November 2, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Digital Currency Group, which owns Grayscale and CoinDesk, sold $700 million in stock at a $10 billion valuationin a funding round led by two SoftBank funds.

-

Binance temporarily paused withdrawals on Monday, citing a “large backlog” of trades.

-

NYDIG acquired Bottlepay, a Bitcoin startup, in a $300 million stock purchase.

-

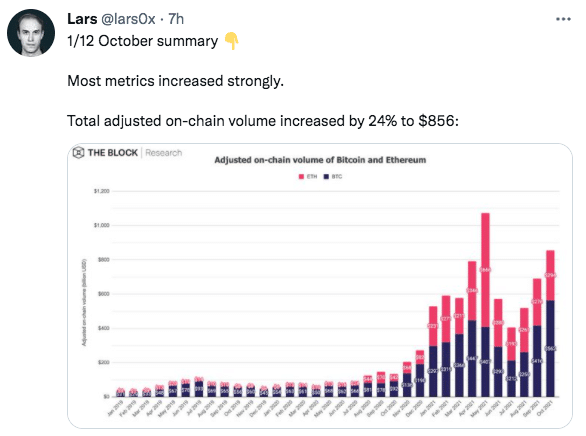

Goldman Sachs is sending institutional trading clientsresearch from The Block, a crypto news and data firm.

-

Bitcoin mining difficulty increased for the 8th time since China’s crypto ban.

-

Patreon is looking into opening up its platform to crypto payments.

-

A Squid Game-themed token fell prey to a rug pull.

-

ETH makes up the largest percentage of collateral backing DAI.

-

Digital asset funds saw inflows of $288 million for the week ending October 29th.

-

OpenSea’s monthly volume dropped 12% in October.

-

CryptoPunk 7557 sold for 4.444 ETH yesterday — nearly $1.5 million less than the price floor for similar-looking punks.

-

In a partnership with Robinhood, Burger King is giving away$2 million+ in cryptocurrency.

-

Avalanche Foundation announced a new $220 million fund to bring more developers to the layer 1 blockchain.

-

Ant Group, Tencent, and JD.com signed a “self-regulation” convention on NFTs with state organizations in China.

-

The Ethereum Name Service is decentralizing governance.

What Do You Meme?

What’s Poppin’?

Yesterday, the President’s Working Group (PWG) published its long-promised report on the risks stablecoins pose to the financial system writ large.

“Stablecoins and stablecoin arrangements raise significant concerns from an investor protection and market integrity perspective,” the report reads.

Notably, the PWG, in conjunction with the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency, called for Congress to limit stablecoin issuance in the US to “insured depository institutions,” forcing stablecoin companies to bend to traditional, bank-like regulations concerning reserves, issuance, and insurance.

“To address risks to stablecoin users and guard against stablecoin runs, legislation should require stablecoin issuers to be insured depository institutions, which are subject to appropriate supervision and regulation, at the depository institution and the holding company level,” the PWG wrote. “The legislation would prohibit other entities from issuing payment stablecoins.”

Additionally, the PWG called upon Congress to “act promptly to enact legislation” regarding stablecoins. In lieu of congressional action, however, the PWG is ready to recommend that the Financial Stability Oversight Council (FSOC) designate stablecoins as a “systemic important” activity, which would permit federal agencies to establish risk management criteria concerning stablecoin backing.

However, while the PWG asked for Congressional clarity, the group did make it clear that existing stablecoins “may implicate the jurisdiction of the SEC and/or CFTC.” The report went on to say, “To the extent within the jurisdiction of the SEC or the CFTC, trading, lending, borrowing, and other activity involving stablecoins must be conducted in compliance with applicable provisions of the federal securities laws and the CEA.”

As pointed out by CoinDesk, the report recommended that a federal agency regulate custodial wallet providers and that stablecoin issuer’s interactions with tech or telecom providers be limited — a move that appears to be aimed directly at Diem, the stablecoin project of Meta (previously Facebook).

The report also took time to discuss digital asset platforms and DeFi citing eleven bullet points of risk, including “fraud,” “money laundering,” and “excessive leverage.” The report added, perhaps foreshadowing a future report, that “Digital asset trading platforms and DeFi also raise broader questions about digital asset market regulation, supervision, and enforcement. These questions are under active consideration by the CFTC and SEC but are not the subject of the recommendations in this report.”

The PWG report is noteworthy because it is the first document addressing regulators’ thoughts on stablecoins in the US. It should be noted that the report does not amount to law or legislation; it only recommends that Congress, or other regulators, take action.

You can read the full report here.

Recommended Reads

|

On The Pod…

Tor Bair of Secret on Why Private Smart Contracts Are Important

Secret Network is a privacy-first, permissionless layer 1 blockchain built for computational privacy. Tor Bair, founder of Secret Foundation, a developer of Secret Network, discusses what makes Secret Network unique, including smart contract privacy, private metadata for NFTs, and how regulators should treat privacy tech in blockchain. Show highlights:

- how Tor fell down the crypto rabbit hole

- what the Secret Network is and how it is bringing privacy to blockchain

- why public blockchains are problematic

- what makes Secret Network different from Monero or Zcash

- how Secret Network works from a technical perspective

- what type of applications Secret Network can support that public blockchains cannot

- why blockchain voting is probably a bad idea (for now)

- what attack vectors exist regarding Secret Network

- how Secret Network nodes work and why there are only 50 of them

- how Secret Network fixes miner extractable value (MEV)

- what DeFi applications are possible on Secret Network

- how NFTs on Secret Network are different from public blockchain NFTs

- how regulators should treat Secret Network

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians