October 26, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

SEC Chair Gary Gensler said that DeFi will “end poorly” without protections.

-

Digital asset investment products saw $1.5 billion in inflows last week — an all-time high.

-

Sino Capital launched a $200 million fund with backing from FTX to invest in crypto projects.

-

China is not soliciting public opinion regarding its bitcoin mining ban.

-

An investor in Europe is seeking $140 million in compensation from Binance by claiming his position was unjustly liquidated in late 2020.

-

BlockFi is partnering with Neuberger Berman to create a line of crypto products, like ETFs.

-

Solana (SOL) reached a new all-time high at approximately $219 and is now the sixth-largest cryptocurrency by market capitalization.

-

Matt West, a Yearn developer, is running for Congress.

-

Over 3 million email addresses from CoinMarketCap were leaked.

-

Korea Teacher’s Credit Union, which manages $47 billion, is investing in Bitcoin, reports Joseph Young.

-

Senator Rand Paul is questioning whether cryptocurrency could become the reserve currency of the world.

-

NFT marketplace SuperRare had its best month ever based on trading volume.

- Near Protocol is offering $800 million in grants funding for ecosystem development.

- A new report from the US Treasury Department and other agencies will indicate that the SEC should have significant authority to regulate stablecoins.

What Do You Meme?

What’s Poppin’?

Yesterday, Bakkt (NYSE: BKKT) shares rose 234.43%, jumping from $13.87 to $30.60 during trading hours as the crypto platform announced partnerships with Mastercard and Fiserv. In after-hours trading, shares ballooned even further, reaching nearly $47, as of 6:04 pm ET,

Bakkt is unlocking crypto payment rails for Mastercard consumers, according to a Monday morning press release. Soon, Mastercard customers will be able to buy, sell, and hold digital assets through Bakkt custodial wallets. Additionally, Mastercard says the partnership will streamline the issuance of branded crypto credit and debit cards.

“Mastercard is committed to offering a wide range of payment solutions that deliver more choice, value and impact every day,” said Sherri Haymond, executive vice president of digital partnerships at Mastercard, in a statement. “Together with Bakkt and grounded by our principled approach to innovation, we’ll not only empower our partners to offer a dynamic mix of digital assets options, but also deliver differentiated and relevant consumer experiences.”

Fiserv announced a similar deal with Bakkt on Monday afternoon. Through Bakkt’s digital asset platform, Fiserv plans to “enable practical uses of crypto and emerging asset classes” for their customers. The payments company specifically envisions Bakkt helping facilitate crypto-asset payment mechanisms for B2B and B2C payouts, loyalty programs, and transactions.

It has been a busy week for Bakkt. In addition to the new deals with Mastercard and Fiserve, the crypto platform went public last Monday (October 15th) through a SPAC deal that valuedthe company at $2.1 billion.

Recommended Reads

- @Punk6529 on NFTs:

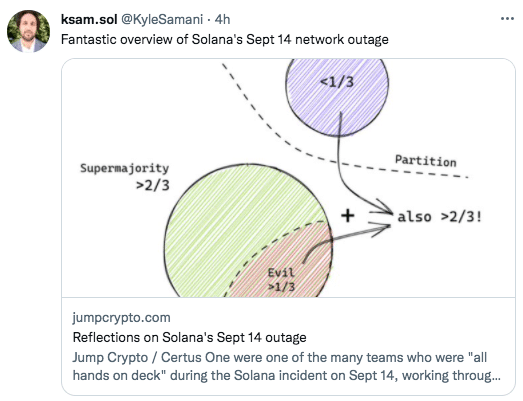

- Jump Crypto on Solana’s network outage in September:

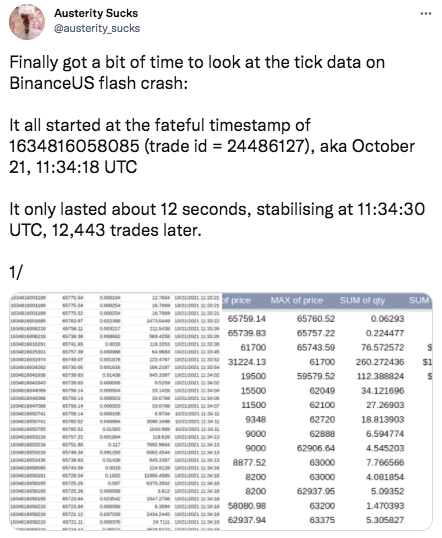

- @austerity_sucks on Bitcoin crashing to roughly $8K on BinanceUS:

On The Pod…

Not Reporting Info on Some Transaction Partners Could Soon Be a Felony

Remember the $1 trillion infrastructure bill, which caused considerable backlash from the crypto community due to the language regarding “brokers?” Abe Sutherland, an adjunct professor at University of Virginia School of Law, believes another provision tucked inside the bill could end up being a far more significant issue for anyone transacting in digital assets. Show highlights:

-

how Abe fell down the crypto rabbit hole

-

what provision 6050I is and how it could affect anyone transacting with digital assets

-

how 6050I works and when it would apply

-

why violating 6050I would be a felony

-

how 6050I discourages digital asset transactions

-

how 6050I would apply to different transaction types, like peer-to-peer trades, NFT sales, and smart contract escrow accounts

-

what information recipients of digital assets must verify from the sender

-

how the government came up with the $10,000 reporting threshold and why Abe believes this number is outdated

-

why Abe thinks proposing 6050I within the infrastructure bill is inappropriate

-

what reasons the government has to want to put such stringent reporting requirements on digital asset transactions

-

how 6050I fits under the financial laws of the Bank Secrecy Act

-

why Abe believes the amendment should be struck from the infrastructure bill

-

what Abe thinks of the constitutionality of 6050I

-

how Abe views 6050I as less about generating tax revenue and more about tracking people’s digital asset transactions

-

what action steps he says the crypto community can take to fix the bill

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians