March 31, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Sky Mavis said it’s committed to reimbursing players affected by Tuesday’s $625 million hack of Ronin bridge.

-

AAVE is up nearly 100% since its V3 update.

-

MetaMask now has Apple Pay support.

-

Robinhood’s crypto lead is leaving to start a crypto firm.

-

Crypto sellers are sitting on the sidelines while Terra stacks sats.

-

An Azuki NFT sold for $1.4 million.

-

CowSwap completed an airdrop worth about $100 million.

-

The EU will begin negotiations on its Markets in Crypto Assets (MiCA) regulations package today.

- Solana is skyrocketing in the wake of OpenSea’s announcement that Solana support will launch in April.

Today in Crypto Adoption…

-

Visa launched a one-year NFT immersion program.

-

Lionel Messi signed a $20 million deal with Socios, a fan token platform.

The $$$ Corner…

-

LayerZero raised $135 million at a $1 billion valuation.

-

Cross River Bank (disclosure: a current sponsor of Unchained) raised $620 million at an undisclosed valuation.

-

Helium Inc, the foundation behind Helium blockchain, rebranded to Nova Labs and announced a $200 million Series D valuing the firm at $1.2 billion.

- Gumi Cryptos Capital launched a fund to back 50 web3 startups.

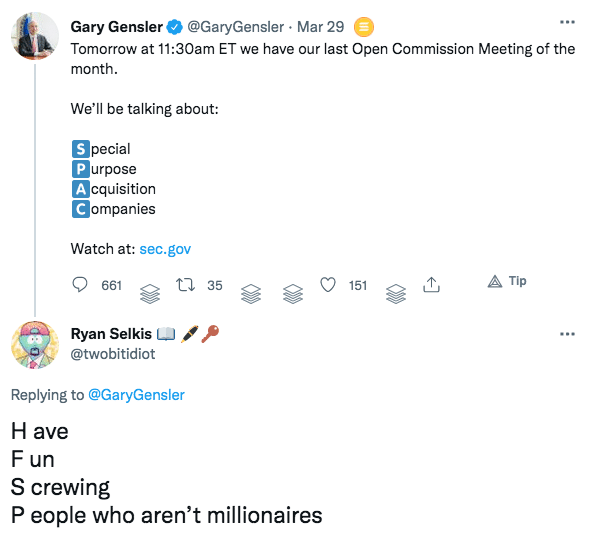

What Do You Meme?

What’s Poppin’?

Token Runnings

By now, you’ve probably heard of play-to-earn.

What if I told you that now you could run to earn?

STEPN, a web3 fitness app on Solana, is taking over the metaverse. Its native token, GMT, is up 20% over the last 24 hours, cementing its place as a $1 billion market cap protocol.

GMT, which launched this month, has jumped 1,158% since inception and 289% in the last 14 days. Out of the top 100 tokens by market cap, GMT is the best performer of 2022 by quite a stretch (WAVES is in second place at 258% YTD).

The premise of STEPN is simple. It is essentially a Fitbit app with an NFT integration and tokenomics that are very similar to Axie Infinity.

Users buy STEPN NFTs and earn Green Satoshi Tokens (GST) by walking, jogging, or running. Once leveled up, users can begin to earn GMT, the governance token of STEPN. (Humorously, to stop certain tomfoolery, STEPN has a “moonwalking” status that stops the flow of tokens if the app tracks weird movements like, for instance, “using an electronic scooter or strap phone on their dog,” as STEPN’s whitepaper outlines.)

However, just as Axie Infinity has faced backlash for its high-cost entry point, STEPN is also quite expensive for new market entrants. The cheapest sneaker NFT, which is necessary to begin running or walking to earn, is 9.1 SOL (well over $1,000).

As emphasized by GMT’s price movement, STEPN has been on fire (it has over 100,000 downloads on Google Play and 100,000 Twitter followers). Furthermore, a March 29th Twitter post stirred quite a bit of interest on Crypto Twitter that hinted at partnerships with Nike, Binance, and Asics, if the logos found within the graphic can be trusted.

Recommended Reads

-

Cooper Turley on music NFTs:

-

Lyn Alden on TVL:

-

BitMEX on The Cryptopians:

On The Pod…

Do Kwon Is Backing UST With Bitcoin – And Here’s What Else He Is Building

Do Kwon is the CEO of Terraform Labs and a director at Luna Foundation Guard. On Unchained, he explains why LFG is spearheading a plan to partially back Terra’s $15 billion stablecoin UST with Bitcoin. He also dives into another project idea that would transform developer salaries into financial assets that, as far as I can tell, he has not yet spoken about publicly.

Part 1: Everything you need to know about Terra, UST, and BTC.

-

how Terra works and why Do thinks UST will soon be the third-largest stablecoin

-

why Do and LFG decided to back UST with bitcoin

-

why Do thinks LUNA’s price will continue to appreciate despite UST’s new dependence on bitcoin

-

how UST might perform if the price of a bitcoin were to crash

-

why diversifying UST with different types of collateral could help Terra politically

-

how LFG plans to use bridges, smart contracts, and an AMM reserve pool to secure its bitcoin

-

why Do thinks Terra is now a Layer 2 project for Bitcoin

-

who is deciding to purchase bitcoin and who determines what other assets to purchase as collateral for UST

-

how a bitcoin reserve pool would help UST not de-peg from the dollar

-

whether Do thinks Anchor’s 19%+ yield is sustainable and why Anchor is moving to other chains

Part 2: Do, the self-described “toymaker” of DeFi.

-

why Do is fascinated with creating a fungible labor market

-

how developer working hours could become a token traded on an AMM and used to take out loans

-

why Do thinks developer salaries in crypto should be cyclical

-

how on-chain identity and history will be similar to credit scores

-

why Do is a personal fan of Thorchain – but is reticent to use it as a bridge for LFG

-

why Do is interested in Prism Protocol

-

what Do thinks the impact of a pro-crypto president will have on South Korea

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians