March 7, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Revolut banned transfers in Russia and Belarus; Mastercard, Visa, and PayPal suspended services in Russia.

-

Ukraine is buying military gear with donated crypto.

-

Ethereum miners made $1.19 billion in revenue during February.

-

Crypto exchange OKX signed a sponsorship deal with Manchester City.

-

A bug in Convex Finance led to locked tokens flooding the market, which dragged down prices.

- Circle delayed its DeFi API product, citing the need for more regulatory clarity.

Today in Crypto Adoption…

-

CVS filed trademarks for NFT and virtual goods.

-

A vending machine in NYC is selling NFTs.

-

The Philippines central bank plans to go forward with its CBDC research.

- Shake Shack is reportedly offering customers crypto rewards for purchasing through Cash App.

The $$$ Corner…

-

a16z announced a $70 million investment into staking protocol Lido Finance.

-

Sherlock, a DeFi security firm, is set to raise $100 million in a token sale.

- ArDrive raised $17.2 million to make a decentralized alternative to Arweave’s gateway.

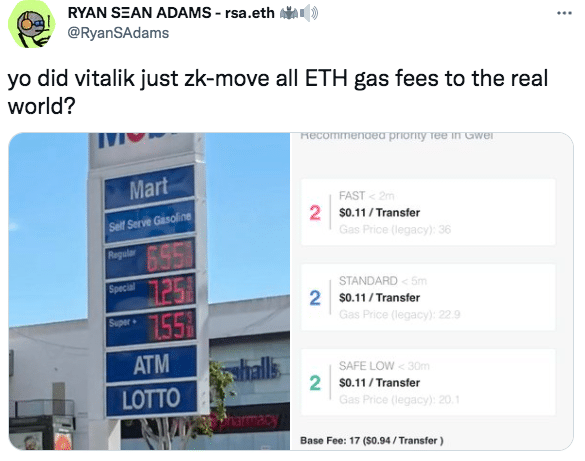

What Do You Meme?

What’s Poppin’?

This DeFi OG Is Leaving Crypto

Andre Cronje, known as “the Godfather of DeFi,” is stepping away from the crypto space, according to a tweet from his business partner Anton Nell, a builder best known for his work on Fantom.

“Andre and I have decided that we are closing the chapter of contributing to the defi/crypto space,” wrote Anton on early Sunday morning.

With the decision, Andre and Anton are closing down approximately 25 apps and services, meaning the custom front-ends built by Andre for Yearn Finance and Keeper Network. However, the decentralized smart contracts that have already been launched will continue to run on Ethereum.

For those keeping a close watch on Andre’s recent activity on social media, the move may not come as a surprise. His LinkedIn was updated earlier last week to show jobs at Fantom Foundation, CryptoBriefing, Yearn.Finance, and “DeFi Architect” ending in February of 2022. His Twitter account was also deleted recently.

Notably, the Cronje-associated tokens took major hits over the weekend. Solidly, a fork of Olympus DAO on Fantom, saw its native token SOLID drop 46% between Saturday and Sunday afternoon. Keep3r’s and Iron Bank’s tokens also dropped more than 30% on the news.

Yearn Finance, probably Cronje’s most successful and influential innovations, also dropped, falling 10% after Nell’s tweets. However, as pointed out by Banteg, an anon dev on Yearn Finance, Andre has not been active in building Yearn for some time. “People burying YFI, you do realize Andre hasn’t worked on it for over a year? And even if he did, there are 50 full-time people and 140 part-time contributors to back things up,” explained Banteg on Twitter.

Cronje’s sudden departure from crypto is on-brand, as his relationship with the crypto community has been tenuous. During his time in crypto, he wrote a two-part blog titled “Building in DeFi sucks,” one of his blockchain games called Eminence experienced a serious exploit before he had even launched the code, and Andre had been threatening to quit for quite some time.

However, based on Nell’s tweet, Cronje is really leaving for good this time. “Unlike previous “building in defi sucks” rage quits, this is not a knee jerk reaction to the hate received from releasing a project, but a decision that has been coming for a while now. Thanks you to everyone that supported us over the past few years,” concluded Nell.

Recommended Reads

-

Placeholder’s Chris Burniske on investing in crypto tokens in a bear market:

-

a16z’s Chris Dixon on building in web3:

-

@shivsakhuja with everything you need to know about the Terra ecosystem:

On The Pod…

How Ukraine Is Leveraging Crypto in Its Fight Against Russia

Tomicah Tillemann, the global chief policy officer of Katie Haun’s new firm, analyzes Russia’s invasion of Ukraine and explains how crypto is being used in an unprecedented manner to render aid to civilians, move money across the world, and potentially document war crimes. Show highlights:

-

Tomicah’s background, which includes stints working for the State Department and a16z

-

recap of Russia’s invasion of Ukraine

-

what Tomicah thinks of the decision to boot certain Russian banks from SWIFT

-

why Tomicah believes that it would be very difficult for Russia to use crypto at a large scale to evade sanctions

-

why ruble/BTC volume is spiking

-

how Ukraine’s usage of web3 tools could change humanitarian aid forever

-

what lessons to take away from Ukraine’s almost-airdrop

-

the four real-world crypto use cases governments should take notice of

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians