Plus, how much you can earn staking ETH2

This week, on Monday, Bitcoin reached a new all-time high, and on Tuesday, Ethereum 2.0 went live with the beacon chain. Many signs point to institutional investment being the driver behind the current bull run, since public interest has yet to reach the heights of the 2017 frenzy. Congress is pushing a bill that would require all stablecoin issuers to obtain bank charters, but the crypto community says such a law would be nothing but a step backward. Visa has announced that they have begun integrating USDC into their platforms. And the Forbes’ annual Under 30 list has a strong presence of crypto entrepreneurs.

This Week’s Crypto News…

Ethereum 2.0’s Beacon Chain Is Live

On Tuesday at noon UTC, the Ethereum 2.0 beacon chain launched after years of anticipation, ushering in the blockchain’s next era. The beacon chain launch is “phase 0” of Ethereum’s multi-step upgrade to a more scalable blockchain. There are still many technical hurdles to surpass, including sharding and rollup adoption, before the chain will be fully operational. However, as of press time, there are almost 1 million ETH staked, almost double the number that was required for the launch.

If you’re wondering about staking’s risks and rewards, for staking 1 ETH, validators are currently earning around 0.014 ETH/month, or $8.50, with the amount expected to decrease as the number of participants increases. However, any ether staked on the chain will be locked up for months and potentially even years. Staking also entails software risks as well as the possibility that you could lose your initial deposit if you fail to keep up with the network.

Despite some suggestions that current DeFi rewards may be a better bet, exchanges are already intending to support Ethereum 2.0 staking. Coinbase has announced it will support ETH2 staking and trading to eligible jurisdictions starting early next year while also allowing customers to convert ETH to ETH2 and earn staking rewards. Binance likewise announced an ETH2 staking service would be live on December 2, with daily rewards distributed in the form of BETH tokens.

Bitcoin Hits New All-Time High

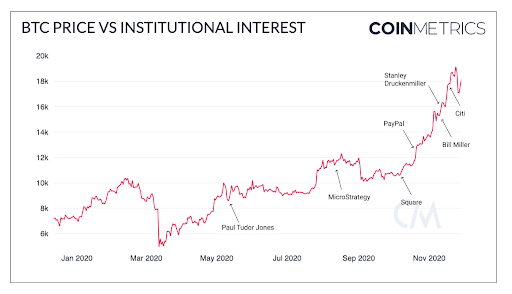

Bitcoin reached $19,850 on Monday morning, inching past the previous record set in December 2017. Chainalysis attributed the rise to institutional investors purchasing steadily over time, and then taking the money off exchanges to hold. An analysis by Coin Metrics beginning in November illustrated that the recent upwards price movements have been occurring mostly during U.S. market hours, further supporting the thesis that institutional investors are pushing the price up. When tracking the Bitcoin price against notable events of institutional interest, such as Microstrategy and Square’s purchases of Bitcoin, PayPal’s integration of Bitcoin and well-known traditional investors Bill Miller and Stan Druckenmiller expressing confidence in Bitcoin, a clear trendline emerges.

Another data point supporting the theory that institutional investor interest is driving the price up is that there is a lack of public interest in Bitcoin compared to late 2017. The amount of Bitcoin-related tweets is far below levels at that time and has been relatively flat for the last two years. Media mentions and searches are also at lower levels than during the previous bull run.

Niall Ferguson, writing in Bloomberg, cited the pandemic as a catalyst for increased adoption in Bitcoin this year. He noted that the explosion of stimulus dollars underscored Bitcoin’s value due to its scarcity, and this was happening already amidst a shift toward digital payments. He went on to say that the incoming Biden administration should not seek to develop a “Chinese-style digital dollar” and instead “should recognize the benefits of integrating Bitcoin into the U.S. financial system — which, after all, was originally designed to be less centralized and more respectful of individual privacy than the systems of less-free societies.”

Metrics Show Bitcoin and Ethereum Activity is Heating Up

Online metrics are showing an increase in activity on the Bitcoin and Ethereum networks. The Block’s Director of Research, Larry Cermak, posted a comprehensive data summary to Twitter, showing “almost everything we track is reaching all-time highs.” Total on-chain volume increased to 51.5% to a new yearly high of $204 billion in November, with miner revenue growing 48% over the previous month for Bitcoin and 22% for Ethereum. Stablecoins, in particular, have more than tripled in 2020, with Cermak citing DeFi and Tether-collateralized derivatives as main factors. A survey by Blockchain Capital also shows increasing awareness and adoption among the general public. More than one in three Americans interviewed said they’re likely to buy Bitcoin in the next five years, and 41% of Americans found it likely that most people will be using Bitcoin in the next ten years.

House Bill Would Require Bank Charters for Stablecoin Issuers

In the U.S., Congress has presented a bill that would require stablecoin issuers to secure bank charters and regulatory approval before issuing any stablecoin. The bill is designed to protect individuals, according to Representative Rashida Tlaib, who said, “Preventing cryptocurrency providers from repeating the crimes against low- and moderate-income residents of color traditional big banks have is critically important.”

Circle Co-founder and CEO Jeremy Allaire responded to the news on Twitter, saying, “Forcing crypto, fintech and blockchain companies into the enormous regulatory burdens of Federal Reserve and FDIC regulation and supervision is inconsistent with the goals of supporting innovation in the fair and inclusive delivery of payments that comes from stablecoins.”

Visa to Connect to USDC

Next year, Visa’s card network of 60 million merchants will be connected to stablecoin USDC. Visa will be the first corporate card to allow businesses to spend a balance of USDC. Visa does not plan to custody USDC at this time, although, effective immediately, Circle will begin working with Visa to integrate USDC software with its platforms. According to Visa head of crypto Cuy Sheffield, “We continue to think of Visa as a network of networks. Blockchain networks and stablecoins, like USDC, are just additional networks. So we think that there’s a significant value that Visa can provide to our clients, enabling them to access them and enabling them to spend at our merchants.”

Crypto News Roundup

- More than $4 billion worth of cryptocurrency (including $3.8 billion BTC) was seized by Chinese police during a crackdown on the PlusToken Ponzi scheme, with a Chinese court saying the seized crypto “will be processed pursuant to laws” and “forfeited to the national treasury.”

- In collaboration with crypto startup Lukka, the S&P Dow Jones Indices plans to launch two index products, which will enable asset management firms to build their own crypto-based investment products.

- The Libra Association announced the adoption of a new name, Diem, as well as several executive appointments ahead of its eventual launch.

- After its chief executives were charged with violations of the Bank Secrecy Act by the Department of Justice, 100x Group, which runs BitMEX, appointed Alexander Höptner as its chief executive officer; Höptner was formerly CEO of Börse Stuttgart and Euwax.

A Strong Crypto Showing in Forbes’ 30 Under 30 2021 List

Forbes published its annual 30 under 30 list celebrating young entrepreneurs. Several blockchain and crypto entrepreneurs made the cut in the finance and venture capital categories. Among the crypto heavyweights on this year’s list were Volt Capital’s Soona Amhaz, FTX Founder Sam Bankman-Fried, Augur co-founder Joey Krug, Coinlist co-founder Brian Tubergen, and Bitcoin Core developer Amiti Uttarwar, among others. You can also read an in-depth writeup on the crypto-centric names on the list at Decrypt.