June 18, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

- Wedbush Securities joined the Paxos Settlement Service, which settles US securities using blockchain tech

- NFT real estate sold for $913K in Decentraland

- The Bitcoin Mining Council hosted its first meeting yesterday

- The National Republican Congressional Committee is partnering with BitPay to accept donations in cryptocurrency (Axios)

- World Bank denied El Salvador’s request for assistance in making Bitcoin legal tender

- Circle is partnering with Maps.me to provide users stablecoin capability

- TRM Labs, a blockchain analytics firm, raised a $14M Series A

What Do You Meme?

What’s Poppin’?

According to data from Coin Gecko, IRON Titanium Token (TITAN) crashed from $60 to just a sliver above $0 in less than 24 hours on Wednesday.

TITAN is linked to the IRON Finance project, which mints so-called stablecoins by locking in a combination of 25% TITAN and 75% USDC. CoinDesk reported that QUOTE “when new IRON stablecoins are minted, the demand for TITAN increases, driving up its price. Conversely, when the price of TITAN falls dramatically, as was the case on Wednesday evening, the peg becomes unstable.”

In a post-mortem blog post, Iron Finance described the event as “the world’s first large-scale crypto bank run.”

As TITAN began freefalling from $60, so did the pegged value of IRON, falling to under 70 cents as a bank run was initiated on TITAN, creating, as Fred Schebesta, founder of Finder.com.au and an Iron Finance investor, told CoinDesk, “a crypto vortex of money.” Iron Finance explained this vortex as a “negative feedback loop” and “the worst thing that could happen to the protocol,” where panic selling led to more TITAN creation which drove TITAN prices down, which caused more panic…

For context, at one point, Iron Finance had $2+ billion in value locked into the network. That number has dropped to $238 million as of press time.

TITAN and IRON Finance were available on Polygon and Binance Smart Chain. Mark Cuban, billionaire investor and avid DeFi user, recently admitted to being a liquidity provider on Quickswap, an automated market maker native to Polygon, for the DAI/TITAN trading pair (in a blog post on DeFi that I recommend in my daily newsletter earlier this week).

In response to a tweet referencing the TITAN crash as a rug pull, Cuban replied that he “got hit like everyone else.”

Later, in an email to Bloomberg, he called for regulation in the industry “to define what a stable coin is, and what collateralization is acceptable.”

Preston Byrne, partner at Anderson Kill, tweeted back at him:

Recommended Reads

- While TITAN and IRON unequivocally failed as a stablecoin, Messari’s Ryan Watkin’s believes that all algo stablecoins are not minted equally:

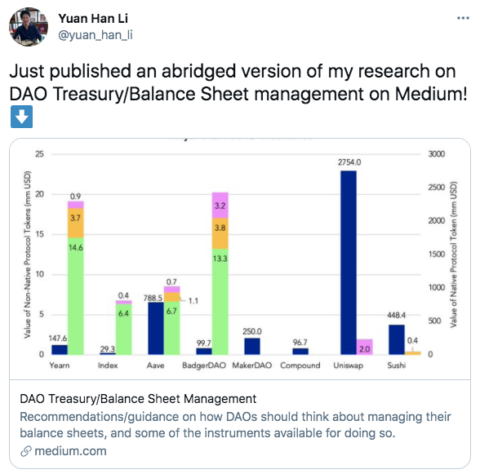

- Yuan Han Li, a researcher at Blockchain Captial, on his recommendations and guidance for DAOs regarding treasuries and balance sheets:

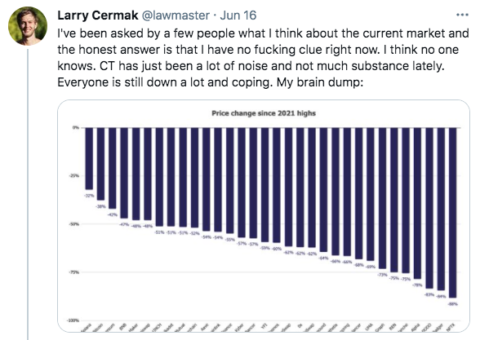

- Larry Cermak, director of research at The Block, tweeted a quality brain dump on the state of crypto:

On The Pod…

Polygon: The Layer 2 Solution Doing 8 Times as Many Transactions a Day as Ethereum

Jaynti Kanani, cofounder and CEO of Polygon, discusses why the layer 2 solution has seen so much success during a down crypto market. Show highlights:

-

what factors have led to Polygon’s and MATIC’s impressive performance YTD

-

how Polygon is scaling Ethereum

-

what types of projects are taking off on Polygon

-

how Polygon is attempting to address the issue of layer 2 composability

-

how Polygon plans to use its latest funding

-

why Jaynti is confident Polygon will still be necessary after ETH 2.0 launches

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians