September 9, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Robinhood launched a new program that allows customers to set recurring crypto purchases without fees.

-

Private equity firm 10T Holdings raised approximately $750M across two funds to invest in digital asset companies.

-

An OpenSea bug destroyed $100K worth of Ethereum-based NFTs.

-

Eden Network, an Ethereum protocol, raised $17.4M to combat miner extractable value.

-

A lawmaker in Panama introduced a bill to regulate crypto assets to the country’s National Assembly.

-

Reports from Twitter show that some users received over $50,000 in airdropped DYDX tokens; US traders were not eligible for the airdrop due to concerns over securities laws.

-

Flexa, a crypto payments firm, is working with merchants in El Salvador to build out Lightning Network payment systems.

- Ukraine’s parliament passed a law legalizing and regulating virtual assets within the country.

What Do You Meme?

What’s Poppin’?

The US Securities Exchange and Exchange Commission (SEC) issued a Wells notice to Coinbase last Wednesday, signaling the regulator’s intent to sue the cryptocurrency exchange when/if Coinbase launches its Lend program.

Much like other crypto companies, such as BlockFi, Coinbase recently announced a new program, dubbed Lend, to allow customers to earn interest on certain assets — starting with 4% on USDC.

According to Coinbase’s Chief Legal Officer, Paul Grewal, the exchange had been in contact with the SEC for over six months regarding Lend. “Coinbase believes in the value of open and substantive dialogue with our regulators,” Grewal wrote. So, instead of launching and then asking forgiveness, Coinbase took Lend directly to the SEC before going live with the product.

The SEC, however, allegedly deemed Lend a security, citing the precedent of two Supreme Court cases, Howey and Reves. Consequently, the SEC opened up a formal investigation into Coinbase and has asked for the name and contact information for every customer on the Lend waitlist, to which Coinbase has not provided.

Tuesday night, Coinbase CEO Brian Armstrong took to Twitter to profess his displeasure with what he described as the SEC’s lack of communication and guidance. “They refuse to tell us why they think it’s a security, and instead subpoena a bunch of records from us (we comply), demand testimony from our employees (we comply), and then tell us they will be suing us if we proceed to launch, with zero explanation as to why,” Armstrong wrote.

He went on, noting that Coinbase intends to be a law-abiding corporation, even if Armstrong finds the current state of regulation frustrating. “Look….we’re committed to following the law. Sometimes the law is unclear. So if the SEC wants to publish guidance, we are also happy to follow that (it’s nice if you actually enforce it evenly across the industry equally btw),” he added. “They are refusing to offer any opinion in writing to the industry on what should be allowed and why, and instead are engaging in intimidation tactics behind closed doors. Whatever their theory is here, it feels like a reach/land grab vs other regulators.”

Quick reactions:

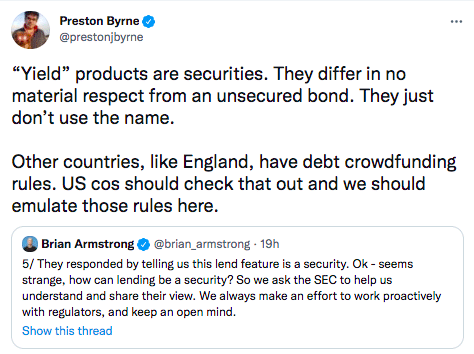

- Preston Byrne, partner at Anderson Kill, acknowledged that Coinbase’s Lend product is most likely a security. He recommends that Coinbase, and US companies in general, get in contact with English counsel to figure out how to implement UK debt crowdfunding rules.

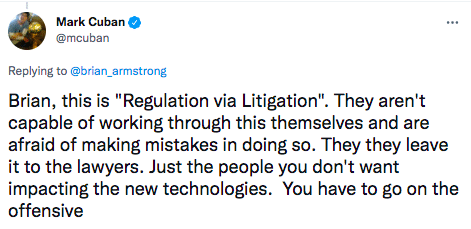

- Mark Cuban, Dallas Mavericks Owner, believes that Coinbase should go on the offensive against the SEC and force the regulator to accept the impact of new tech.

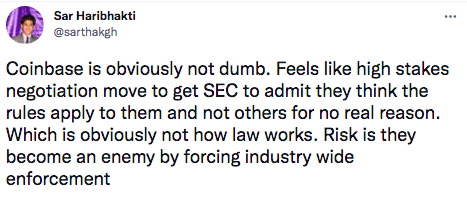

- Sar Haribhakti, program director of fintech at On Deck, thinks Coinbase’s move to directly engage the SEC could be risky, as an SEC decision on Coinbase could lead to industry-wide enforcement.

Recommended Reads

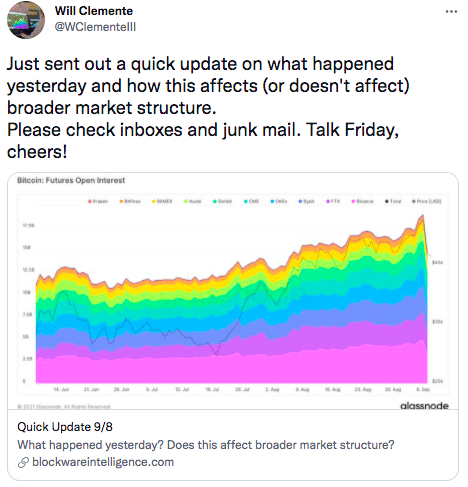

- Blockware’s Will Clemente on how Tuesday’s dip affects the crypto market:

- LexDAO on NFTs and real property:

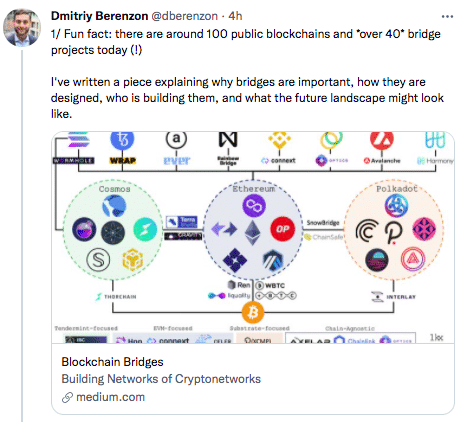

- Dmitriy Berenzon, research partner at 1kx, on blockchain bridges:

On The Pod…

How Crypto Streaming Service Audius Hit Six Million Monthly Active Users

Audius, a blockchain native music streaming platform, hit six million monthly active users in August and announced a partnership with TikTok. Roneil Rumburg, co-founder and CEO of Audius, talks about how Audius works, AUDIO tokenomics, the give and take of decentralization, and more. Show highlights:

- what problems Audius is solving for creators

- how artists are utilizing crypto to connect with fans

- how the crypto components of Audius fit together

- what three utilities AUDIO, the native token of Audius, offers holders

- why Audius requires over $500K in AUDIO tokens to run a node

- why AUDIO’s inflation rate is higher than other popular tokens like Ethereum or Bitcoin

- which portions of Audius are centralized versus decentralized

- where the majority of Audius’s listens come from (hint: it’s not the app)

- how Audius has created a “password” system to make blockchain technology easier to use for non-crypto natives

- why Audius uses both Solana and Ethereum

- how big-name artists like Diplo found their way onto Audius

- how Audius makes it easier to upload music to TikTok

- what’s next for Audius

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians