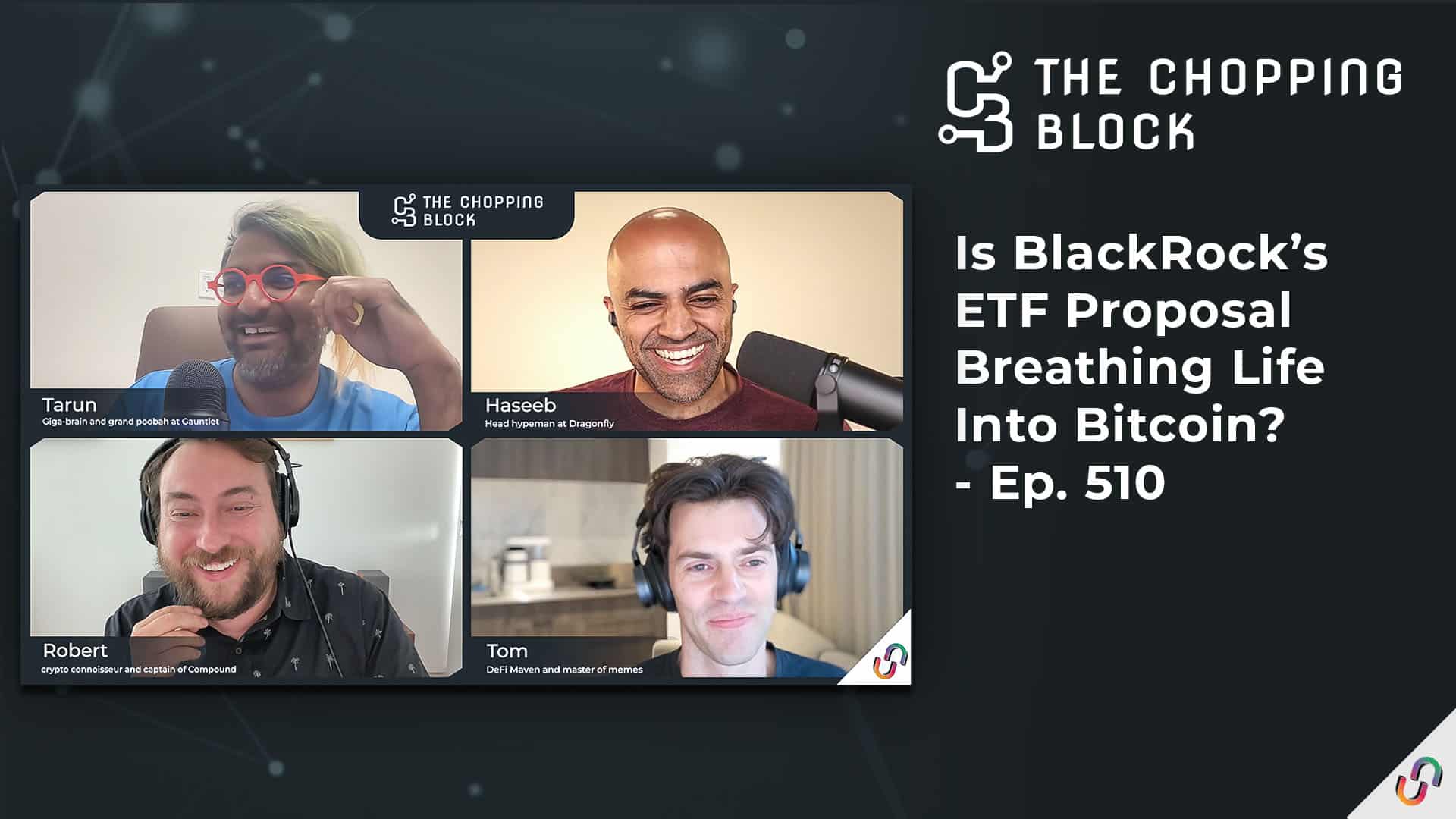

Welcome to “The Chopping Block” – where crypto insiders Haseeb Qureshi, Tom Schmidt, Tarun Chitra, and Robert Leshner chop it up about the latest crypto news. With BTC topping $30,000, the gang tackles the apparent surge in institutional bitcoin interest, with BlackRock’s spot ETF application spawning a bumper crop of similar bids. Why did all these TradFi players act at the same time? That, plus a look at the drama surrounding SEC-friendly Prometheum’s Congressional testimony and what Haseeb and Robert see as the trading platform’s many “red flags.”

Listen to the episode on Apple Podcasts, Spotify, Overcast, Podcast Addict, Pocket Casts, Stitcher, Castbox, Google Podcasts, TuneIn, Amazon Music, or on your favorite podcast platform.

Show highlights:

- the not-so logical reasons why the markets are up

- whether GBTC’s ETF conversion will also get approved if BlackRock’s bitcoin ETF gets the SEC go-ahead

- how all the applications were ready and were “waiting for some sign,” according to Robert

- whether Grayscale will have to sell the underlying assets of its GBTC trust

- why a bitcoin spot ETF is more retail-friendly than a bitcoin futures one

- how plausible it is that London becomes a leading crypto hub

- the drama around Prometheum’s testimony before Congress

- the “shady” details of Prometheum’s track record, according to Haseeb

- why Tarun says that the venture-funded exchanges have “completely failed on many different levels” and what tokens he would list

- what happened with Curve founder Michael Egorov’s loan on Aave and why Gauntlet, Tarun’s company, advocated freezing the CRV market in the lending protocol

- why the Aave community rejected the proposal

Hosts

- Haseeb Qureshi, managing partner at Dragonfly

- Robert Leshner, founder of Compound

- Tom Schmidt, general partner at Dragonfly

- Tarun Chitra, managing partner at Robot Ventures

Disclosures

Links

- Unchained:

- WSJ: Crypto Exchange Backed by Citadel Securities, Fidelity, Schwab Starts Operations

- Cointelegraph:

- CoinDesk: Andreessen Horowitz (a16z) Chooses U.K. as Destination for First Office Outside U.S.