And other record-breaking stats

There was jaw-dropping news on the Bitcoin front: Bitcoin had a “high” severity bug back in 2018. Although it was fixed and no one appears to have attempted to exploit it, the bug could have allowed attackers to steal funds. Otherwise, as one who’s been watching the DeFi space could probably predict, August was a good month for both Bitcoin and Ethereum, with volumes and fees up, and early indicators for September trending upward.

There’s also more news suggesting that interest is growing — both among builders and users. Swerve, a forked project from the automated market maker Curve, had a healthy amount of liquidity locked in it within a week, and small businesses in Africa are increasingly turning to Bitcoin. However, because it’s still early, there are plenty of cautionary tales. One lucky trader turned $200 into $290,000 with the click of a button, but their gain caused the project to collapse. Meanwhile, there are more stories of magic internet money disappearing into the ether.

On Unchained, don’t miss Olaf Carlson-Wee who spouts serious knowledge and foresight about all things DeFi, plus waxes philosophical on the new organizations we’re seeing emerge in DeFi and how they could disrupt the traditional corporate structure. One of my favorite sections is where he says, of YFI, “[W]hat you’re seeing is bootstrapping a corporation from zero, right, outside of any jurisdiction, without really any sort of management or concept of management. YFI has more of an inventor than a CEO, much in the way that Satoshi invented Bitcoin but is by no means the CEO of Bitcoin and has no outsize ability to manipulate Bitcoin. … it’s remarkable that something like YFI can bootstrap itself to being worth a billion dollars over the course of just a couple months. I think it’s completely unprecedented, and I do think it looks more like a corporation in the traditional sense of coordinating a pool of capital and humans than it looks like a pure ‘cryptocurrency’ the way we think of, say, Bitcoin or Ethereum.”

This week’s Unconfirmed episode is also a don’t miss – a conversation with the pseudonymous cofounder of SushiSwap, 0xMaki, who appeared on video masked — but wearing a $YFI sweatshirt and $YAM pants.

This Week’s Crypto News…

Bitcoin Core Had High Severity Bug in 2018, Is Now Fixed

Bitcoin’s main software had a critical bug that could have split the $190 billion network in two and allowed attackers to steal funds. The denial-of-service vulnerability was discovered in the Bitcoin Core software over two years ago, but has not been disclosed publicly until now. Although it was quietly fixed in 2018, reporting of the bug was delayed because it took node operators longer than expected to update their software. The vulnerability ranked 7.8 on a scale of 1 to 10, with 9 or above being considered critical. Luckily, no attempt to take advantage of this vulnerability was found.

DeFi Ushers in Record-Breaking Volume in August

If you’ve been following everything in DeFi this summer, you will probably not be surprised to hear that August was a record-breaking month for on-chain volume, trading, and Ethereum transaction fees.

Total adjusted on-chain volume, which serves as a proxy for economic throughput, saw a 30-month high. Bitcoin’s on-chain volume increased by 23% from $66 billion to $81 billion. Ethereum’s on-chain volume showed a massive increase of 82% from $24 billion to $44 billion. Overall, Bitcoin still maintained an on-chain volume in August that was almost two times higher than Ethereum’s.

Transaction fees on Ethereum, thanks to the burgeoning DeFi market, reached an all-time high of over 40% of the total miner revenue, compared to 10% in May.

Big names are taking notice of the DeFi frenzy, as the volume of DeFi tokens on over-the-counter desks has ballooned over the last quarter. However, these desks still appear wary of trading on decentralized exchanges. Binance, for instance, announced its own AMM pool for liquidity providers dubbed Binance Liquidity Swap. The pool will offer different liquidity pools with instant token swap functionality, although the protocol itself is not decentralized.

As for September, volume on Uniswap in the first ten days of the month has already surpassed August’s total numbers, and the second-largest dex, Curve, had also exceeded August’s record numbers by Thursday. And, next week, Coinbase Pro will add trading in YFI.

Swerve Reaches Half of Curve’s Deposits in Days

Just a week after launch, Swerve Finance, the unaudited fork of AMM Curve Finance, has gathered deposits worth $525 million. That’s about half of Curve’s total value locked, which is just over $1 billion.

Swerve is a “100% community-owned and governed” fork of Curve, and generated SWRV tokens for users on day one of the AMM launching. Curve, in comparison, did not issue a token from the start, and when it did, an anonymous developer deployed smart contracts without the team’s knowledge.

Larry Cermak of the Block compares and contrasts Swerve and SushiSwap, since they are both successful forks of popular DeFi projects. He says this trend will continue: QUOTE, “There will be a struggle between the original protocols that have the brand and development talent vs. the protocols that have a ‘fairer’ distribution and more community-driven governance.”

Bitcoin Transactions Up Among Small Businesses in Africa

Small business owners in Africa are turning to Bitcoin for the speed and convenience it offers when paying their suppliers. Reuters reports that monthly Bitcoin transfers in Africa have jumped over 55% in a year to reach $316 million in June, according to data from Chainalysis. The number of monthly transfers is also up almost 50%, to over 600,000, with the bulk of the activity taking place in Nigeria, South Africa and Kenya.

Driving the boom are the young, tech-savvy population of the continent, as well as trade with China. Chainalysis found that East Asia is a top partner when it comes to bitcoin trading in Africa. Bitcoin has also boosted profits for these businesses, thanks to savings in money-transfer fees and reduced foreign exchange fees when converting to and from the US dollar. One seller of mobile phones, Abolaji Odunjo, says, of using Bitcoin, QUOTE, “You don’t have to pay charges, you don’t have to buy dollars.”

In related news, Digital Currency Group announced it had acquired Luno, a retail-focused exchange with a strong presence in Africa, as well as Southeast Asia. Luno, which launched in 2013, has received funding from DCG since 2014, and the acquisition positions DCG to have a strong presence in emerging markets.

700 ETH Lost in Chainlink Attack

Nine Chainlink node operators suffered an attack on August 30 that resulted in 700 ETH (about $335,000 at the time) taken from their “hot” wallets. Exploiting the way nodes respond to queries, the attackers sent price feed requests, which resulted in node operators spending large amounts of gas, which then pushed up the price of Chi, a tokenized form of gas. The attacker then minted Chi tokens at these elevated prices, later selling them for ETH.

Once the node operators were drained of ETH, they were unable to fulfill data requests. The attack lasted two hours until a temporary solution to block non-whitelisted requests from active DeFi protocols such as Aave and Synthetix was implemented. A Chainlink spokesperson said the attack did not impact its network despite node operators paying the high fees necessary to continue powering the system. While stating that consumers were not affected, the spokesperson acknowledged that elevated gas prices prompted the attack.

A DeFi Trader Turned $200 Into $290,00 by Exploiting a Bug in $SYFI

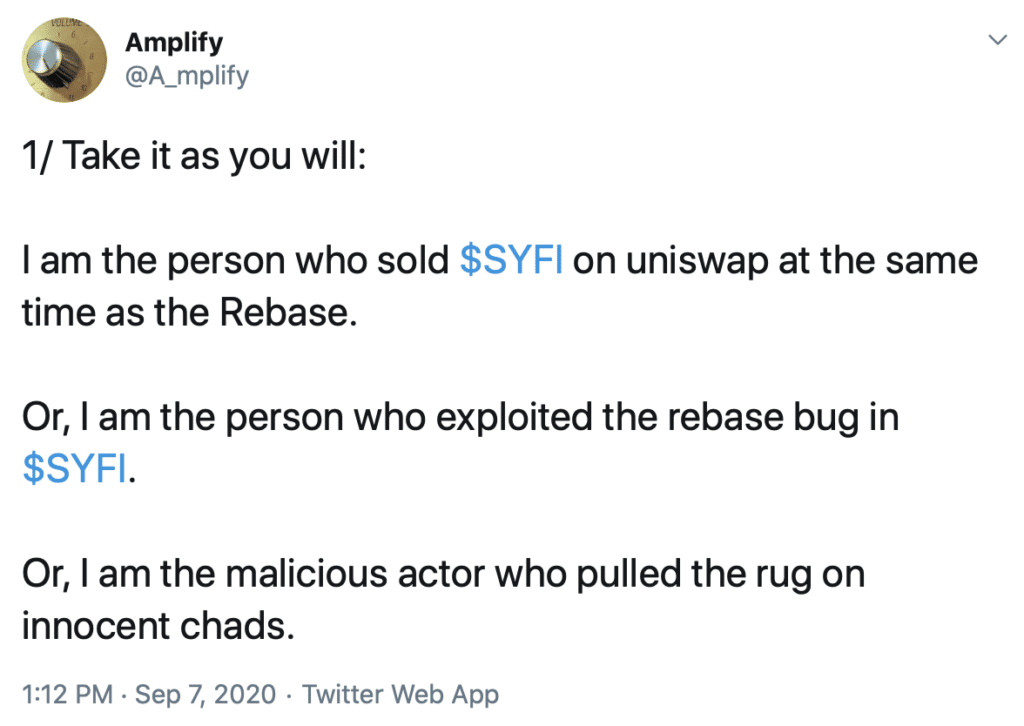

An anonymous trader says they stumbled into an opportunity that led them to quitting their day job. A Twitter user named Amplify said that they traded $200 worth of an obscure coin called SYFI, a derivative of YFI, at the time of the rebase but the rebase malfunctioned — and that spontaneous trade netted them $290,000.

On Uniswap, Amplify saw that 2 SYFI would turn into 15,551 SYFI, which was worth 740 ETH (about $250,000). Amplify at first thought it was a UI bug but figured that if not, they would lose less than $50 in fees, so it was worth trying. Their win was everyone else’s loss: the project collapsed.

Amplify says they meant no harm to anyone, while also making clear they saw the developers as responsible for offering a presale for a forked coin and then pushing it forward with unaudited code. They also reiterated they had no idea the bug existed, saying, QUOTE, “I simply pressed a button because I saw something unbelievable on the other side.”

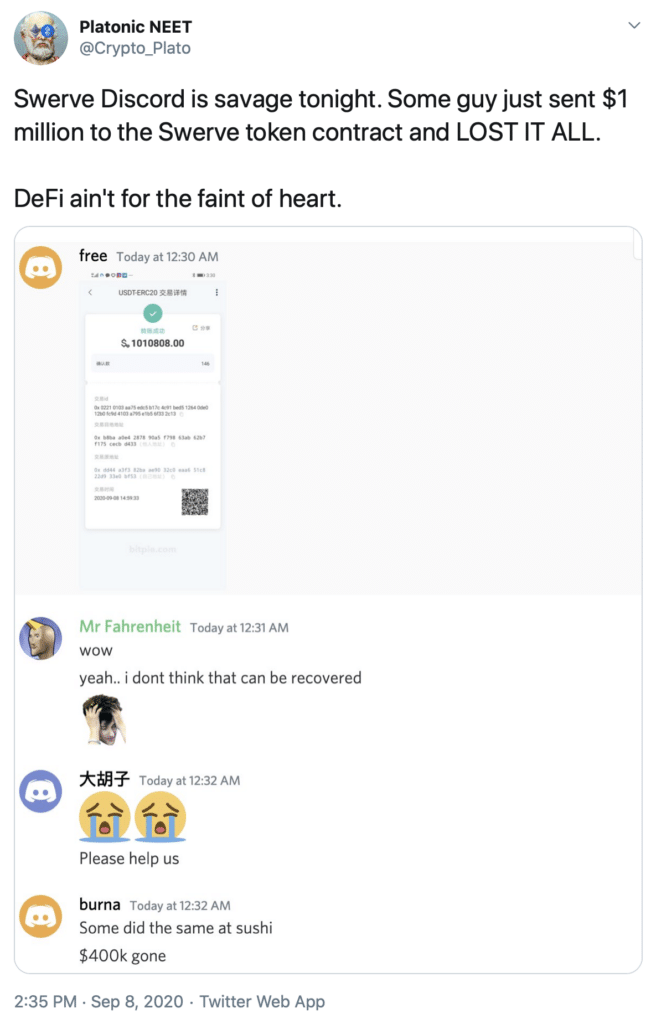

On a related note, Twitter user Crypto_Plato posted a screenshot from the Swerve Discord on September 8, showing a transaction in which someone lost $1 million by sending that money to the Swerve token contract rather than a liquidity pool. Be careful, DeFi traders!

Jack Dorsey on Making Bitcoin More Accessible

In a Reuters interview, Twitter CEO Jack Dorsey said, QUOTE, “I think the internet wants … a native currency, and I think Bitcoin is the best manifestation of that thus far.” He said it was important for people like him and other operators to make Bitcoin easy for people to access, understand, and utilize. He said the two critical challenges it faces are the long transaction times and the lack of an intuitive, user-friendly interface.

Eth2 Medalla Data Challenge

With Ethereum’s Medalla testnet now live, the Ethereum community has issued a challenge to all Ethereans to document their “best Medalla data insights in the most readable blog post possible” for prizes up to $15,000. The deadline for submissions is October 20 and must concern data analysis or visualization of the Medalla testnet, using open source tools and scripts referenced in the blog post. If you’re interested in participating, check out the link in the show notes for this episode.