August 11, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

- ETH trading on Coinbase surpassed BTC in Q2 2021.

- PNC, the fifth-largest bank in the US, plans to offer crypto investment services to clients.

- The Senate passed the trillion-dollar infrastructure bill with the original crypto amendment language intact.

- VanEck filed for a BTC futures ETF.

- a16z led a $100M token sale for Helium’s HNT.

- Venmo launched a credit card offering crypto rewards.

- FalconX, a cryptocurrency trading desk, announced a $210M raise at a $3.75B valuation.

- Indian crypto exchange CoinDCX raised $90M in a Series C valuing the company at $1.1B.

- Digital asset funds saw a net outflow for the fifth straight time for the week ending August 8th.

- Gemini acquired Guesser, a DeFi predictions platform.

- The SEC is demanding over 1 million Slack messages from Ripple.

What Do You Meme?

What’s Poppin’?

Two stories stood out yesterday…

Story 1: “Dear Hacker”

Poly Network, a cross-chain DeFi project, was hit with a $600M+ hack on Tuesday morning — the largest in DeFi history. Funds linked to three separate addresses were exploited, with $273M in Ethereum tokens, $252M in tokens from Binance Smart Chian, and $85M in tokens on Polygon Network, drained from the project. According to The Block’s Igor Igamberdiev, the hack was caused by a cryptography issue.

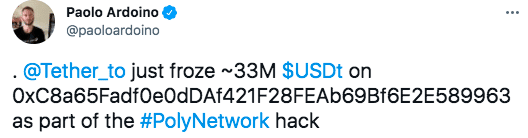

Shortly after the funds were stolen, Tether was able to freeze $33M in USDT that was part of the attack. Those tokens will no longer be able to move (thanks to the centralized nature of Tether).

In a classic crypto twist, after Tether blacklisted the hacker’s USDT, a crypto user sent a transaction to one of the addresses holding stolen funds, tipping off the hacker not to use the USDT. The hacker then transferred 13.37 ETH to the user, presumably in thanks for the information.

However, the identity of the attacker may already be known, according to blockchain security firm SlowMist. The company claims to know the attacker’s ID, email, IP information, and device fingerprint, citing information obtained from a Chinese crypto exchange as its source.

In response to the claim, the hacker sent another transaction with a message, reading “IT WOULD HAVE BEEN A BILLION HACK IF I HAD MOVED REMAINING SHITCOINS! DID I JUST SAVE THE PROJECT? NOT SO INTERESTED IN MONEY, NOW CONSIDERING RETURNING SOME TOKENS OR JUST LEAVING THEM HERE.”

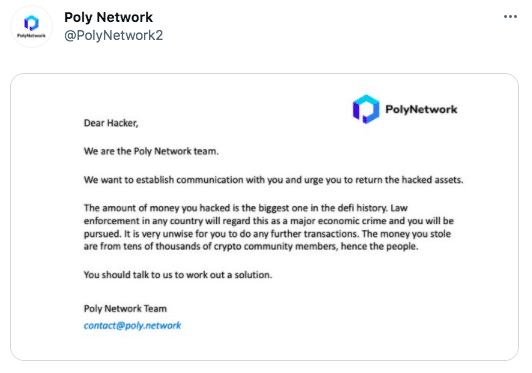

As of publishing time, it appears the Poly Network team would be willing to talk about returning the funds, posting a statement on Twitter saying the hacker “should talk to us to work out a solution.”

Story 2: BitMEX Settles

BitMEX is settling with both the United States Commodity Futures Trading Commission (CFTC) and Financial Crimes Enforcement Network (FinCEN). The cryptocurrency exchange has agreed to pay $100M to resolve charges.

The settlement concludes October 2020 charges against BitMEX from the CFTC, alleging the company illegally operated a cryptocurrency trading platform in the US and violated anti-money laundering laws.

Notably, the $100M will only settle the civil charges against BitMEX. The CFTC’s criminal case against BitMEX founders Arthur Hayes, Benjamin Delo, and Samuel Reed will continue. Arthur Hayes, former CEO and billionaire, will be tried next year.

Regarding FinCEN, BitMEX is closing the door on alleged violations of violating the Bank Secrecy Act and FinCEN’s implementing regulations. “BitMEX’s rapid growth into one of the largest futures commission merchants offering convertible virtual currency derivatives without a commensurate anti-money laundering program put the U.S. financial system at meaningful risk,” FinCEN’s Deputy Director AnnaLou Tirol said. “It is critical that platforms build in financial integrity from the start, so that financial innovation and opportunity are protected from vulnerabilities and exploitation.”

In a blog post yesterday afternoon, Alexander Höptner, Chief Executive Officer of BitMEX, expressed relief at putting a rocky era of compliance “behind” the company. He wrote:

“Today marks an important day in our company’s history, and we are very glad to put this behind us. As crypto matures and enters a new era, we too have evolved into the largest crypto derivatives platform with a fully verified user base. Comprehensive user verification, robust compliance, and anti-money laundering capabilities are not only hallmarks of our business – they are drivers of our long-term success”.

Recommended Reads

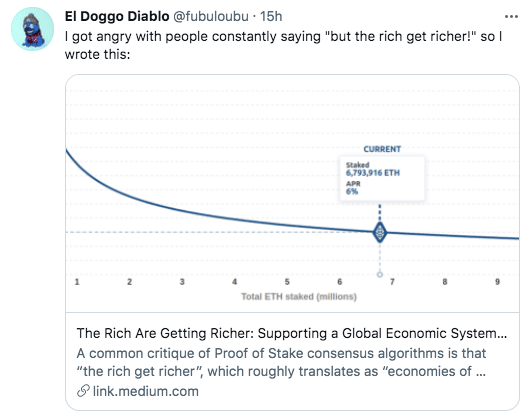

- Proof-of-stake versus proof-of-work:

- Coinbase CEO Brian Armstong’s thoughts on the infrastructure bill:

- Coin Metrics on burning ether:

On The Pod…

Is ETH on Its Way to Becoming Ultra-Sound Money? Yes, Says Justin DrakeEthereum just went through its most complex upgrade ever. Justin Drake, researcher at the Ethereum Foundation, discusses what the upgrade, aka the London hard fork, means for ether’s future as what he calls “ultra-sound money.” At the end of the episode, he also drops a few Bitcoin hot takes. Show highlights:

- his background and how he got involved in crypto

- how EIP 1559 will affect Ethereum now that it is live

- why burning ether is good for the Ethereum economy

- what two concepts are crucial to understanding money

- what three ways ether is used as money

- why he believes ether will become “ultra sound money,” when gold and silver are just “sound money”

- what the main drivers of ETH’s value are

- how the merge from proof-of-work to proof-of-stake will happen for Ethereum

- how much more efficient Justin calculates proof-of-stake will be compared to proof-of-work

- why people are saying Ethereum is going through a “triple halvening”

- what factors influence how much Ethereum is issued and burned

- how Ethereum could become deflationary

- why net sell pressure is about to decrease

- what projects are burning the most ETH now that EIP 1559 is live

- why Justin is worried about Bitcoin’s future

- what Bitcoin could do to survive once it only subsists on transaction fees

- whether Justin considers himself a bitcoiner

- how ETH as ultra-sound money is becoming a meme

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians