Plus, what people are 👀 when it comes to Coinbase

The relationship between regulators and the crypto industry is simultaneously getting cozier and more fraught. With news that Coinbase was likely to go public as early as this year, on Unconfirmed Jeff Roberts discussed how the company has been laying the legal groundwork for potentially offering a blockchain-based token as well. Meanwhile, another regulator joined the board of analytics firm Chainalysis, while the crypto community decried CENTRE blacklisting an Ethereum address holding USDC in response to a request from law enforcement.

On Unchained, we covered all things yield farming, diving into the craze and the sticky questions it brings up. And more developments came out of DeFi, including the launch of credit delegation on Aave, and DeFi reaching $2 billion in total value locked.

This Week’s Crypto News…

CENTRE Blacklists an Ethereum Address Holding USDC

The CENTRE Consortium jointly run by Circle and Coinbase has blacklisted an address that holds $100,000 worth of the stablecoin USDC, in response to a request from law enforcement. Circle said in a statement, “While we cannot comment on the specifics of law enforcement requests, Centre complies with binding court orders that have appropriate jurisdiction over the organization.” The blacklisted address can no longer receive USDC, nor can any of the USDC in that address be transferred on-chain. The Block reports that USDC balances in blacklisted addresses may be “wholly and permanently unrecoverable.”

Dozens of Crypto Companies Get $30+ Million in PPP Bailout Loans

More than 75 crypto and blockchain companies received over $30 million in payroll loans due to the coronavirus. Polychain Capital, ConsenSys and CipherTrace, the latter two of which, disclosure, are previous sponsors of my shows, as well as Tron and Zcash’s Electric Coin Company all obtained funds. For instance, ConsenSys received between $5 and $10 million from Signature Bank, Bittrex, got between $1 and $2 million from Celtic Bank, Circle and Shapeshift each was granted between $1 million and $2 million from Silicon Valley Bank, and cybersecurity and blockchain solution firm Kryptoblocks appears to have obtained between $1 million and $5 million. Several others, including IOHK USA, CipherTrace, Polychain Electric Coin Company and Blockfolio received between $350,000 and $1 million.

In a report, The Block said development firms accounted for 29% of the firms who got loans, while financial services companies received 25%. Trading platforms came in next at 12%. Eleven of the recipients had executed initial coin offerings that had raked in $341 million.

Aave Brings ‘Undercollateralized Lending’ to DeFi, Nabs $4.5 Million Seed Investment

DeFi lending protocol Aave launched a new service for “credit delegation,” in which a user can deposit funds, earn a higher interest rate, and lend them out to a designated person who has not put down any collateral. In the absence of collateral, the borrower and lender use a legally binding contract specifying interest rates and repayment deadlines created by blockchain-based OpenLaw. The Block reports that if the borrower does not repay the loan, the lender “can take him [or her] to court — as long as they are in the same jurisdiction.”

Aave had some other news this week: ParaFi invested $4.5 million into what is currently the third-largest DeFi lending protocol.

The Next Year in Ethereum

Tyler Smith, a validator for Ethereum 2.0 test nets, wrote up a tweet storm on Ethereum 2.0, saying it will be “the most pivotal event in all of crypto since the launch of ETH1.0. People talk about Bitcoin halving events … they are minor league compared to this.” He said a lot of institutional money was waiting to see if Ethereum would deliver, but brought up a number of major concerns, such as how taxes should be handled for what he called ETH 2.0 ether vs. ETH 1.0 ether, asking the Ethereum Foundation to make an official statement saying they were the same. (Somehow, I don’t think the foundation is considered the final word …) He also noted, “An additional tax headache will be accounting for staking gains while the tokens are locked on the beacon chain. In the US, mining rewards are taxed as ordinary income. But how are you supposed to pay taxes on Ether you can’t sell?”

Meanwhile, Larry Cermak of The Block noted that Ethereum transaction fees as a percentage of miner revenue have been soaring to 18%, far surpassing Bitcoin’s which are at about 4%.

Trump’s Former Sanctions Chief Joins Chainalysis Board as It Raises $13 Million Extension

Blockchain analytics firm Chainalysis garnered a $13 million extension to its Series B fundraising, which now totals $49 million, plus welcomed a new board member: US President Donald Trump’s former Treasury under secretary for terrorism and financial intelligence, Sigal Mandelker. Also participating in this round was actor and investor Ashton Kutcher. Michael del Castillo of Forbes, who reported the story, noted that Mandelker’s move was part of “an increasingly clear trend of influential regulators joining the cryptocurrency companies they once overesaw.”

Arca Launches US Treasury Fund on Ethereum With SEC Blessing

Los Angeles-based money manager Arca has launched the Arca US Treasury Fund, which is an SEC-registered closed-end fund whose digital shares trade via “ArCoins” on the Ethereum blockchain. It mainly invests in short-term US Treasury bills and notes. The SEC gave it a “Notice of Effectiveness” on July 6, making it the first time the SEC has given its blessing to a fund represented by cryptographic tokens, with the approval coming after 20 months of effort.

TikTok’s Dogecoin Challenge Causes Price to 2x

Seven days ago, Dogecoin was languishing at one-fifth of one penny. As of press time, it’s more than doubled, with that rise beginning Tuesday, when a bunch of TikTok users began publishing videos urging people to buy Dogecoin and try to push the cryptocurrency to $1. The cryptocurrency is best-known for being a meme cryptocurrency with its own mascot: a Shiba Inu who says things like “much wow” in Comic Sans font. Bloomberg reports that some users are prodding others to “all get rich” and “tell everyone you know.” Another user zooms in on an image of Dogecoin while in the background plays the song, “Fly Me to the Moon.”

The Block reports that the campaign resulted in DOGE trading volumes skyrocketing to 22 times the average daily trading volume in 2020 to $27 million, and that Dogecoin hit the top popularity score on Google Trends of 100.

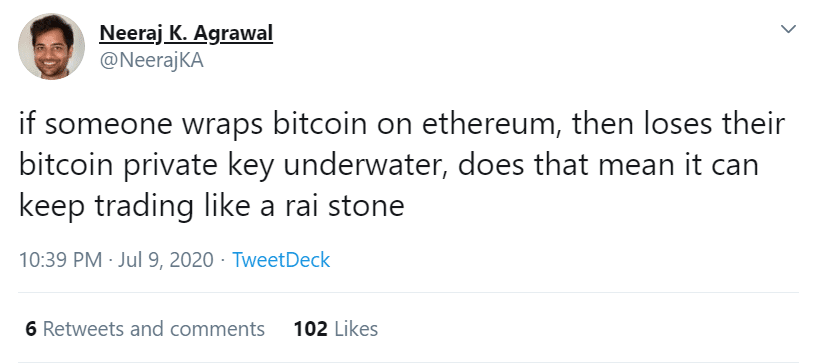

DeFi Rai Stones

This tweet by Neeraj Agrawal of Coin Center was too funny to not mention. Some background to help you get the joke. Blockchain-based systems are often said to be similar to a form of money from the Micronesian island of Yap, in which families would use large stones called Rai stones as money but because they were too heavy to move, they would use a ledger-based system to keep track of who owned which or how much of any Rai stone. This even applied to Rai stones that had fallen into the ocean when they’d been transported by boat from elsewhere.

So, now, with that background, Neeraj said,