May 24, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- Graphic artist BEEPLE’s Twitter account was hacked to promote a scam.

- Two major Korean exchanges warned investors about litecoin’s activation of confidential transactions, a sign they could delist it.

- South Korean authorities want to freeze assets from the Luna Foundation Guard.

- Lockheed Martin and Filecoin Foundation plan to explore hosting blockchain nodes in space.

- Crypto fund assets under management have shrunk significantly, according to Coinshares.

- DESK, CoinDesk’s social token, is relaunched.

- The CFTC charged two men with perpetrating a $44 million crypto fraud.

- Davos’ World Economic Forum showed plenty of interest in crypto.

Today in Crypto Adoption…

- French banking giant BNP Paribas joined Onyx, JP Morgan’s permissioned blockchain.

- eBay announced they will sell a sports NFT collection.

- GameStop launched a self-custodial wallet that allows gamers to interact with Web3.

The $$$ Corner…

- Protego Trust Bank, a chartered crypto bank whose board includes Brian Brooks, aims for a $2 billion dollar valuation.

- Pebble crypto app raised $6.2 million.

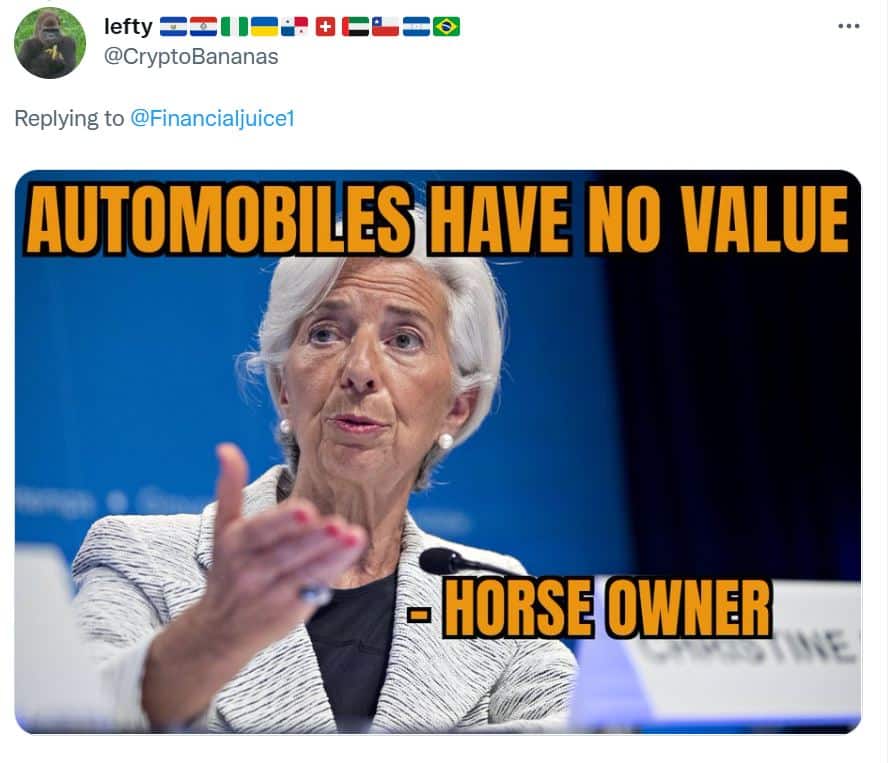

What Do You Meme?

What’s Poppin’?

Fed: 12% of US Adults Used Crypto in 2021

According to a report released by the Federal Reserve, 12% of US households either used or held cryptocurrencies during 2021. The data was disclosed in the Economic Well-Being of U.S. Households report, which is published annually, but this is the first time that it includes information about cryptocurrencies.

One conclusion from the report is that crypto is seen as an investment tool rather than as a medium of payment. Data shows that 2% of people using crypto are using it to purchase stuff, and only 1% use it to send money to family or friends. “Cryptocurrency use as an investment was far more common than use for transactions or purchases,” said the report.

Another conclusion has to do with what type of people hold and use crypto. It looks like low-income people are more likely to use crypto as a transactional tool. “While transactional use of cryptocurrencies was low, those using cryptocurrencies for purchases rather than as investments frequently lacked traditional bank and credit card accounts,” the report noted. In contrast, higher-income people were more likely to use crypto as an investment and “almost always had a traditional banking relationship, and typically had other retirement savings.”

While some think it’s positive that only 12% of the country used crypto during 2021 because it means we are very early, there are others who disagree.

Adam Cochran, partner at Cinneamhain Ventures, said on Twitter that this is “disappointing news” because although we are still early on the adoption curve, 12% is still a big enough number to overwhelm crypto applications, which are still early in their product development curve and could leave many mainstream users confused. “When users try out a product that is not ready for them, they often churn away from it but are also often left with a negative experience,” added Cochran.

Recommended Reads

- MakerDAO on Rocket Pool’s rETH token as a potential new collateral type.

- The dangers, present and future of cross-chain communication by CoinYuppie.

- Lightcrypto on TRXUSDT.

On The Pod…

Cobie and Chris Burniske on How to Navigate a Crypto Bear Market

Cobie, co-founder of Lido and UpOnlyTv, and Chris Burniske, partner at Placeholder Ventures, talk about surviving a crypto bear market, the Terra collapse, lessons they’ve learned from their mistakes, and much more. Show highlights:

- whether Chris and Cobie think crypto is in a bear market

- why Chris says these are the times to buy

- what effect the Terra debacle will have on the crypto industry

- why Chris was expecting UST to blow up

- why Chris thinks there is going to be another massive liquidation event

- whether an algo stablecoin could work

- why bear markets are sometimes a good thing

- how USDT was stress tested and proved its resilience

- how macro is affecting the crypto space and what the role of the Fed is

- when will we see the bottom of this bear market

- how meme coins are the symptoms of a broken system

- why this crypto cycle is different

- whether regulations are helping VCs rather than the retail investors

- why risky assets are the ones that could increase 10,000x

- whether the future of crypto is multichain or not

- how developers signal what ecosystem is going to win in the next expansion cycle

- whether Cobie thinks staking is dying

- how Chris judges market bottoms and tops

- what lessons Cobie and Chris have learned from their mistakes

- what innovations will catalyze the next bull cycle

- what needs to happen in the future for crypto to succeed

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians