May 18, 2021 / Unchained Daily / Laura Shin

🎉Welcome to Unchained Daily 🎉

ICYMI, the Unchained Newsletter is shifting from a weekly recap to a daily blog. Each morning you will receive a few quick bullet points summarizing yesterday’s news, a couple of memes, a brief breakdown of a trending topic, and a few recommended reads.

For those of you who were big fans of the weekly recap, don’t worry — the weekly recap will still be available at the back half of the Unconfirmed pod on Friday!

Without further ado… here is the second edition of the Unchained Daily.

Daily Bits ✍️✍️✍️

-

Bitcoin dropped to $42,000, a three-month low

-

Bank of America joined the Paxos Settlement Service, which uses blockchain tech to achieve same-day settlement for stocks

-

Coinbase announced plans to offer a $1.25 billion debt offering to qualified investors.

-

Digital asset firm Galaxy Digital had an impressive Q1

-

The FDIC is asking banks about how they are handling digital assets

- US Congressman Tom Emmer sent a letter to the Financial Accounting Standards Board (FASB) urging the establishment of clear accounting standards for digital currencies

What Do You Meme?

On Monday, Kyle Samani, CEO and co-founder of Multicoin Capital, tweeted:

The idea that memes move markets is not new. In fact, on Unchained in February of last year, Linda Xie, co-founder at Scalar Capital, read an essay she wrote titled “How Memes Can Help Crypto Go Mainstream.”

However, in the past few months, this theoretical idea of memes acting as market movers has become a strange reality. The crypto industry has seen Dogecoin skyrocket past a 10,000% return YTD thanks to a constant barrage of Elon Musk content, while similar meme-coins like SHIB and AKITA have been pumped online — though one non-pumper, Vitalik Buterin, also dumped them, quite publicly.

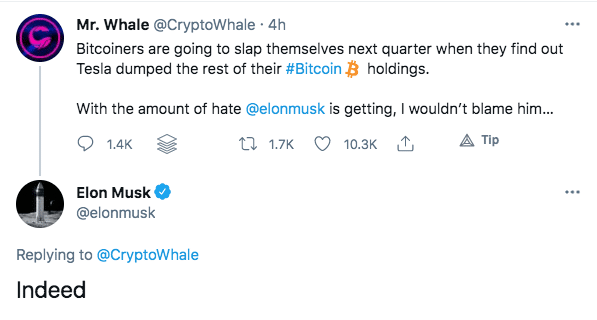

Even Bitcoin is seemingly being pushed up and down by memes, with a single Elon tweet clarifying that Tesla has not sold its BTC position bumping the price up by roughly $2k in under 30 minutes. Of course, Musk only had to issue a clarification because of the speculation arising from an earlier tweet:

I say all this to prepare you, kind reader, for the video below, which is self-described shitcoining and a perfect example of how memes and crypto are intersecting at the moment.

What’s Poppin’?

Ethereum transaction fees are popping.

Decrypt reports that Ethereum transaction fees for May of 2021 are close to breaking the previous monthly record of $722 million — with two weeks left to go in the month — thanks to the bullish combination of network use and ATH ETH prices.

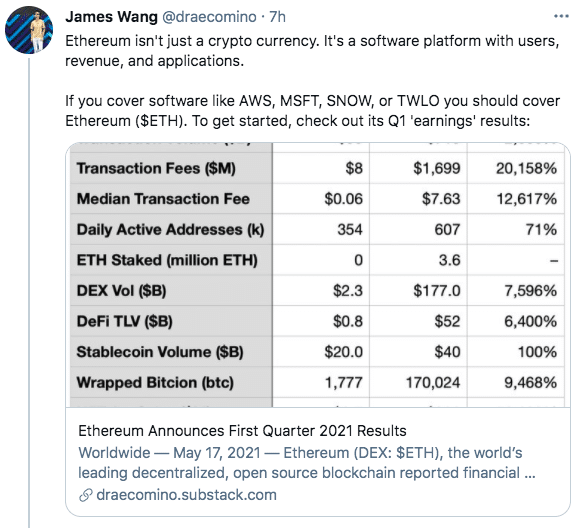

A new high in transaction fees (aka network revenue) on Ethereum is just one portion of an impressive “Q1” for the blockchain, as pointed out by James Wang, a former ARK analyst, in an insightful article yesterday.

Here are a few highlights on the growth of Ethereum between Q1 2021 and Q1 2020 from the article:

- total transaction fees on Ethereum are up 200x, to $1.7 billion

- daily active users increased 71%

- total value locked in DeFi rose 64x to $52 billion — from $800 million

- NFT art sales rose from $700k to $396 million

Read the whole report here:

Recommended Reads

-

Stand aside Bitcoin, perhaps Ethereum is the fastest horse right now:

-

Jeff Dorman, CIO at Arca and recent Unconfirmed guest, penned an essay on Elon, Bitcoin, and where to get better information.

-

Wondering what your lawyer thinks of your latest NFT purchase? She/he probably can’t wait for you to ask:

On The Pod…

Bitcoin vs. the Petrodollar: Which Is More Environmentally Friendly?

Last week, Tesla announced they will no longer accept Bitcoin as payment for vehicles. In a timely episode, Alex Gladstein, chief strategy officer at the Human Rights Foundation, and James McGinniss, CEO and co-founder of David Energy, come onto the show to discuss Bitcoin, the petrodollar, and how to contextualize the energy usage of the first cryptocurrency (BTC) versus the leading fiat currency (USD). Show highlights:

-

their backgrounds and how they became interested in the intersection of currency and energy usage

-

why Alex and James really think Tesla stopped accepting BTC as payment

-

why James thinks Bitcoin’s energy intensity is a “feature, not a bug”

-

Alex on the history of the petrodollar and how the USD in recent decades has been tied to fossil fuel production

-

comparing the carbon cost of a dollar to Bitcoin’s energy consumption

-

what both James and Alex think of the Square and Ark Invest research paper saying renewable energy production could be tied with Bitcoin mining

-

why measuring Bitcoin’s energy usage is difficult

-

how Bitcoin mining in China is changing for the better

-

how the Biden administration might impact Bitcoin

-

where to find more information on Bitcoin and energy consumption

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians