August 24, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

- Iran to allow Bitcoin miners to operate in the country starting in September after banning mining in May.

- OpenSea hit $1B in volume during August, becoming the first NFT marketplace to do so in one month.

- Binance is reportedly looking to raise funds at a $200B valuation.

- Substack has integrated bitcoin as a payment option.

- Digital investment products saw an inflow of $21M for the week ending August 20th.

- FTX signed a $17.5M agreement with the University of California at Berkeley for the naming rights to the field at California Memorial Stadium.

- Tether started printing USDT again after a two-month halt.

- President Nayib Bukele confirmed that El Salvador will not make the use of BTC as legal tender mandatory.

- Arizona Iced Tea recently purchased a Bored Ape Yacht Club NFT but may have overstepped its commercial limits when announcing the investment.

- In order to decide whether a digital asset falls under its regulatory purview, the CFTC does not ask whether a digital asset is a security or a commodity. Instead, the CFTC is focused on identifying whether a futures contract or derivatives product is involved, according to Commissioner Dawn Stump.

What Do You Meme?

What’s Poppin’?

On early Monday morning, Visa (yes, that Visa) announced that it had purchased CryptoPunk #7610 for 49.5 ETH (approximately $150K). Visa has been collecting such items, dubbed “historic commerce artifacts,” for over 60 years. The expensive JPEG will be joining “early paper credit cards” and the “zip zap machine” among Visa’s collection — not exactly the most inspiring company for NFTs to be lumped into.

However, it appears that Visa is bullish on NFTs.

In a report published yesterday, the payment giant said that “NFTs represent a deeper and more innovative way for fans to engage and potential new revenue streams for organizations.” To that end, “Visa is committed to evolving its products and solutions to enable new commerce solutions, including but not limited to crypto and NFTs, and help consumers and its partners understand and engage with these new digital goods.”

“We think NFTs will play an important role in the future of retail, social media, entertainment, and commerce,” said Cuy Sheffield, Visa’s head of crypto. Adding, “to help our clients and partners participate, we need a firsthand understanding of the infrastructure requirements for a global brand to purchase, store, and leverage an NFT.”

Visa’s crypto aspirations are not limited to NFTs. The company appears to be building out a robust suite of crypto products. For example:

- Visa is currently working with 50 crypto platforms to facilitate crypto spending via credit cards at any of the 70 million merchants accepting Visa worldwide.

- The company has a “growing network of crypto wallets” that it is confident will help in storing NFT collectibles and art.

- Visa is upgrading its infrastructure to enable stablecoin settlement, starting with USDC on Ethereum.

- For banks or fintech companies, Visa offers a “Crypto API” to enable buying/selling crypto assets within digital banking apps.

- Visa’s research team is already looking into offline digital currency transactions and new forms of cryptography.

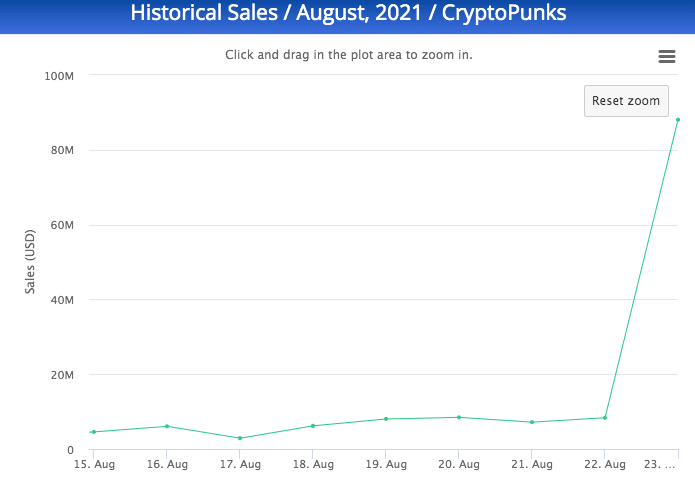

While it remains to be seen how Visa’s NFT and crypto plan unfolds, the short-term effect on the CryptoPunk market is clear…

On Sunday, CryptoPunks did $8.3M in volume over 39 transactions. Yesterday, CryptoPunk volume jumped to $88M+ over 332 transactions, nearly increasing 10X in just a day.

Another interesting tidbit to round out the Visa news is that people have started dropping NFTs into Visa’s NFT wallet. At publishing time, users have dropped over 63 NFTs, ranging from a Lord Kek Rare Pepe card to, well, the Ethereum domain name for “footpic.eth.”

Welcome to the degen life Visa 🙂

Recommended Reads

- Coinbase COO Emilie Choi on USDC’s backing:

- Not Boring’s Packy McCormick on Solana:

- The New York Times on Ark Invest’s Cathie Woods:

On The Pod…

BitGo on Why the Travel Rule Should Not Apply to Digital AssetsBitGo CEO Mike Belshe and COO Jeff Horowitz talk about one of the hottest topics facing the crypto industry today: regulation. They discuss…

- what BitGo does

- why Jeff left his successful TradFi career to go crypto

- how crypto compliance and custody differs from the traditional finance world

- the state of crypto education amongst regulators

- why Jeff and Mike think the infrastructure bill is a win for the crypto industry

- what FinCEN is doing to regulate crypto

- why they think the infrastructure bill’s goal of raising billions in crypto taxes could only bring in millions

- what FATF guidance regarding VASPs requires of crypto companies

- why the travel rule could lead to US customer data being shared overseas

- how digital assets change the implications of the travel rule

- how regulators are attempting to deal with DeFi

- what the FATF guidance means for FATF countries, like the US

- why DeFi is not ready for strict regulations

- Jeff’s views on Brian Brooks’s departure from BinanceUS

- the Galaxy Digital acquisition of BitGo

- what security issues a trillion-dollar wallet presents

- why BitGo refused to put a “freeze” function in its WBTC contract

- why Tesla and MicroStrategy purchased BTC and why other companies have been slow to follow suit

- whether BitGo will offer NFT solutions going forward

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians