Here are some of the most important things to watch out for this week:

1. Genesis’s First Bankruptcy Hearing

Digital Currency Group subsidiary Genesis has filed for Chapter 11 bankruptcy protection and is scheduled to have its first hearing on Monday. The hearing will be presided over by Judge Sean H. Lane in the Southern District of New York.

This is the first step in official bankruptcy proceedings where the court will determine whether or not to accept the relief requested. If things go as planned, a US Trustee will appoint a committee of unsecured creditors to participate in Genesis’s proposed reorganization plan. According to the court filings, members of the committee will be selected from 20 of the firm’s largest unsecured creditors.

Genesis owes more than $3.5 billion to its top 50 creditors, which includes a claim in the bankruptcy filing of $766 million to Gemini Trust Company, making it a notable candidate for Genesis’s creditor committee. Last week, Gemini co-founder Cameron Winklevoss said Genesis’s bankruptcy filing was a “crucial step” to recover assets for Gemini Earn users.

Preliminary information from the filings revealed that Genesis pledged GBTC shares as collateral to Gemini Earn. After Genesis suspended withdrawals, Gemini foreclosed its GBTC collateral and sold these shares to a private buyer – something that likely contributed to GBTC’s widening discount to Net Asset Value.

2. CoinDesk is Up For Sale

Crypto media outlet and DCG subsidiary CoinDesk is exploring a full or partial sale. The company hired investment bankers Lazard to assist with the process, The Block reported last week.

CoinDesk CEO Kevin Worth said the firm has received “numerous inbound indications” over the last few months. However, some believe that these offers may not be quite as high as Worth would have liked.

According to Andrew Parish’s sources, initial bids for the media publication are around the $15 million to $25 million range, with the majority of interest coming from mainstream media houses outside the crypto industry.

UPDATE: Initial conversations/bids for @CoinDesk range from $15M-$25M

**source: “interest is coming from media properties outside of crypto, multiples are much, much lower than expected.”

— Andrew (@AP_Abacus) January 21, 2023

Cardano founder Charles Hoskinon is among these interested parties, according to a Bloomberg report on Friday. In a livestream last week, Hoskinson said that the company was valued at around $200 million from inquiries he had made through the grapevine.

3. Bitcoin Whales Accumulating

Despite a somewhat concerning outlook for some big players in the crypto industry, whale investors have been on a buying spree over the last few weeks. According to data from Santiment, a cohort of Bitcoin whales holding between 1,000 and 10,000 BTC bought $1.46 billion worth of BTC in the last two weeks.

🐳 #Bitcoin has now surpassed $22.7k for the first time since August 18, 2022. The price rise has come as the large whale tier group of addresses holding 1,000 to 10,000 $BTC has collectively accumulated 64,638 ($1.46 billion) $BTC in the past 15 days. 👍 https://t.co/H6jCsZDgUR pic.twitter.com/RaN2I48ybg

— Santiment (@santimentfeed) January 20, 2023

Santiment attributes a large part of the cryptocurrency’s rally past $23,000 this weekend to this whale activity.

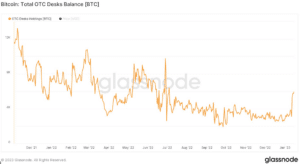

Data from Glassnode last week showed that the amount of BTC held by OTC desks had also increased by 70% since Jan. 11.