August 17, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

- 55 of the top 100 banks by AUM have invested in crypto or blockchain-related companies.

- Microsoft is looking to use Ethereum to combat piracy.

- The crypto market hit $2T for the first time since May on early Monday morning.

- Bluesky, Twitter’s decentralized social media initiative, will be headed by crypto developer Jay Graber.

- Poly Network is offering a $500K bug bounty to find vulnerabilities in the protocol’s code.

- Digital asset investment products just completed the sixth week in a row of capital outflows.

- The US State Department plans to hand out crypto rewards to informants.

- Crypto staking firm Figment raised a $50M Series B.

- Public companies own 1% of the total BTC supply.

- Congressmen Patrick McHenry and Glenn Thompson described SEC Chairman Gary Gensler’s recent comments on crypto as “concerning.”

- Novi, Facebook’s crypto subsidiary, is looking to work with a stablecoin other than Diem (formerly Libra).

What Do You Meme?

What’s Poppin’?

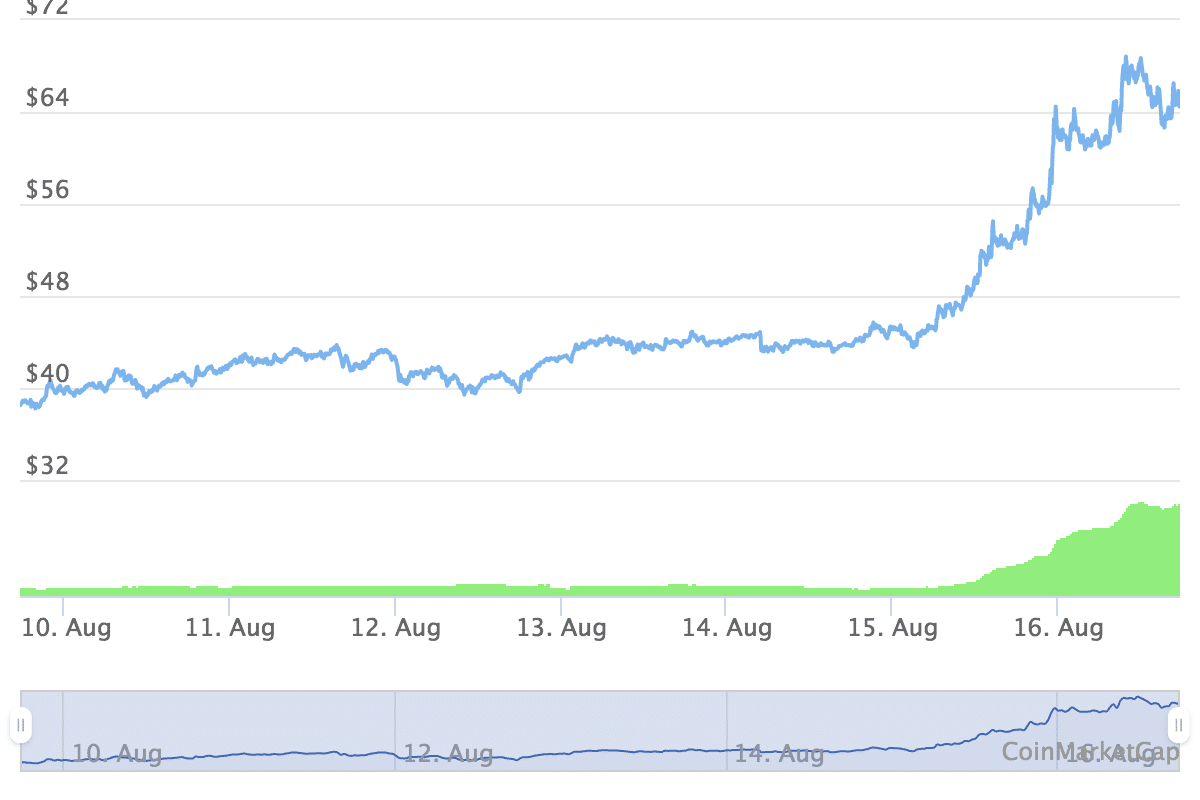

Solana is poppin’. The high throughput blockchain’s native token, SOL, hit an all-time high yesterday of $68.82, according to CoinMarketCap. At publishing time, SOL is up 21% over the past 24 hours, nearly 70% over the past seven days, and over 125% over the past month.

Various analysts have offered a slew of reasons for Solana’s recent pump — outside of its appeal as a quicker and cheaper layer 1 alternative to Ethereum.

Notably, as Arca’s Jeff Dorman pointed out in a blog yesterday, total value locked (TVL) on the platform has climbed almost as quickly as SOL’s price. Since the start of August, Solana has locked over $700M additional assets into DeFi projects running on its network — good for a 60% increase.

In total, the blockchain has nearly $2B worth of assets locked in, according to solanaproject.com.

Now, that may not sound like much, as Ethereum has $82.1 in TVL locked into DeFi protocols, according to defipulse.com. However, Ethereum only hit $2B TVL last July — roughly five years after its launch. Solana, by contrast, reached $2B in TVL in about 18 months.

Part of the reason Solana’s TVL is increasing at such a rapid rate is several high-profile projects bringing attention to the blockchain.

- Yesterday, Audius, a music platform based on Ethereum and Solana, announced a partnership with TikTok and will be the first streaming service to allow direct sharing to TikTok.

- The Degenerate Ape Academy, an NFT project built on Solana, sold out in 8 minutes on Sunday. The project notched $6M in trading volume — despite issues with the platform. According to Pentoshi, a crypto analyst, it only cost $.01 to mint an NFT on Solana — a drastic decrease compared to Ethereum.

- Mango Markets, a DEX on Solana, raised $70M via a token sale on Wednesday of last week. Mango will offer spot trading, lending, and perpetual futures. CoinDesk’s Danny Nelson noted that the deal was unusual in DeFi, writing, “many decentralized finance (DeFi) protocols aim to raise between $1 million and $15 million in seed stage funding, one source said, making Mango DAO’s (decentralized autonomous organization) $70 million an outlier.”

- Last Monday, Wormhole, a Solana-based bridge, launched on its mainnet, connecting the blockchain to Terra, Ethereum, and Binance Smart Chain. Essentially, Wormhole will allow for a faster, and hopefully simpler, way for non-native assets to enter Solana’s DeFi ecosystem.

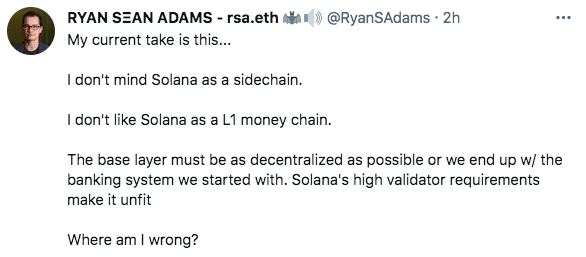

However, not everyone is excited about SOL’s performance, as highlighted by Bankless’s Ryan Adams…

For more info on Solana (and how it measures up against Ethereum), check out the recent Unchained pod with Synthetix Founder Kain Warwick and Multicoin Capital’s Kyle Samani:

Youtube: https://www.youtube.com/watch?v=LKcoO3w80Po

Recommended Reads

- Vitalik Buterin on decentralized governance:

- With Solana’s native token, SOL, hitting an ATH yesterday, here is a deep dive into the blockchain, courtesy of Multicoin Capital:

- Morning Brew on Steve Aoki + NFTs:

On The Pod…

On-Chain Analytics Show ETH Accumulation Is Greater Than That of BTC

NFTs are the talk of the metaverse, EIP 1559 just went live, and DeFi stats are rebounding. On Unchained, Fredrik Haga, cofounder and CEO at Dune Analytics, along with Richard Chen, general partner at 1confirmation, discuss the booming Ethereum ecosystem through the lens of on-chain data, diving into NFTs, DeFi, ETH, and their favorite layer 2s. Show highlights:

- why Ethereum is on such a pronounced upswing

- why on-chain metrics lead to superior information reporting

- mind-blowing OpenSea statistics

- why NFTs are so hot at the moment

- how Richard explains NFTs to normies

- whether the NFT market is sustainable

- what makes an NFT drop pop and why profile pics (PFPs) matter

- how Polygon NFTs compare to Ethereum NFTs

- the main driving force behind DeFi usage

- how Richard measures the total amount of DeFi users

- what brings new users into DeFi

- what DEX trends Fredrik is keeping his eye on

- why structured products are crucial to DeFi’s continued success

- how Ethereum is doing since the London hard fork

- why NFT drops are like 2017 ICOs

- what metric shows ETH adoption outpacing BTC adoption among institutions

- which layer 2 solutions are Fredrik and Richard excited about

- why Richard considers Binance Smart Chain a centralized blockchain

- why Fredrik likes what Solana is building

- Richard and Fredrik’s predictions for the NFTs, DeFi, and ETH going forward

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians