June 16, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

-

Tron DAO Reserve plans to pull 2.5 billion TRX ($125 million) from Binance to attempt to re-peg the price of USDD to $1.

-

Celsius is working “non-stop” according to its CEO, but has yet to release a plan to open up withdrawals again.

-

Celsius also appointed Citigroup to advise the lender on possible solutions after its withdrawal freeze.

-

MetaMask, Phantom, and other browser wallets successfully patched a security vulnerability before attackers were able to take advantage of it.

-

Chainlink price feeds are live on Moonbeam.

-

Investors redeemed $1.6 billion worth of USDT this week.

-

Nansen launched a web3 messaging app called Nansen Connect.

- Stacey Cunningham, a former NYSE president, has joinedUniswap Labs as an advisor.

Today in Crypto Adoption…

- FINRA wants to hire fired crypto employees.

The $$$ Corner…

-

AR-focused company Kaleidoco announced a $7 million seed round.

- NFTPort raised $26 million in a Series A funding round.

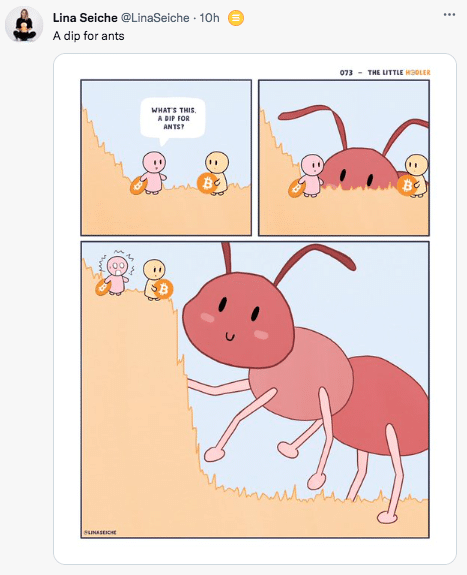

What Do You Meme?

What’s Poppin’?

Crypto Exchanges: To Hire or to Fire?

The recent market downturn is having quite an impact on the crypto job market.

Three of the largest companies in the industry, Coinbase, Crypto.com (disclosure: a sponsor), and BlockFi, all announced layoffs this week.

-

Coinbase let go roughly 1,100 employees, or 18% of their workforce, on Monday due to a potential “crypto winter” that could last for an “extended period.”

-

Crypto.com trimmed its headcount by 5% over the weekend after laying off 260 employees.

-

Crypto lending platform BlockFi plans to reduce its workforce by 20% according to CEO Zac Prince on Twitter, along with other cost-cutting measures like cutting marketing spend, eliminating non-critical vendors, and reducing executive compensation.

However, not all crypto companies are cutting workforce numbers in the down market. For example, Binance CEO Changpeng Zhao (CZ) says that the exchange is hiring for 2,000 open positions at the moment.

Kraken (disclosure: a previous sponsor), the crypto exchange led by CEO Jesse Powell (who wrote a VERY interesting thread on Kraken’s culture that is linked to in the NYT story in Recommended Reads today), also clarified that they are still hiring for the 500+ open positions on their job board. “We have not adjusted our hiring plan, and we do not intend to make any layoffs,” Kraken wrote in a blog post.

FTX is also looking to hire, though on a much smaller scale. According to FTX CEO Sam Bankman Fried, the firm expectsto grow from 300 to 400 employees in the next year.

Recommended Reads

-

The NYT on Kraken’s culture:

-

Meltem Demirors on why crypto companies are struggling right now:

-

Messari on valuing Fei Protocol:

On The Pod…

The Legal and Regulatory Fallout From Terra’s Collapse: Who Will Pay?

Olta Andoni, deputy general counsel at Ava Labs, and Ari Redbord, head of legal and government affairs at TRM Labs, discuss the Terra stablecoin meltdown, implications for impending international regulations, and the history of stablecoin regulation internationally. Topics covered include:

- What the most important legal issues are for the Terra meltdown

- How the Terra implosion will trigger more regulation of the space

- How regulators seemed to think stablecoins should be regulated even before Terra

- How their approach differs between dollar-backed stablecoins vs. algorithmic vs. crypto collateral-backed coins

- How European regulators want stablecoin issuers to be treated like banks

- What the Lummis-Gillibrand bill would mean for US stablecoin regulation

- Whether Terra’s demise will mean that regulators won’t tolerate experimentation with algorithmic stablecoins

- Why regulators will be skittish about stablecoins in response to Terra’s meltdown

- Why Olta and Ari were impressed by the NY Department of Financial Services guidance on stablecoins

- What the establishment of SEC jurisdiction over Terraform Labs based on the Mirror investigation from last fall means for any enforcement action by the SEC over Terra

- Whether Do Kwon and/or Terraform could face criminal charges in multiple jurisdictions

- Why international regulatory consistency is important in the crypto space

- Whether civil and class-action lawsuits against Terraform could be expected

- How Terra 2.0 could open TFL up to further action from regulators and law enforcement

- Why more education is needed to overcome anxiety about DeFi regulations

- How hack nondisclosures could be subject to government investigation

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians