Bitcoin miners have been offloading their holdings of BTC in the months leading up to the upcoming halving, a different pattern of behavior compared to the 2020 halving, partly because the price of BTC, unlike in past years, has surpassed its all-time high before the four-year event.

The fourth halving, set to reduce block rewards from 6.5 BTC to 3.25 BTC, has been marked by a decrease in the amount of BTC held in the miners’ addresses, an effort to realize profit and take advantage of BTC’s high price to upgrade their fleets. The previous 2020 halving had a different trend insofar as miners were accumulating BTC.

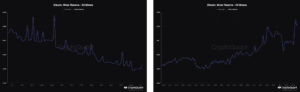

Data from blockchain analytics firm CryptoQuant shows that miners’ BTC reserves have decreased by more than $866 million worth of BTC since Jan. 1, 2024 — a stark contrast to the 2020 halving when miners accumulated roughly $429 million in the four months leading up to Bitcoin’s third halving.

Read More: Bitcoin’s Fourth Halving Is Right Around the Corner. Is It Still a Good Time to Buy?

In 2020, miners avoided selling prior to the halving because they were expecting a bull run to occur afterwards. “Blockchain analysis shows that mining pools have been holding more Bitcoin as the halving approaches. This may mean that mining pools believe the post-halving Bitcoin price surge is on its way,” wrote blockchain analytics firm Chainalysis in 2020. With BTC already surpassing its all-time high in 2024, miners offloading some of their minted BTC is possibly a sign they are comfortable with realizing profits.

The chart on the left shows the amount of BTC held in miners’ wallets in 2024 and the chart on the right displays miners’ holdings of BTC in 2020. (CryptoQuant)

Staying Competitive

Some bitcoin miners have decided to offload some of their holdings this year to upgrade their fleet of machines to “stay competitive” and “ahead of the curve” for the moment block rewards get cut, said Colin Harper, Head of Content and Research at Bitcoin mining firm Luxor, in a conversation with Unchained.

For example, mining firm Marathon Digital Holdings announced on Mar. 5, 2024 that it had sold 290 bitcoins in February, worth about $19.1 million at today’s prices. Marathon “still intends to sell a portion of its bitcoin holdings in future periods to support monthly operations,” its press release stated. “In anticipation of the next Bitcoin network halving, the Company continues to build liquidity on the balance sheet to capitalize on strategic opportunities.”

Read More: Bitcoin Miners See Record $2 Billion in Monthly Revenue

Riot Platforms disclosed on Feb. 5, 2024 that it had offloaded 211 bitcoins in January. A few weeks later, Riot announced the purchase of 31,500 WhatsMiner M60S miners from MicroBT for $97.4 million.

The Effect on Hashrate

Based on how BTC reached an all-time high this year before Bitcoin’s code executes the block reward decrease for miners securing and validating the network, Harper predicts that a key difference between the upcoming halving and previous halvings will be the amount of hashrate that will go offline after block rewards are cut.

“Bitcoin’s price hitting an all-time high before the halving changed the equation for the hashrate that will come offline,” Harper added. Since miners are generating more income in dollar value from the price appreciation of BTC pushing past $69,000, they are operating at higher profit margins in this cycle, which gives them more room to operate when block rewards are cut in half.

Read More: Who Is Buying Into Spot Bitcoin ETFs? We’ll Soon Start to Get an Idea

For Harper, this means that fewer firms will be forced to discontinue their operations and that a smaller percentage of overall hashrate will go offline following this year’s halving, compared to previous cycles. Bitcoin’s network hashrate the day before its 2020 halving stood at 114 exahashes per second (EH/s), but dropped 18.4% to 93 EH/s by the following week, according to Luxor Mining’s Hashrate Index data. For 2024, “we’re estimating anywhere from only 3% to 7% [of hashrate] will come offline,” said Harper.

The price of BTC has decreased 5.6% in the past seven days to trade at $66,121 at presstime, data from CoinGecko.