MicroStrategy and Square stack more sats

Another week, another Bitcoin all-time high and, of course, a precipitous 20% drop following the $58k peak. Diamond hands held, laser eyes meme-ed, and I made a guest appearance in a Wall Street Bets tweet … if you understood what I just wrote, you are officially a crypto nerd 🙂

This week the crypto space finally was able to delve into the long-awaited Coinbase S-1 filing, which was chock full of all kinds of juicy facts and figures, which we dive into on Unconfirmed with Decrypt’s Jeff Roberts. One finding calls into question how well Coinbase will be able to diversify its revenue.

There was also big news about the Tether versus New York Attorney General’s Office investigation, which resulted in an $18.5 million settlement. MicroStrategy and Square both announced Bitcoin purchases to the tune of $1.2 billion. Decentralized exchange volume hit an all-time high on Ethereum, but so did gas fees, which might be why Layer 2 solutions grabbed a few headlines. Binance’s BNB and Solana’s SOL tokens skyrocketed in price and so did the narrative around Ethereum killers. Traditional finance is continuing to reckon with the rise of DeFi on the heels of the Gamestop + Robinhood situation. In other news, Ripple moved to a more crypto-friendly state and OKCoin plans to suspend trading on certain Bitcoin forks.

Be sure not to miss Unchained with Charles Cascarilla of Paxos, whose deep knowledge of financial plumbing and blockchain tech makes him a choice explainer on how the Robinhood debacle could have been prevented with technology — and what Paxos is doing about it.

Listen to the Latest Episode of Unchained

Paxos’s Charles Cascarilla: How Blockchain Tech Could Prevent Another GameStop/Robinhood

Be sure not to miss Unchained with Charles Cascarilla of Paxos, whose deep knowledge of financial plumbing and blockchain tech makes him a choice explainer on how the Robinhood debacle could have been prevented with technology — and what Paxos is doing about it.

Listen to the Latest Episode of Unconfirmed

Coinbase’s S-1: The Number That May Make the Exchange Nervous

Jeff Roberts, executive editor at Decrypt and author of “King of Crypto: One Startup’s Quest to take Cryptocurrency Out of Silicon Valley and Onto Wall Street” talks about Coinbase going public.

Thank you to our sponsor!

Crypto.com: https://bit.ly/3jzkTADDownload the Crypto.com app here: https://crypto.onelink.me/J9Lg/laurashinpodcasttesla

This Week’s Crypto News…

Tether Settles With NYAG for $18.5 Million

After an almost two-year-long investigation, the handing over of 2.5 million documents, and USDT growing from a $2 billion to $35 billion market cap, Bitfinex and Tether agreed to a settlement with the New York Attorney General’s Office on Tuesday in regards to the 22-month inquiry into a possible cover-up of $850 million in losses by Bitfinex. The NYAG will bring no charges as part of the settlement.

In a tweet thread, Tether claimed to “admit no wrongdoing” and said that no there had been no finding that “Tether ever issued without backing.” Tether agreed to pay $18.5 million as part of the settlement and will submit quarterly reports on the composition of Tether’s reserves to the NYAG for two years.

New York Attorney General Letitia James was a bit harsher in her description of the settlement. In a press release, she said, “Bitfinex and Tether unlawfully covered-up massive financial losses to keep their scheme going and protect their bottom lines. Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie.”

While it is too early to decide winners and losers of the Tether vs NYAG saga, it seems that both sides got what they wanted: the New York Attorney General gets to be a quasi-regulator of Tether and Tether is allowed to continue functioning with only a minor fine. However, Tether cannot serve New York citizens or businesses. Whether or not this ends up being worse for Tether or for New York, currently considered one of the financial capitals of the world — only time will tell.

The settlement and resulting transparency should help resolve unfounded suspicions that issuance of Tether somehow artificially inflated the Bitcoin price. Dan Held, head of growth at Kraken, may have been correct in January when he wrote “Tether FUD [fear, uncertainty, doubt] is overblown.”

BTC falters, Square and MicroStrategy Undeterred

Bitcoin reached a new all-time high on Sunday at $58,367 and promptly dipped, dropping to below $45,000 by early Tuesday morning, a correction of roughly 20%. But these price swings likely don’t faze corporations like MicroStrategy, which announced Tuesday it had added another $1 billion in BTC to its books, bringing its total investment to 19,452 bitcoins, the equivalent to roughly $4.5 billion. Square also announced a purchase of $170 million in BTC this week, bringing its total investment in BTC to roughly 5% of its total assets. The company also reported selling $4.57 billion in bitcoins to customers through CashApp in 2020 and revealed that one million customers purchased bitcoin for the first time in January 2021 alone.

In other institutional news, asset manager Stone Ridge is adding Bitcoin to its diversified alternatives fund, effective April 26th. The fund will have exposure to BTC through put options on futures contracts.

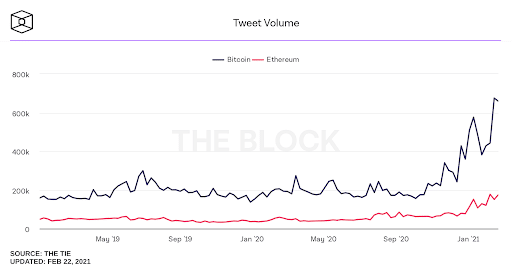

In other bullish news, “Bitcoin” weekly tweet volume hit a new high this month.

In Quillette, Alex Gladstein, chief strategy officer at the Human Rights Foundation, published an op-ed on how governments may not be able to stop bitcoin on a protocol level and refutes several theories on how Bitcoin could be stopped. He says, “There is an enormous amount of speculation on the Internet about how Bitcoin might be attacked, but few stop to think about why it hasn’t already been destroyed. The answer is that there are political and economic incentives for more and more people to push the system forward and strengthen its security, and strong political, economic, and technical disincentives that discourage attacks.” If you have a normie friend thinking Bitcoin might one day go down, this is a great essay to show him or her.

DeFi Roundup

- Decentralized exchange monthly volume hit an all-time high at $65 billion on Thursday, just 24 days into February, passing last month’s record of $61 billion.

- Average ETH gas fees hit a yearly high on Tuesday, with the average ERC-20 transaction fee hitting $38.21 according to BitInfoCharts.com.

- Ethereum layer 2 solutions were popular this week. Layer 2 solutions aim to provide reduced gas fees, lower latency, and greater throughput rather than putting every transaction on the Ethereum blockchain:

- Decentralized derivatives exchange dYdX is open for trading on Ethereum layer-2 scaling solution StarkWare. Trading is currently limited, though a full public launch is expected in a few weeks. The exchange lists BTC/USD and ETH/USD perpetual contracts, lending, and margin trading.

- Andreessen Horowitz (a16z) is investing $25 million into Optimism, a startup focused on scaling the Ethereum network. Optimism began a soft launch of its product in January, partnering with DeFi protocol Synthetix to begin testing its new throughput and transaction speed.

Ethereum Killers on the Upswing

With high gas fees on Ethereum being highlighted this week, it is no surprise that would-be ETH killers have been, well, killing it.

BNB, the native token to the Binance Smart Chain, Binance’s competitor to Ethereum, jumped from $40 to $300 in just 20 days and now sits as the third-largest cryptocurrency by market cap. PancakeSwap, a cloned Uniswap dapp running on the Binance Smart Chain, is currently the number one DEX by number of unique wallets and just $3 billion behind Uniswap in weekly volume. The recent popularity of BNB, however, has raised questions around the centralized nature of the chain and whether Binance’s conflict of interest in having an Ethereum competitor might have accounted for its suspension of ETH and Ethereum-based token withdrawals on Monday.

Solana, another Ethereum competitor, has seen impressive growth this week, with the SOL token doubling from $8 to $14 as of press time Thursday. Alameda Research announced a $40 million investment in Oxygen, a DeFi primer brokerage that will launch on decentralized exchange Serum. Sam Bankman-Fried, CEO of FTX and advisor to both Serum and Oxygen, pointed to the speed and lower cost of the Solana blockchain as reasons for choosing it.

Problems With Traditional Financial Plumbing Highlight Potential in Blockchain

On Wednesday, an outage at the Federal Reserve resulted in settlement issues for many financial institutions, causing ACH and FedWire delays at crypto exchanges. On the heels of the GameStop debacle, the DTCC, the main processor of U.S. stock trades, released a whitepaper outlining a plan to reduce the settlement of trades from two days to one, aka T+1. DTCC thinks it can accomplish this within two years — which, in crypto time, seems like an unbelievably long way away. Hear more about how such issues could be resolved by a blockchain-based platform such as Paxos Settlement Service, which Paxos CEO Charles Cascarilla discusses on this week’s Unchained.

But blockchain technology continues to intrigue the government. Federal Reserve Chair Jerome Powell announced that the Fed will be engaging the public on the topic of the digital dollar later this year.

SEC Commissioner Hester Pierce gave a speech titled “🚀 Atomic Trading 🚀” — replete with actual rocket emojis — urging federal regulators to “be more proactive in embracing technology.” She specifically cited DeFi as an example, saying, “DeFi’s promises of democratization, open access, transparency, predictability, and systemic resilience are alluring.“ She also noted distributed ledger technology has the potential to improve the current financial infrastructure, mentioning that shortening the process for settling trades from T+3 to T+1 could decrease risk associated with open positions and reduce collateral demands. She referred to Robinhood CEO Vlad Tenev’s testimony from last week when he called for real-time settlement of trades, and said, “After all, crypto transactions settle quickly and effectively without a central counterparty. Smart contracts and distributed ledger technology could make the entire clearing and settlement process in the equity markets faster and more efficient.”

Fallout From SEC Lawsuit Against Ripple Continues

In light of the SEC’s lawsuit against enterprise blockchain firm Ripple and two of its executives, Moneygram, a publicly-traded remittance firm, has stopped using Ripple’s services. Ripple also made headlines this week by announcing a move to Wyoming, news that was broken by Wyoming blockchain whisperer and Avanti CEO Caitlin Long.

OKCoin Delists BCH and BSV

Since exchanges make money on the trading of coins, no matter whether they are high- or low-quality coins, they are typically incentivized to list as many assets as possible. So it was surprising when crypto exchange OKCoin announced that trading of two forks of Bitcoin, Bitcoin Cash (BCH) and Bitcoin Satoshi’s Vision (BSV) will be suspended on its platform starting March 1, 2021. Both coins are variations on Bitcoin, with a focus on larger block size limits and layer 2 solutions respectively. OKCoin says it is a neutral platform and that it believes in allowing its customers to invest for themselves, but that, based on the fact that the market caps of both coins are around 1% of Bitcoin’s “the markets have cast their vote.” Another factor that pushed it over the edge was the recent decision by Craig Wright, a leader in the BSV community who has claimed he is Satoshi Nakamoto, to enforce copyright claims to the Bitcoin whitepaper.

Fat Protocols Strikes Again

This Fun Bits is for those of you who remember the quiet days of 2016 when the Fat Protocols thesis was all the rage…

The Fat Protocols thesis was the theory that in the crypto version of the internet, protocols and their native tokens would be worth more than applications built on top, whereas in the original internet, protocols like HTTP and SMTP were worth nothing, but applications such as Google, Facebook, and Amazon that were built on top became hugely valuable. Well, if you were wondering how that works out when you compare a seed investment in Coinbase to an investment in Bitcoin at the same time, a site called Casebitcoin.com has your back. It judges the seed investment in Coinbase to be around September 12, 2012, and says that, assuming a seed valuation of $10 million, Coinbase’s valuation upon going public would need to exceed $47 billion to beat Bitcoin’s 250,000% return since then — and the way things are going right now, that looks like it’s been locked up.