July 16, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Revolut, a London-based neobank that offers crypto services, raised $800M at a $33B valuation.

-

THORChain lost an estimated 4,000 ETH in an attack yesterday.

-

Italian regulators say Binance is not authorized to carry out activities in Italy.

-

Congressman Tom Emmer re-introduced the Securities Clarity Act.

-

PayPal is increasing its weekly crypto purchase limit to $100,000

-

Axelar, a blockchain bridge, raised $25M in a Series A.

-

The UK’s Financial Conduct Authority has allocated $15M to educate young Britons on the riskiness associated with certain assets, including crypto.

-

Data from Cambridge shows that power usage amongst Chinese miners started falling in April — before authorities in China began cracking down.

- Axie Infinity’s AXS is up 700% since June lows.

What Do You Meme?

What’s Poppin’?

US Forms Anti-Ransomware Effort; Will Pay for Tips With Crypto

To fight back against a wave of ransomware attacks that have crippled companies and industries, the White House is forming a cross-government task force to investigate the phenomenon, whose ransom payments are made through cryptocurrency. The group will look for ways of “halting ransom payments made through cryptocurrency platforms.” It will also focus on prevention, such as helping potential targets bolster their internal systems.

Additionally, the US State Department’s Rewards for Justice program is adding crypto as a payout option, in what may be a first for a federal agency. The reward is for up to $10 million for information on cyber criminals “acting at the direction or under the control of a foreign government.”

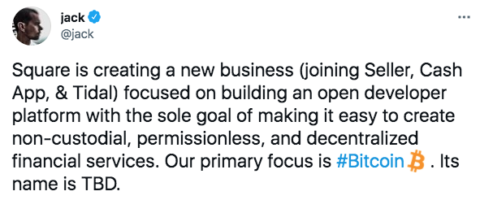

Jack Dorsey Announces New Bitcoin Platform Business

Square, along with Seller, Cash App, and Tidal, is creating a new platform business with Bitcoin as its primary focus, tweeted Twitter CEO Jack Dorsey. Like Square’s Bitcoin hardware wallet, the new company will be completely open-sourced, with the goal of “making it easy to create non-custodial, permissionless, and decentralized financial services.” As of now, the company lacks a name.

Recommended Reads

- Decrypt’s Jeff Roberts on why Circle was blindsided by Brian Brooks’s decision to join Binance US:

- Token Terminal believes the world is shifting toward an internet native economy:

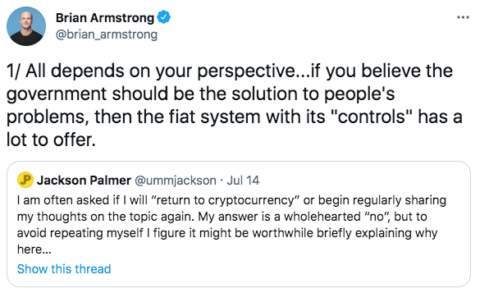

- On Wednesday, Dogecoin co-founder Jackson Palmer wrote a scathing review of the cryptocurrency industry. Here is Jackson’s thread, quote-tweeted by Coinbase CEO Brian Armstrong’s response:

On The Pod…

Why It Might Be Too Late for Binance to Avoid Regulatory Action

Christine Parker, partner at Reed Smith, summarizes the slew of regulatory headlines facing Binance and how such scrutiny may affect the exchange going forward. Show highlights:

-

which countries are investigating Binance

-

why it has been difficult for governing bodies to regulate Binance

-

whether the reports that regulatory bodies, like the CFTC/IRS/DOJ, coming after Binance are correct

-

when Christine expects regulators to make a move against Binance

-

how hiring ex-regulators might help Binance in Congress

-

whether Binance’s strategy of leaving countries with tight regulations helped or hurt the exchange

-

what Christine thinks of Binance’s strategy to localize its business model

-

whether or not it is too late to avoid regulatory penalties for Binance

-

why transitioning to a DAO business model would not absolve Binance of prior infractions

-

how the BitMEX situation could inform Binance

-

whether criminal charges could be in Binance CEO Changpeng Zhao’s future

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians