November 9, 2022 / Unchained Daily / Laura Shin

What’s Poppin’?

Binance Set to Buy FTX Amid Liquidity Crisis

The two world’s largest crypto exchanges want to merge. Is this the end of Sam Bankman-Fried’s crypto empire?

SBF’s Net Worth Plummets 94% in One Day

Almost all of billionaire FTX CEO Sam Bankman-Fried’s fortune has disappeared overnight.

OFAC Updates Tornado Cash Sanctions To Include DAO

The OFAC amended the Tornado Cash sanctions to include the protocol’s DAO.

Coinbase and Genesis Declare No Exposure to Collapsing FTX

Major crypto companies Genesis and Coinbase assured customers that they had no exposure to FTX.

Did Alameda Go Down With 3AC in Q2?

by Samyuktha Sriram

A series of unusual transfers documented by Coin Metrics’ Lucas Nuzzi have prompted theories that FTX and Alameda’s troubles began earlier this year.

Alameda Owes More Than $30M in DeFi Debt

by Samyuktha Sriram

Alameda’s visible on-chain activity points to more than $30 million worth of debt obligations across lending pools.

In Other News… ✍️✍️✍️

- Bitcoin miner Riot Blockchain missed revenue estimates for the third quarter amid turmoil in the mining industry.

- Tether’s CTO denied exposure to FTX and Alameda.

- Following BitDAO’s request, Alameda Research provided proof that it still holds tokens worth $39 million received in a swap agreement with the DAO.

- A judge’s tentative ruling showed that Kardashian and Mayweather may be on track to win their lawsuit over Ethereum Max.

The $$$ Corner…

- Crypto venture firm LeadBlock Partners closed a new fund with a target value of $150 million. The fund is backed by Yuga Labs, Bitpanda and BlockFi.

- Investment firm Abrdn led a $28.5 million Series A round for crypto exchange Archax.

- Eterlast, a Web3 gaming company, raised $4.5 million in a round led by Supernode Global.

- Sepana, a decentralized search startup, amassed $10 million in a funding round led by venture firms Hack VC and Pitango First.

- Job Protocol, a decentralized recruitment network, raised $1.5 million in funding led by Tioga Capital.

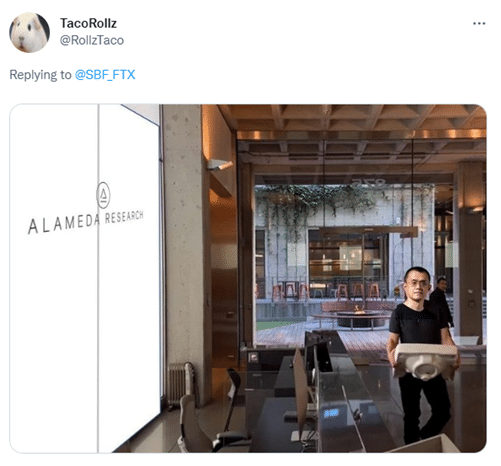

What Do You Meme?

Recommended Reads

- Tasche Che on how to time the crypto markets

- Ignas, a DeFi researcher, on 3 early stage projects

- Matt Levine on Binance and FTX

On The Pod…

Lyn Alden, founder of Lyn Alden Investment Strategy, and Udi Wertheimer, a recovering Bitcoin maxi, talk about Bitcoin Maximalism, how Bitcoin is developing, and what’s the future of Bitcoin’s security model. Show highlights:

- What the definition of Bitcoin maximalism is

- whether BTC maximalism is toxic

- whether Vitalik Buterin is still a bitcoiner and how Bitcoiners became the ‘token police’, according to Udi

- why Lyn thinks Bitcoin has been attacked by the media since the beginning

- the attacks by Bitcoin maximalists on Nic Carter and Andreas Antonopoulos

- how adoption kicked in during previous cycles and why it benefitted BTC

- what the different types of Bitcoiners are

- what developments are being made around Bitcoin

- the importance of Bitcoin being permissionless

- what the use cases for Bitcoin are and whether it’s still a highly speculative asset

- whether people care about using decentralized payment tools

- how Lyn defines ‘ultra sound money’ and why she thinks that Bitcoin is better at that than ETH

- whether Bitcoin’s security model needs to be fixed

- why being able to run a node is essential for censorship resistance

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: https://amzn.to/3CvfrbE