July 7, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- Polygon follows Solana and partners with phone maker Nothing to build a web3 phone.

- A fake job offer was behind the exploit of Axie Infinity, which resulted in a loss of $540 million earlier this year.

- US officials who have crypto investments are now prohibited from working on crypto-related policies.

- Genesis Global Trading confirmed its exposure to Three Arrows Capital.

- Ethereum’s testnet Sepolia was successfully integrated into the Proof of Stake chain.

- Binance will start charging zero fees to BTC pairs on its platform.

- Hut 8, a Canadian crypto miner, added 5,800 mining rigs to its facilities.

- Core Scientific, a crypto mining firm, sold $165 million worth of BTC in June.

- Porter Finance, an Ethereum DeFi protocol, shut down its bond issuance platform due to lack of lending demand.

- American CryptoFed DAO withdrew its request to the SEC to register two tokens as securities.

- FTX launched a partnership with hardware wallet company Ledger.

- Solana Labs gets sued with the claim that SOL is an unregistered security.

Today in Crypto Adoption…

- LimeWire will launch an NFT collection in collaboration with Brandy, Travis Barker, Nicky Jam and others.

The $$$ Corner…

- Blockchain startup Bitmark raised $5.6 million after launching an NFT wallet.

- DeFi platform Ondo Finance raised $10 million in a public token sale.

- Planetarium Labs, a web3 gaming startup, raised $32 million in series A funding.

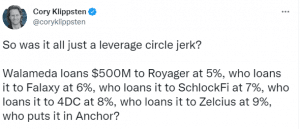

What Do You Meme?

What’s Poppin’?

Voyager Digital Files for Chapter 11 Bankruptcy

By Juan Aranovich

Crypto broker Voyager Digital filed for Chapter 11 bankruptcy on late Tuesday night. The proceedings started in the U.S. Bankruptcy Court for the Southern District of New York.

Chapter 11 is a form of bankruptcy that involves a reorganization of a debtor’s business affairs, debts, and assets. It allows a company to stay in business and restructure its obligations.Last week, Voyager halted all trading, deposits and withdrawals from its platform and issued a notice of default to crypto fund Three Arrows Capital for failing to repay a loan worth $650 million. This exposure to 3AC put Voyager in a delicate financial position.

According to the statement released by the company, Voyager has $1.3 billion in crypto assets. It also holds $350 million in cash in an account in Metropolitan Commercial Bank.

“We strongly believe in the future of the industry but the prolonged volatility in the crypto markets, and the default of Three Arrows Capital, require us to take this decisive action,” said Stephen Ehrlich, CEO of Voyager Digital.

Ehrlich also confirmed that Voyager will continue to operate throughout the process. Under the restructuring plan, if approved by the Court, customers with crypto assets in their accounts will receive a combination of:

- Crypto in their accounts

- Proceeds from 3AC recovery

- Common shares

- Voyager tokens

Crypto researcher 0xHamZ said that, even if 3AC doesn’t recover and VYG token has no value, customers could expect 80 cents on the dollar between available cash and crypto assets; meanwhile, Bloomberg columnist Matt Levine puts his floor estimate at 72 cents on the dollar.

People who had assets in Voyager reacted to the news in the Voyager’s subreddit. “This is what’s hard to stomach. Losses due to loss of value is something that can happen. Losses due to the company loaning my hard earned money out, losing that money and then going bankrupt is a whole different type of pain,” said one user.

Check out Laura’s interview with one Voyager customer who has $70,000 locked in the platform: “On June 20th, they reached out to a bunch of partners and entered into these NDAs to try to bail them out, and six days before that, they sent an email out to us, reassuring us that they didn’t have any exposure to Celsius, they never engaged in DeFi lending.”Recommended Reads

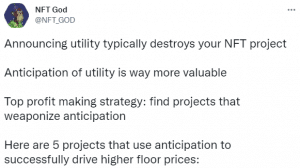

1) NFT God on 5 successful NFT projects:

2) Green Pill on Play & Earn:

3) OnChain Wizard on token prices:

On The Pod…

Hasu, strategic advisor to Lido, and Tarun Chitra, founder of Gauntlet, explain everything about staked ETH, aka stETH, how it should be priced, Lido’s market dominance, and much more. Show highlights:

- the role of Lido, what stETH is, and what its benefits are

- whether Ethereum’s lack of delegated proof of stake contributes to the need for stETH

- why stETH is not mispriced and why it doesn’t necessarily have to be worth 1 ETH

- the inherent risks associated with stETH

- how there was not enough liquidity to handle all the liquidations, especially in automated vaults on, for instance, Instadapp

- how automated market makers work and what Curve’s amplification factor is

- whether 3AC and Celsius had a significant impact on the stETH/ETH “de-peg”

- how does the Merge affect the liquidity of stETH

- Hasu’s and Tarun’s level of confidence that the Merge will happen this year and whether it will be a success

- what will happen to the price of stETH after the redemptions are enabled

- why Lido has achieved such a level of dominance

- how Lido decreases the cost of staking and helps improve the security of the Ethereum blockchain

- whether there is going to be a “winner take all” in the liquid staking derivatives market

- how liquidity fragmentation can cause the system to blow up

- why LDO tokenholders might not have the same incentives as ETH tokenholders

- what is the Lido’s new dual governance model and what is it trying to achieve

- whether Lido should self limit its market dominance

- how Lido coordinates validators and the role of the LDO token in this coordination

- what are the lessons to be learned from the stETH situation

- how governance is a liability to DeFi protocols

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians