PLUS: NFTs are going mainstream

This week saw Bitcoin and Ethereum stay relatively flat, hovering around $49,000 and $1,500, respectively. While the two most prominent cryptocurrencies languished, the rest of the market had a vibrant seven days.

Non-fungible tokens continue to push the boundaries of digital ownership and artistic control. Kings of Leon will release an NFT album today, becoming the first rock band to do so, Grimes sold her collection of art NFTs to the tune of $5.8 million in under 20 minutes, and a group of crypto enthusiasts physically burned a Banksy piece titled “Morons,” and revived it as a digital piece that will now be sold as an NFT via OpenSea. Whether NFTs turn out to be the ICOs of 2021 or are here to stay is still up in the air.

Traditional institutions announced quite a few tantalizing crypto schemes this week. On the tech side, Amazon Web Services now supports Ethereum, and PayPal plans to purchase crypto custody firm Curv. On the finance side, Goldman is relaunching its cryptocurrency trading desk, Schwab is considering becoming a crypto broker, and Citibank believes that Bitcoin is at a tipping point.

In other crypto news, the IRS clarified its position on the “did you receive, sell, send exchange, or otherwise acquire” cryptocurrency question found on the 1040. WallStreetBets may be moving to DeFi with plans to “stop betting against the house and become the new house.” BitMEX CEO Arthur Hayes could potentially surrender to U.S. authorities in April. And DeFi saw two hacks this week, with one being a possible rug pull.

On the podcasts, Caitlin Long dives deep on all things crypto banking, dangling enticing tidbits about her upcoming Avanti Bank’s philosophy and its forthcoming token, AVIT, and explaining what was really the core issue with GameStop. And today, Gil Luria, the first Wall Street analyst to cover bitcoin back in 2013, reemerges after a four-year hiatus from crypto to talk about why he views Coinbase’s upcoming direct listing as the Amazon moment for crypto and what his price target is for the stock.

Listen to the Latest Episode of Unchained

Caitlin Long: Why Avanti Will Be a New Kind of Crypto BankBe sure not to miss Unchained with Caitlin Long, founder and CEO of Avanti Financial Group, as she talks about the issues plaguing the current state of technology in traditional finance and how her background as a 22-year Wall Street veteran, gubernatorial appointee to the Wyoming Blockchain Task Force, and crypto pioneer is helping her shape Avanti into a bridge between conventional banking and crypto.

Listen to the Latest Episode of Unconfirmed

Is Coinbase Stock a Good Buy? This Analyst Says YesGil Luria, director of research at D.A. Davidson, talks about the upcoming Coinbase direct listing and his recent research note, “Introducing Crypto’s Amazon Moment.”

Thank you to our sponsor!

Crypto.com: https://bit.ly/3jzkTADDownload the Crypto.com app here: https://crypto.onelink.me/J9Lg/laurashinpodcasttesla

This Week’s Crypto News…

NFTs Take Off With Mainstream Artists 🚀

The NFT craze is reaching multiple corners of mainstream culture. Kings of Leon will release their new album, “When You See Yourself,” in non-fungible token (NFT) form Friday, March 5, at noon ET, becoming the first rock band to do so, according to Rolling Stone. The NFTs are available through YellowHeart, a company focused on NFTs for concert tickets and musical artists, and will be priced at $50 for the two-week sale. YellowHeart will also mint 18 unique “golden tickets,” six of which the band will put to auction, guaranteeing the owner four front-row seats to Kings of Leon concerts during each tour for life, marking the first time concert tickets will be officially sold as NFTs.

Another big name in music is cashing in on the NFT craze. Grimes, the Canadian singer, and partner to Elon Musk, made $5.8 million in under 20 minutes on Sunday through her sale of digital artwork. Her collection, WarNymph, was sold via NFT platform Nifty Gateway and a percentage of the proceeds from the WarNymph NFT sales will be donated to Carbon180, a company dedicated to reducing carbon emissions.

Street artist Banksy saw a piece of his artwork, titled “Morons,” physically burned on a Twitter live stream before being resurrected — digitally — as an NFT. Morons, purchased by Injective Protocol for $95,000 and then promptly destroyed, ridicules art collectors for purchasing expensive pieces of art. On the purpose of the burning, a representative of the company explained, “The main intention here is to be the first-ever event where a physical piece of art is turned into a digital piece.” The digital version of Morons is currently on OpenSea in an auction set to end on Sunday, March 7.

Chris Dixon, general partner at a16z crypto, published a well-timed blog post about NFTs, and how they have the potential to “accelerate the trend of creators monetizing directly with their fans” by fundamentally altering the economics for artists. He lists three main ways NFTs can change creator economics: 1) the removal of middlemen, 2) the allowance for what he calls “granular price tiering,” which is like how Kickstarter enables creators to make more money from especially enthusiastic supporters than they can from the everyday fan, and 3) the transformation of customers to owners. (If you’re interested in more of the a16z crypto investment thesis around NFTs, definitely check out general partner Katie Haun discussing NFTs eloquently on a recent Tim Ferriss podcast.) James Beck, director of communications and content at ConsenSys, penned a blog this week lauding NFTs for providing a challenge to what internet ownership is and might be. He believes that NFTs will transform the music industry by tracking metadata (like audio files, rights, etc.) across multiple platforms, allowing artists to receive royalties for every listen and/or sale.To round out a crazy week in NFTs, Yield Guild Games, a decentralized autonomous organization (DAO) that invests in NFTs, received funding from Scalar Capital, Delphi Digital, Blocktower Capital, and others. YGG will use the funds, totaling $1.3 million, to invest in virtual land and other in-game assets.

Traditional Finance Is Coming to Crypto… One Headline at a Time

- Amazon Web Services (AWS) announced that its service, Amazon Managed Blockchain, now supports Ethereum, enabling customers to focus on building Ethereum-based applications without going through the complicated process of operating their own Ethereum infrastructure.

- PayPal is in the process of purchasing Curv, a crypto custody firm, for a rumored $200 million to $500 million. In an exclusive interview with Decrypt, PayPal CEO Dan Schulman confirmed the launch of a crypto-dedicated business unit that will, amongst other plans, expand crypto offerings beyond “buy, sell, hold.” Users of the crypto derivatives platform FTX can also now use the payments giant to deposit fiat onto the exchange.

- Goldman Sachs is relaunching its cryptocurrency trading desk after a three-year respite. It plans to support BTC futures by mid-March after being put into hiatus in 2018 due to regulatory concerns.

- State Street has been appointed the fund administrator and transfer agent of the VanEck Bitcoin Trust, a proposed bitcoin ETF. VanEck submitted its most recent bitcoin ETF filing in December 2020.

- Not to be outdone by Visa and Mastercard, Discover Financial, the third-largest US credit card company, posted a job listing for a product manager to develop and deliver upon the company’s blockchain “roadmap.”

- Charles Schwab, which oversees $6.8 trillion in client assets, is exploring different white-label solutions for crypto brokerage.

- Citibank authored a report titled “Bitcoin: At the Tipping Point,” which proposed that “bitcoin could become an international trade currency” as a decentralized and secure form of payment. Citi’s researchers, however, cited scalability, environmental considerations, and capital inefficiencies as potential barriers to widespread adoption.

- Jurrien Timmer, Fidelity’s director of global macro global asset allocation, compared bitcoin directly to gold in a recent research piece. While admitting that Bitcoin faces risk from volatility, competitors, etc., he ended his note by writing, “[for investors], the question of bitcoin may no longer be ‘whether’ but ‘how much?’”

The IRS Clarifies the 1040 Question

Crypto investors who simply purchased crypto with fiat money in 2020 received clarification from the Internal Revenue Service on Tuesday. On the current iteration of the 1040, the IRS asks, “At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?” According to the IRS crypto FAQ, taxpayers who solely purchased crypto in 2020 are effectively exempted from answering “yes.”

If the above section stressed you out, perhaps it is fortuitous that TaxBit, a Utah-based start-up, announced a $100 million Series A investment round. The company offers crypto-specific tax software for both individuals and businesses. And ICYMI, be sure to check out our guide on everything you need to know about crypto taxes for 2020.

WallStreetBets Is Becoming a DAO

A group of moderators from WallStreetBets (WSB) launched a new website outlining a plan to decentralize WSB. The group, calling themselves WallStreetBets 2.0, plans to use the native tools of DeFi to utilize smart contracts and pool investments targeting short orders from hedge funds. The anonymous moderator gives an impassioned argument for decentralization, writing, “it’s time to stop betting against the house and become the new house. It’s time to stop using centralized platforms that can shut us down without warning. It’s time to stop using a broken financial system that is archaic and inefficient. It’s time to decentralize.”

Speaking of centralized, Robinhood, the trading platform that fueled the WSB and GameStop mania by shutting down trading multiple times, is planning to confidentially file an initial public offering as soon as March, reports Bloomberg.

BitMEX CEO May Surrender to US Government Next Month

Arthur Hayes, co-founder and CEO of BitMEX, may surrender to U.S. authorities next month according to Jessica Greenwood, an assistant U.S. attorney. Hayes, along with fellow co-founder Ben Delo and BitMEX’s first employee Gregory Dwyer, was charged by the Department of Justice last October for violating the Bank Secrecy Act by evading U.S anti-money laundering requirements. The Commodity Futures Trading Commission (CFTC) also filed charges accusing Hayes, Delo, and Dwyer of operating an unregistered trading platform.

Hayes currently resides in Singapore and would travel to Hawaii for the initial stages of virtual hearings if he goes forward with the proposed voluntary surrender.

Meanwhile, BitMEX is carrying on, trying to remake its image with regulators. According to a profile in Bloomberg of the new CEO, Alexander Höptner, the former CEO of Börse Stuttgart, his goal is to “amend relationships with global regulators while also expanding businesses ranging from spot trading to brokerage and custody services.” He told Bloomberg, “I was coming from the regulated and classical world. I have a lot of touch points with the regulators already. Now I’m working on the crypto side and bringing the crypto side to the regulated world.”

DeFi Roundup

- Meerkat Finance claims to have lost $31 million in crypto assets just one day after launching on the Binance Smart Chain. The Block reports that the hacker drained funds utilizing the smart contract’s original deployer account, suggesting that either the private key of the deployer was compromised or this was an orchestrated rug pull. Additionally, Meerkat has taken down both its website and Twitter account.

- Uniswap finished off February with four consecutive new weekly volume records totaling $32 billion in monthly volume. To put that in perspective, February of 2019 and February of 2020 saw Uniswap do $12 million and $144 million in volume, respectively.

- Furucombo, a tool built for optimizing DeFi strategies, was hacked on Saturday. The exploiter stole roughly $15 million by targeting Furucombo’s transaction batching protocol. The team said in a blog post it is “committed to compensating all users who were affected.” The vulnerability has since been patched.

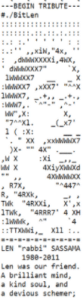

Reminiscence of CypherPunk Suggests Satoshi Nakamoto Committed Suicide

I realize this headline doesn’t sound like such a fun bit, but this essay seems to be another worthy contribution toward solving the enduring mystery of Satoshi Nakamoto’s identity. It starts by saying that each node on the Bitcoin network contains a memorial to cypherpunk Len Sassaman embedded into the transaction data.

The pseudonymous author, leung, then attempts to connect the dots to suggest that Len may have been Satoshi, while also celebrating Len himself, who tragically took his own life in 2011, two months after Satoshi’s last known communication, which said, “I’ve moved on to other things and probably won’t be around in the future.”