September 14, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

SEC Chair Gary Gensler indicated that crypto lending and staking platforms most likely fall under US securities law; Gensler also noted that Coinbase lists “dozens of tokens that might be securities.”

-

Bitcoin Core version 22.0, the latest version of the Bitcoin core software, was released on Monday.

-

Ernst and Young (EY) will use Polygon to deploy EY blockchain products onto Ethereum.

-

Interactive Brokers launched cryptocurrency trading on its platform.

-

Jump Trading announced the launch of Jump Crypto.

-

SkyBridge Capital, led by Anthony Scaramucci, is releasing an NFT site.

-

Bitcoin energy consumption in 2021 has already outpacedall of 2020.

-

Gate.io, a crypto exchange, opened a $100M fund to invest in budding crypto startups.

-

An unsuccessful attempt at attacking Ethereum managed to fool several nodes.

-

Immutable, an NFT startup, raised a $60M Series B.

-

Amberdata, a crypto data startup, brought in $15M through Series A led by Citi.

-

Argo Blockchain, a crypto mining company, commenced its initial public offering (IPO) yesterday.

-

Layer 2 solution Arbitrum suffered a temporary outage.

What Do You Meme?

What’s Poppin’?

How quickly narratives change in crypto.

After leading Tuesday’s newsletter with the headline “SOL > BTC + ETH” in reference to a surge in interest for Solana-based digital asset funds in comparison to BTC and ETH, today’s What’s Poppin’ is covering Solana for an entirely different reason.

Solana, a high throughput smart contract blockchain, experienced significant issues on its mainnet yesterday. As of publishing time, the network has been down for over 10 hours, according to data from Solscan. This means that no blocks, transactions, or network activity was recorded between 8 am ET to 7:00 pm ET.

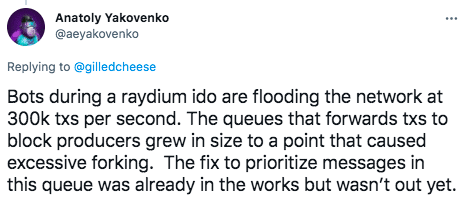

The Solana Foundation addressed the downtime on Twitter, explaining that a large increase in transactions, peaking at over 400,000 per second, flooded the network, causing Solana to start forking. Once the network began forking, nodes were overwhelmed due to the excessive memory consumption of multiple chains running simultaneously.

Anatoly Yakovenko, CEO of Solana Labs, believes that a Raydium initial DEX offering (IDO) caused the flood of transactions.

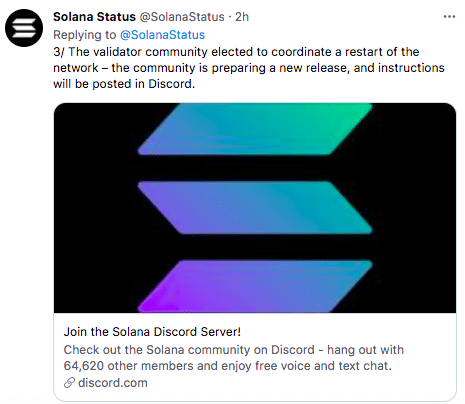

Solana node operators began coordinating a “restart” of the network at roughly 3 pm ET Tuesday afternoon. According to CoinDesk, the restart would include a patch of the network that would allow Solana to come back online once 66% of validators, a supermajority, go live. As of publishing time, Solana remains down, though the validator community on Discord remains quite active.

While rare, it is not entirely unheard of for blockchains to shut down. Even Bitcoin experienced 14 hours of downtime during its formative years between 2009 and 2013. Since then, Bitcoin has run continuously, with a 99.986% functional runtime. For Solana, in particular, an outage is not surprising, as the network is less than two years old and still in beta mode. Yesterday’s outage was Solana’s first since December of 2020.

For Anatoly’s part, the CEO took the outage in stride, emphasizing the youth of Solana’s network. It appears Anatoly is more worried about Solana’s 10-year outlook and its ability to serve 1 billion users, rather than stressing over its inability to handle 400,000 transactions per second just 18 months into the blockchain’s existence.

Unsurprisingly, Solana’s native token, SOL, dropped more than 15% yesterday, dipping from roughly $175 down below $150. The dip comes just one week after SOL’s latest all-time high, which saw the token cross $216.

Recommended Reads

- Fidelity on institutional investors and digital assets:

- The Defiant on airdrops:

- @CometShock on how Solana’s chain-stoppage could affect the network:

On The Pod…

Can Bitcoin Be Secured Only by Transaction Fees? Two Researchers Sound Off

Once the block reward diminishes greatly, can Bitcoin be secured only by transaction fees? On Unchained, Bitcoin writer Vijay Boyapati and Ethereum Foundation’s Justin Drake debate the merits of Bitcoin’s security model, which Drake says will largely rely on transaction fees as soon as within 20-30 years, not in 100+ years. Highlights:

- Justin’s and Vijay’s professional backgrounds

- why Justin thinks Bitcoin cannot survive solely on fees

- how Bitcoin is currently secured

- what makes Bitcoin’s security subjective rather than binary

- how much it would cost in dollars to 51% attack Bitcoin

- what the Bitcoin network could do in response to a 51% attack

- how to calculate Bitcoin’s security budget

- why Bitcoin’s price can’t go exponential forever

- whether a “nuclear option” for Bitcoin miners could protect against a 51% attack

- why nation-states could be either pro or anti-Bitcoin

- why a Bitcoin Standard could be similar to the Gold Standard

- how Bitcoin will change going forward, and why Vijay thinks transaction fees will increase

- why Justin does not think transaction fees will increase enough to secure Bitcoin’s base layer

- how Justin would fix Bitcoin’s security model — and why he thinks the 21 million hard cap is a meme

- why Vijay does not think Bitcoin’s security model will ever change — especially the 21 million hard cap

- what Justin thinks Ethereum is doing better than Bitcoin

- why Vijay thinks Ethereum will fail

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians