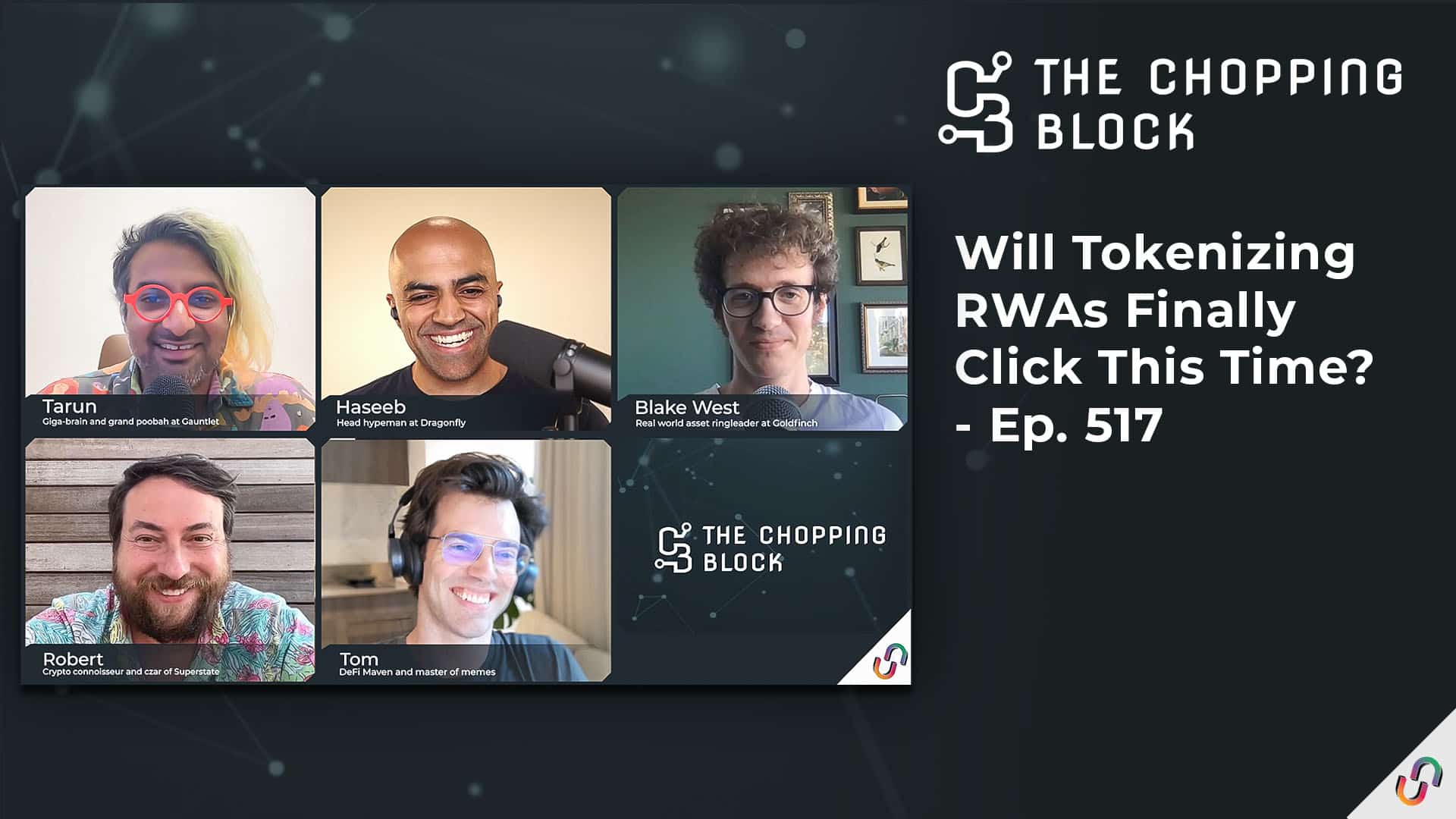

Welcome to “The Chopping Block” – where crypto insiders Haseeb Qureshi, Tom Schmidt, Tarun Chitra, and Robert Leshner chop it up about the latest crypto news. This week, the crew is joined by Goldfinch co-founder Blake West to talk about the momentum around asset tokenization. Whether it’s private credit (what Goldfinch specializes in) or U.S. Treasurys (what Robert’s new venture Superstate will tackle), real-world assets (RWAs) are en vogue among the crypto set. What’s driving this fresh interest in an old concept that has failed to take off?

Listen to the episode on Apple Podcasts, Spotify, Overcast, Podcast Addict, Pocket Casts, Stitcher, Castbox, Google Podcasts, TuneIn, Amazon Music, or on your favorite podcast platform.

Show highlights:

- how Blake got into RWAs

- why Robert launched his new company Superstate

- why Robert hates the term “real-world asset”

- why the only actual RWA in the blockchain space is the U.S. dollar, aka stablecoins

- why other non-native crypto assets have struggled to migrate onto blockchains

- how having on-chain T-bills could push demand for stablecoins

- why private credit is a good thing to bring on chain, according to Blake

- what the not-so-obvious benefits of bringing these things onto blockchains are

- whether Arkham’s model of de-anonymizing people goes against the ethos of crypto

Hosts

- Haseeb Qureshi, managing partner at Dragonfly

- Robert Leshner, founder of Compound

- Tom Schmidt, general partner at Dragonfly

- Tarun Chitra, managing partner at Robot Ventures

Guest:

- Blake West, cofounder of Goldfinch

Disclosures

Links

- Unchained:

- CoinDesk: