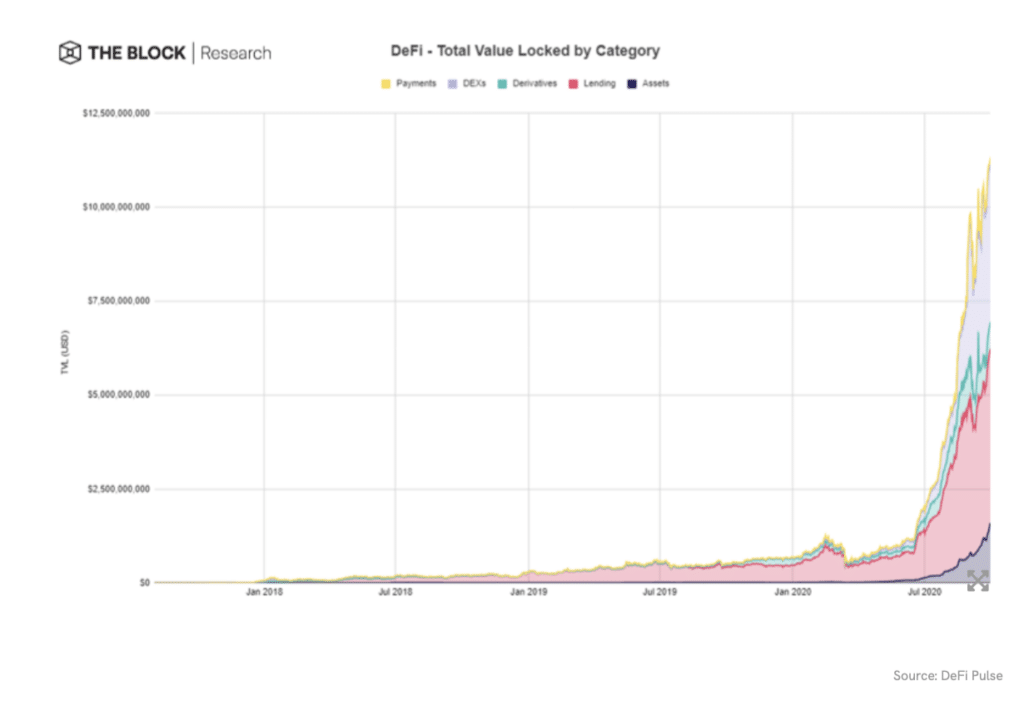

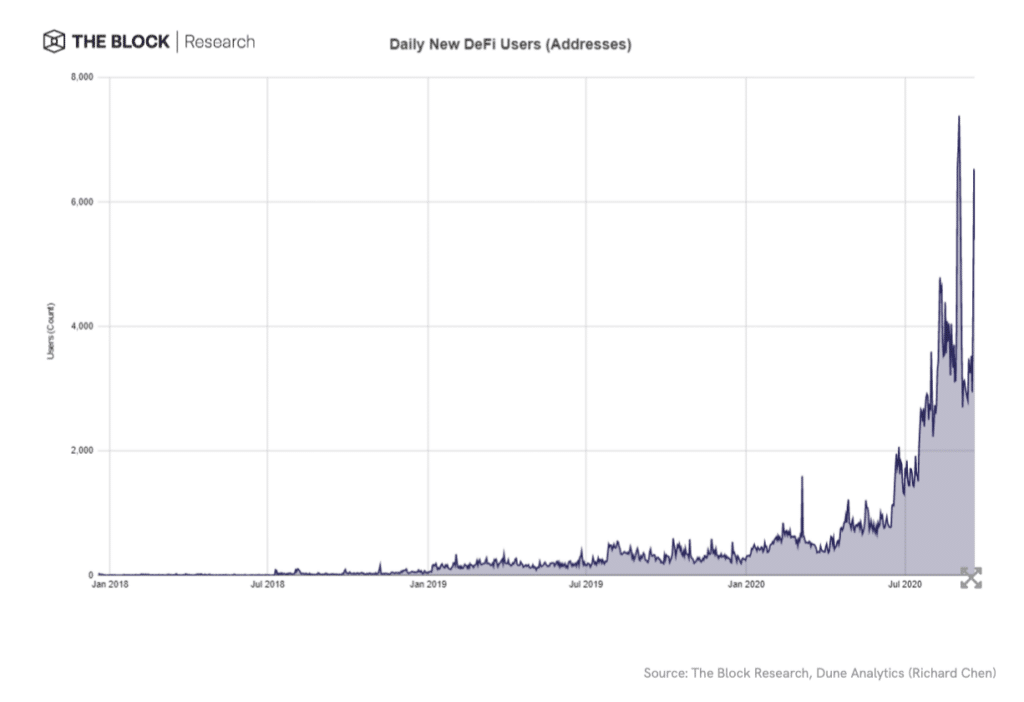

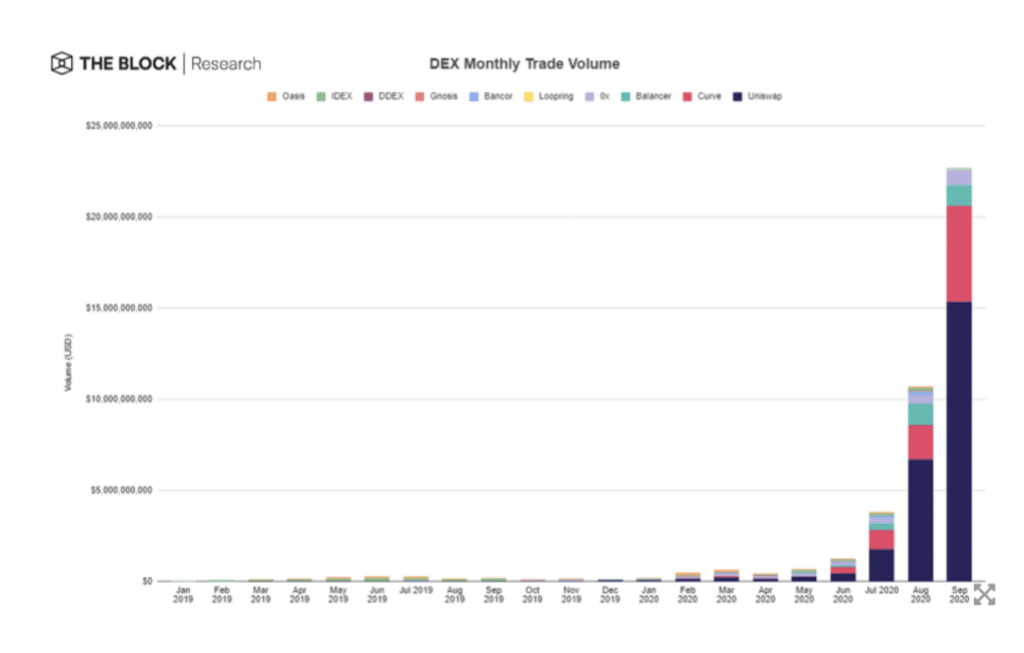

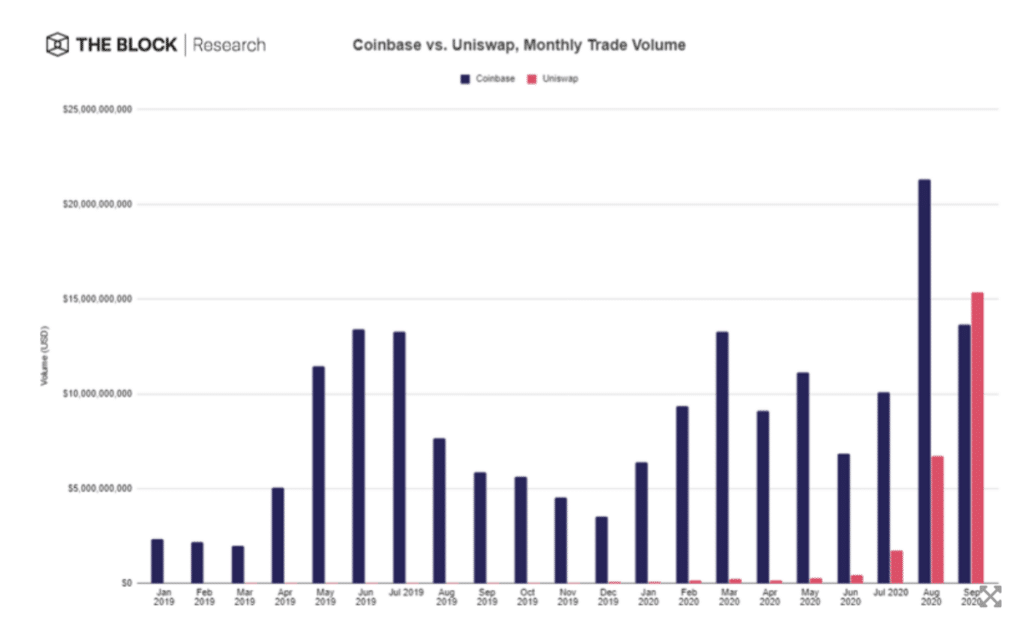

The Block Research has compiled 37 different charts that analyze various metrics across DeFi projects.

The total value locked in DeFi has now surpassed $11 billion with the three largest protocols by value locked being, in order, Uniswap, MakerDAO, and Aave. And on average, around 4,000 new addresses interact with DeFi protocols every day.

Although many users have multiple addresses, the trend towards DeFi is growing, with total DEX volumes in September passing $23 billion, a 74% increase over the previous 30-day period. For the first time, the most popular DEX Uniswap surpassed Coinbase in trading volume.

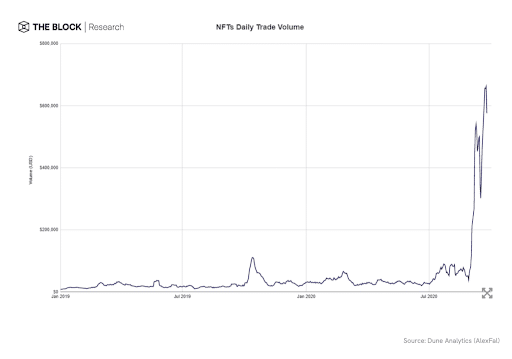

One standout among the graphs was the surge in the trading volume of NFTs, or non-fungible tokens, such as collectibles, with Rarible showing the most consistent volume as new platforms are continuing to be launched.

Live Premiere of New Documentary “Crypto Startup School”

As of this writing, we’ve only had a chance to view the enticing trailer, but Thursday night Andreessen Horowitz presented the new documentary “Crypto Startup School.” The film follows the seven-week program of the same name, announced earlier this year. During the program, experts in the crypto field offered talented technologists assistance in building crypto companies. By the time this video is live, the 30-minute behind-the-scenes look at the program should be available to view on a16z’s YouTube page.