February 14, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

The US Treasury reiterated that crypto stakers, miners, or coders will not be considered “brokers” by the IRS.

-

PancakeSwap is reportedly set to block users from Iran.

-

CryptoPunk #5822 sold for $23.7 million in ETH last week – the most expensive CryptoPunk sale ever.

-

Coinbase’s advanced trading platform resolved a critical vulnerability on Friday thanks to a white hat hacker.

-

FTX.US will be offering stock trading soon.

-

Bitcoin’s hash rate jumped 30% over the weekend to a new ATH.

-

OpenSea launched a venture arm to back NFT and web3 companies.

-

Evmos, a Cosmos-based project that aims to link up the Cosmos and Ethereum ecosystems, will be airdroppingrewards to Ethereum and Cosmos users.

-

Bud Light is giving out physical glasses to N3XT NFT holders.

-

Block, Argo, and Griid are lined up to purchase Intel’s new blockchain accelerator later this year.

Today in Crypto Adoption…

-

Uber’s CEO said the company will accept crypto at some point.

-

World Wildlife Fund reneged on plans to fund conservation through NFTs after backlash.

-

Jamaica is set to roll out a CBDC in 2022.

- The Bitfinex hack and money laundering story is coming to Netflix.

The $$$ Corner…

-

Binance invested $200 million in Forbes and Magnum Opus Acquisition Limited, which is a SPAC, to go public on the New York Stock Exchange. (Disclosure: Forbes is my former employer.)

-

Everyrealm, a virtual real-estate investor, raised $60 million in a funding round led by a16z.

-

Ethernity, an NFT marketplace, raised $20 million in seed funding.

- Dom Hofman, the co-founder of Vine and creator of Loot, raised $12 million from Paradigm for Sup, the parent company of the NFT project Blitmap.

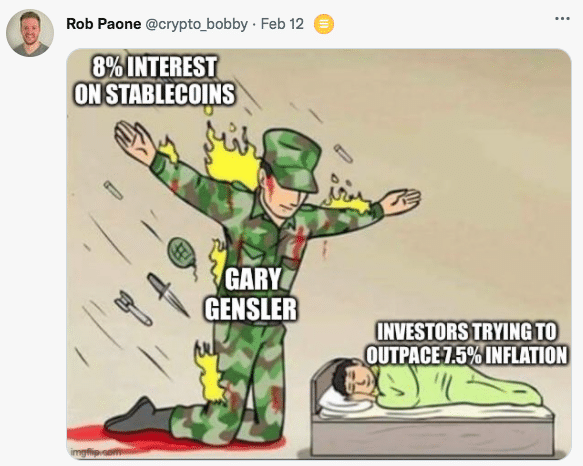

What Do You Meme?

What’s Poppin’?

SEC Slaps BlockFi With $100 Million Fine

BlockFi, a popular crypto lending platform, is reportedly set to pay $100 million to the Securities and Exchange Commission and state regulators as soon as next week. $50 million will be delivered to the SEC, and $50 million will be sent to various states, according to Bloomberg.

The $100 million will go towards settling investigations regarding whether BlockFi’s interest-earning accounts, where customers lend their digital assets to BlockFi in return for yield, are securities offerings. As part of the agreement with regulators, most Americans will not be able to open interest-yielding accounts, reports Bloomberg, citing people familiar with the matter.

BlockFi has been under scrutiny since last summer when five states issued either cease and desist or show-cause notices against BlockFi. Coinbase also had a run-in with regulators over its high-yield product, dubbed Lend, which it had to shut down before launching after the SEC threatened to sue.

On Twitter, BlockFi CEO Zac Prince noted that the company has been in “productive” dialogue with regulators and that BlockFi does “not comment on market rumors.” He also added that current BlockFi accounts will continue functioning as expected. “Clients’ assets are safeguarded on BlockFi’s platform and BlockFi Interest Account clients will continue to earn crypto interest as they always have!”

If Bloomberg’s report proves accurate, $100 million would be one of the largest fines ever levied against a crypto firm by the US.

The news prompted Digital Currency Group’s CEO Barry Silbert to predict that the SEC will not stop at centralized lending platforms. “It would be naive to think that the SEC and state regulators are going to fine BlockFi $100 million, but not go after DeFi lending platforms as well (how, I don’t know),” he wrote on Twitter.

However, Arca CIO Jeff Dorman disagreed: “Blockfi has been running an unregistered hedge fund for years with zero disclosures to depositors in terms of what they do to generate yield. DeFi lenders are 100% transparent with regard to how it works and where yield comes from. You may be right, but not apples to apples.”

While we may have to wait to see how regulators will approach DeFi, it may not be too much longer until other centralized lenders come under similar fire, as Bloomberg reported in January that the SEC is also scrutinizing Celsius, Gemini, and Voyager Digital.

Bonus What’s Poppin’

Crypto Super Bowl Ads Draw in Newbies

During yesterday’s Super Bowl, crypto behemoths showed up big time, with crypto exchanges Coinbase, FTX, and Crypto.com(disclosure: a sponsor) running humorous ads (in addition to crypto being mentioned by TurboTax and eToro).

Based solely on Twitter, FTX appears to have won the night. As reported by The Block’s Frank Chaparro, the exchange added 100,000 followers last night, bringing its total from 415,000 to above 535,000 after it ran an ad headlined by the famous curmudgeon Larry David (from Curb Your Enthusiasm and Seinfeld) faux denouncing inventions like democracy, portable music, and, of course, crypto.

Chaparro noted that Coinbase gained a mere 50,000 or so followers (though the exchange already had 4.7 million followers). Speaking of Coinbase, its commercial was far simpler than FTX’s. The exchange’s minute-long ad showed a QR code bouncing across the screen; viewers that scanned it would be invited to participate in a $3 million giveaway. (Of course, Coinbase then had to throttle back access to its website due to increased traffic.)

If you missed the game or were logged out of Twitter, you can check out all of the crypto-advertisement content in this thread:

Note: The game, which the Rams won, featured a star-studded halftime show in which Snoop Dogg wore an NFT.

Recommended Reads

-

@thomasg_eth, a DAO founder, was recently targeted by a complex social engineering scam. Here’s what he learned:

-

RAC, a Grammy award-winning artist, on money, music, and NFTs:

-

brunny.eth on the market cap of Ethereum:

On The Pod…

How Law Enforcement Tracked Down $3.6 Billion in Bitcoin

On Tuesday, the US government seized $3.6 billion in bitcoin from the 2016 Bitfinex hack and arrested two individuals, Ilya Lichtenstein and Heather Morgan, on charges of money laundering. Tom Robinson, cofounder and chief scientist at the blockchain analytics firm Elliptic, breaks down how law enforcement was able to seize the BTC, what techniques the alleged money launderers used to avoid capture, and who could have pulled off the initial hack. Show highlights:

-

background on the 2016 Bitfinex hack

-

who was arrested this week and why

-

how the US government gained access to the private keys in Lichtenstein’s and Morgan’s control

-

why AlphaBay, a now-defunct darknet website, was crucial to law enforcement’s effort to track down the stolen Bitfinex funds

-

what money laundering techniques were used to cash out the stolen Bitfinex funds before this week’s arrests

-

whether, as blockchain analytics technology advances, it will always catch up to be able to trace the movements of crypto as its laundered

-

why using Monero, a privacy coin, to cash out stolen funds is a red flag

-

why Tom does not think the two individuals arrested this week for money laundering the stolen Bitfinex funds were the original hackers

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians