“I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.”

This quote was famously said by Democratic political strategist James Carville in 1994 during what was known as the “Great Bond Massacre.” From October 1993 to October 1994, the yield of U.S. 10-year treasury bonds jumped from 5.42% to just below 8.0% due to concerns about President Bill Clinton’s spending plans. The Arkansan eventually had to back off.

The power of the bond market reared its head again this week, when U.S. 10-year yields surged overnight on Tuesday from 3.87% to almost 4.49%, indicating a sharp drop in demand. It’s no coincidence that this sudden movement forced President Trump to backtrack on his “reciprocal” tariff program.

But while yields on U.S.-10 years were soaring as traders were liquidating holdings, either to cover other positions or search for potentially safer assets, such as the German bund or gold, one group that was not sweating the market was holders of the rapidly growing $5.86 billion tokenized treasury market.

Tokenized Treasuries Continue to Surge

On April 2, the day of Trump’s tariff announcement, the total tokenized treasury market was worth $4.85 billion. Since then it has added another $1.01 billion, good for a 20.8% increase in a little over a week, according to rwa.xyz. Conversely, the $233 billion stablecoin market, led by USDT and USDC, actually lost $1.63 billion in value, based on data from DeFiLlama.

This contrast in direction further underscores how tokenized treasuries are seeing early growth rates that stablecoins, which have been around since 2014, could have only dreamed of. “If you compare their growth trajectory, it is many multiples of where stablecoin growth was in its earliest days,” said Michael Sonnenshein, Chief Operating Officer at tokenization platform Securitize in an interview.

Additionally, this growth is a continuation of a trend previously reported by Unchained, where hedge funds and other professional traders are using the asset as a yield-bearing form of collateral when trading in margin, which means borrowing funds from exchanges or prime brokers.

This trend accelerated since April 2 as the price of bitcoin vacillated between $74,000-$87,000 as a result of the market uncertainty, and higher beta assets were even more volatile.

“The market turmoil of the last two weeks has caused a surge in our derivatives trading business — most of our counterparties are putting on hedges and repositioning for increased volatility outside of the recent trading range,” said Joshua Lim, Global Co-head of Markets at prime broker FalconX. “Our derivatives activity has increased by +150% vs prior to the tariff announcements, and these new trades, along with revaluation of our existing derivatives portfolio, is increasing margin transfer activity in all forms of collateral. We’re seeing demand to post yield-bearing assets like stablecoins backed by T-bills and even liquid staking tokens for majors like ETH and SOL.”

The Fine Print

But while this growth remains impressive, it’s not set in stone that tokenized treasuries will usurp non-yield-bearing assets like stablecoins.

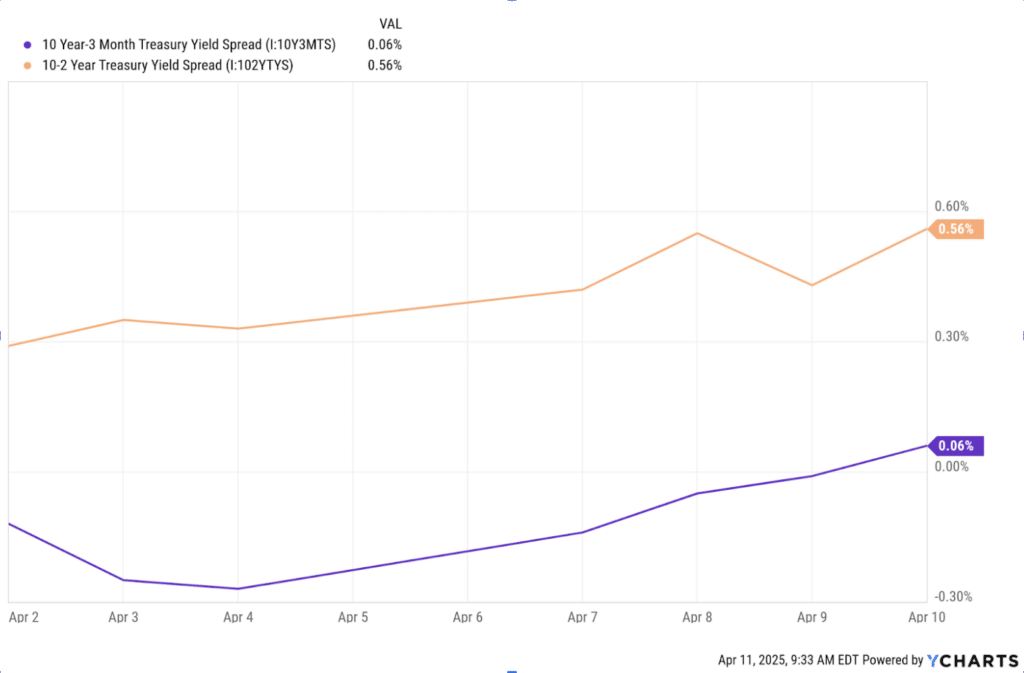

For starters, these assets focus on extremely short-term government debt, residing at the front end of the yield curve, which plots the various yields for corresponding maturation debts of U.S. treasuries. Tokenized treasury issuers such as BlackRock (BUIDL) or Franklin Templeton (BENJI) purchase what are known as T-bills, or U.S. treasuries that have maturation dates of less than one year. This segment is worth just 21.29% (or $6.16 trillion), of the $28.91 trillion treasury market and is deemed the safest set of assets of the market. Case in point, while the spread (or difference) between the 10-year and 2-year debt soared by 93% since April 2, from 29 basis points to 56 basis points, the 10-year to 3-month spread only grew by 18 basis points.

Unlocking the Next Stage of Growth

So, with short-term treasuries largely insulated from the ongoing volatility, at least for now, it seems clear that absent a major national debt ceiling crisis that could lead to an actual default, tokenized T-bill purchasers should be in the clear. And to be frank, if such an event occurred, it would ripple well past tokenized treasuries to stablecoins overall since issuers like Circle and Tether collectively own more than $100 billion of the asset.

“I don’t feel like [the volatility] has been a deterrence yet,” says crypto derivatives exchange Deribit Chief Commercial Officer Jean-David Péquignot in an interview. “I haven’t been in discussion where people start telling me we are backing out of tokenized treasuries. If you think that way, you should get out of USDC and USDT also.”

But while Péquignot is sanguine about the tokenized treasury market overall, he still sees many ways for improvement. For starters, he wants to see a wider array of investors begin to purchase these assets than a few well-endowed funds and corporate or DAO treasuries.

The total market capitalization for these assets has grown exponentially in recent days, largely due to BlackRock’s BUIDL, for which Securitize operates as registered broker dealer, surging from a little over $500 million in market capitalization since the beginning of 2025 to $2.1 billion. But, a large portion of this growth came from two corporate funds: Ethena, which operates the yield-bearing synthetic dollar USDtb, and MakerDAO’s spark, which allocated $500 million to BUIDL.

Péquignot is happy about this growth but also points out that corporate treasuries are likely to be parked in one place for a long time and not be used for collateral. “I’d say as an exchange we’d love to see a little bit more diversification in the asset ownership of those products, with those investors using them across exchanges, making everything a little bit more fungible.”

This step will likely take more time, but it also reveals a key advantage for stablecoins that should keep it in the driver’s seat for years to come, especially with stablecoin legislation expected to be passed into law by August. Tokenized treasuries, money market funds, and the like are securities, which brings forward a whole suite of compliance requirements that do not exist for stablecoins that are treated as payment instruments. For instance, the owners of these products must go through AML/KYC checks and can place restrictions on who or which wallets can receive the assets. “With BUIDL or USYC [another tokenized treasury whose issuer Hashnote was recently purchased by Circle], you have permission access and only certain addresses can hold the asset. That does restrict the ability that I was talking about earlier of being a lot more fundable and loses some of the permissionless aspect of blockchain,” said Péquignot.

So for now, with tokenized treasury markets proving to have a teflon coating against treasury-yield volatility, industry watchers can look for more partnerships and deals to get these products in the hands of users. One recent example is an MOU signed on March 27 by Circle and the New York Stock Exchange Company Intercontinental Exchange (ICE) “to explore using Circle’s stablecoin USDC, as well as tokenized money market offering US Yield Coin (USYC), to develop new products and solutions for its customers.”

Additionally, Deribit is trying to make it easier for retail users (at least those outside of the U.S.) to get their hands on these products. They already offer spot markets for traders to buy USYC before using it as leverage, and they are going to be offering spot BUIDL in the coming weeks as well, becoming the first non-U.S. company to accept the token as collateral.