July 8, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Visa reports that $1B worth of cryptocurrency has been spent via its crypto-linked credit cards in 2021.

-

Tesla could face a $25M-$100M impairment loss on its balance sheet this quarter due to Bitcoin’s poor performance.

-

Robinhood to pay $15M fine over allegations related to its crypto unit’s handling of anti-money laundering.

-

Coinbase has dropped from #1 in the app store to #316 in roughly two months.

-

ARK Invest revealed a planned fee of .95% to cover the operating expenses of its bitcoin ETF.

-

Zerion, a DeFi investing platform, raised $8.2M in a Series A.

-

Tendermint is building a cross-chain app store that will publicly launch in September.

-

Index Cooperative, a DAO, closed a $7.7M funding round led by Galaxy Digital.

-

N26, a neobank based in Germany valued at $3.6B, has plans to launch a crypto trading product.

- Israel’s Ministry of Defense issued an order to seize 84 crypto wallets associated with Hamas; Israel’s new president will be given an NFT of the presidential oath ahead of his inauguration.

What Do You Meme?

What’s Poppin’?

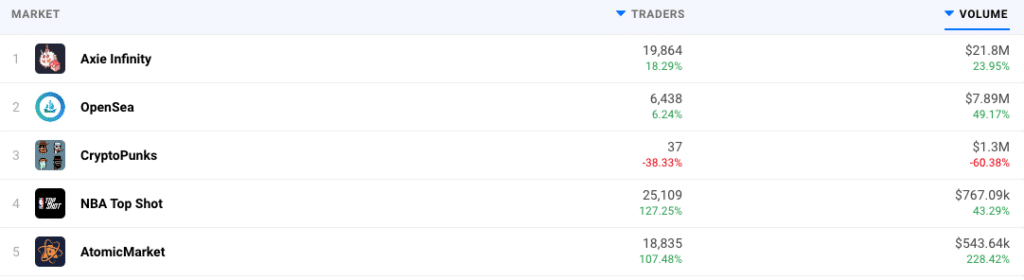

Axie Infinity, an Ethereum-based game, is now the largest NFT marketplace in crypto. In the past 24 hours, the platform has done three times the volume as OpenSea and over 20 times the volume of NBA Top Shot.

Source: DappRadar

The game is built in a similar vein to Pokemon, allowing users to breed and battle NFTs known as axies. Using Axie Infinity’s native token, AXS, players trade axies, stake the coins for rewards, or participate in governance, according to StartupsZone.

For example:

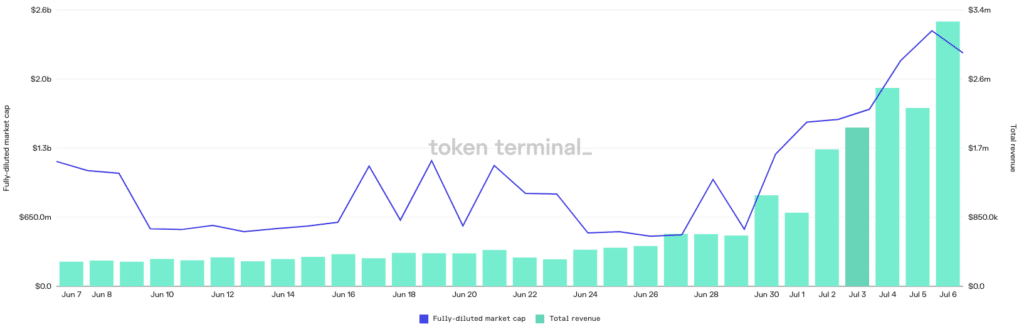

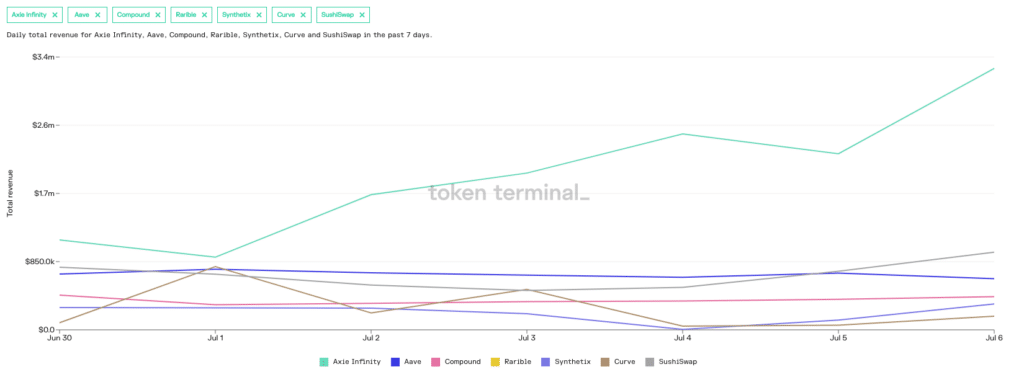

Over the past month, AXS rose 230%. More importantly, Axie Infinity’s revenue has grown with the project, especially in the past week, as shown in the chart below.

Source: Token Terminal

Data from Token Terminal shows that Axie Infinity brought in over $3.2M in revenue on Tuesday alone — 10x its daily revenue from 30 days before.

For context, $3.2M in daily revenue is larger than Aave, Compound, Synthetix, Curve, and SushiSwap… combined.

Source: Token Terminal

Recommended Reads

- Coin Metrics on why Ethereum gas fees have been dropping since April:

- @CroissantEth laid out a 24 step ETH investment thesis:

- Bitcoin core developer Jeremy Rubin on Bitcoin and quantum security:

On The Pod…

The Bitcoin Hash Rate Has Dropped. How Long Will It Take to Return?

Kevin Zhang, vice president of business development at Foundry, breaks down the latest developments surrounding China and bitcoin mining. Show highlights:

- how he came across crypto and which Bitcoin OG he joined at Bitcoin.com to help start its mining operations arm

- what Foundry does and its relationship with Digital Currency Group (DCG)

- why DCG wanted to build out a mining infrastructure business

- what news from China in early March kickstarted the process of the mining ban

- how China’s Central Television broadcasting company might have brought extra scrutiny to cryptocurrencies

- what the 100th anniversary of the Chinese Communist Party has to do with its Bitcoin mining ban

- why the Inner Mongolia and Sichuan Bitcoin mining bans were especially disruptive for Chinese miners

- how much of China’s hash rate Kevin estimates has been shut down since May

- where are miners relocating to

- why Chinese mining equipment will not be allowed to turn on in the US

- whether or not China’s Bitcoin mining ban will stick

- why China banning bitcoin mining will be good for the network in the long run

- what significant risk to Bitcoin’s network is solved by China banning bitcoin mining

- how much Bitcoin’s hash rate will drop and what effect this will have on miner revenue

- why Kevin thinks that Bitcoin is good for renewable energy

- how immersion cooling technology works

- what tangible benefits miners could find by moving to North America

- if El Salvador’s volcanic bitcoin mining plan is feasible

- what Kevin predicts will happen in the Bitcoin mining industry for the latter half of 2021

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians