His nickname? ‘Baby Al Capone’

This was an interesting week in crypto, where a number of large companies had news, but some of the real action was taking place in some of the smaller corners of the space. Read on to get the skinny on the Steem wars and the Aragon/Autark dispute.

Meanwhile, on the pods, listen to my panel from the Ready Layer One conference, in which we got into a debate on whether or not Bitcoin or Ethereum are direct competitors. Plus on Unconfirmed, we learn about the Patoshi pattern, which was discovered in 2013, and why it became relevant again in recent weeks.

This Week’s Crypto News…

When It Comes to Bitcoin, Goldman Sachs Is UnimpressedA Goldman Sachs analysts call on COVID-19 and Bitcoin got everyone excited — until the actual call occurred, and it was clear that Goldman thinks little of the first cryptocurrency. The slides from the call sum up the firm’s perspective pretty well. One subheadline says, “Cryptocurrencies Including Bitcoin Are Not an Asset Class.” The bullet points were:

- Do Not Generate Cash Flow Like Bonds

- Do Not Generate any Earnings Through Exposure to Global Economic Growth

- Do Not Provide Consistent Diversification Benefits Given Their Unstable Correlations

- Do Not Dampen Volatility Given Historical Volatility of 76%

- On March 12, 2020, the price of Bitcoin fell 37% in one day

- Do Not Show Evidence of Hedging Inflation

It continued, “We believe that a security whose appreciation is primarily dependent on whether someone else is willing to pay a higher price for it is not a suitable investment for our clients.

We also believe that while hedge funds may find trading cryptocurrencies appealing because of their high volatility, that allure does not constitute a viable investment rationale.”

The following slides can be summarized in three phrases: “criminal money,” “hacks” and “tulips.”

Fortune had a fun recap of the Crypto Twitter reaction, including this gem from Neeraj Agrawal of Coin Center.

Although Goldman didn’t evaluate Bitcoin on its actual features, the fact that the analysts felt the need to cover it at all suggests there’s interest from clients.

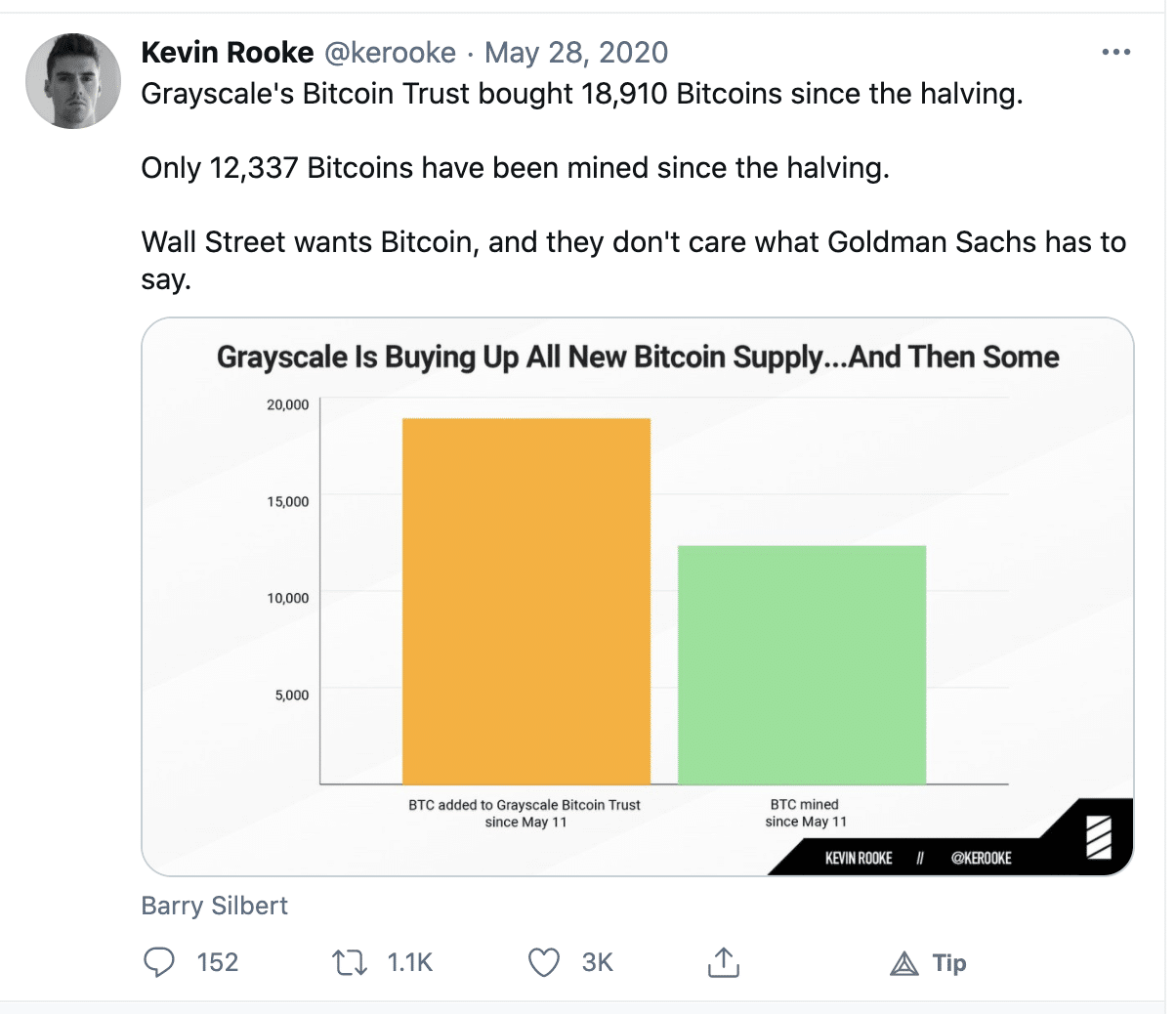

As Kevin Rooke tweeted:

Coinbase Acquiring Prime Broker Tagomi in a $70+ Million Deal

First reported by The Block last fall, crypto unicorn Coinbase is acquiring prime broker Tagomi, which helps clients execute large trades at the best possible price. The deal is pending regulatory approval. The Block also reports that Tagomi was also in talks with Binance and that two sources indicate the price tag was somewhere between $70 million and $100 million. In an interview with CoinDesk, COO Marc Bhargava said that the acquisition would not pose a conflict of interest. He said, “We think we will still be able to deliver really great pricing to our clients. Obviously, we will still have market maker relationships. Over time, we’ll disclose which exchanges we continue to work with.” ICYMI, be sure Listen to the Unchained interview with Tagomi.

Calibra Renames to Novi

Facebook’s Calibra has a new name, Novi. Head of Novi David Marcus tweeted, “Novi comes from the combination of two Latin words, novus = new, and via = way.” Novi will also be interoperable with Whatsapp and Facebook Messenger.

Polkadot Launches Its First Chain Candidate

Polkadot launches what is its first candidate for the Polkadot main net. As founder Gavin Wood wrote in a blog post, Polkadot hopes that it is eventually selected as the final Polkadot chain. He also explained that Polkadot had not actually launched and its token is not yet transferable. That would happen only toward the end of the launch process and under a governance motion. He also said the final stage is to bring in parachains, “once the various security logic is in place and has been audited, and is still some weeks away.”

Steem Forks and Wars Put Binance, Other Exchanges in a Bind

Steem underwent a fork that made the asset balances of certain users go to zero. The addresses targeted were owned by 64 people who did not support the acquisition of Steemit by Tron and Justin Sun. In an official statement, Binance cofounder and CEO Changpeng Zhao said, “We are very much against zeroing other people’s assets on the blockchain. This goes against the very ethos of blockchain and decentralization. The fact that this can happen on a blockchain means it is overly centralized. We don’t want to support this upgrade. But there is a flip side. If we don’t support it (technically), no users can withdraw any STEEM coins. The wallet stopped syncing at a certain height, and there are no other forks. We waited to see what other exchanges would do. And soon enough, other exchanges did the upgrade and enabled withdrawals. Lots of our users demand it as well.” This was his explanation for why Binance supported the fork. He went on to practically advocate that the targeted users create a new fork and said that Binance would likely support “any other reasonable community forks.”

Andreas Antonopoulos tweeted that he expected that the hard fork would result in a class-action lawsuit and that any exchanges that participated could be named defendants. CZ said he was surprised to see Andreas bringing up lawsuits on issues around hard forks, consensus and decentralization.

Blocktower Capital’s Ari Paul called the drama with Steem “probably the most important thing happening in crypto now. It’s an amazing experiment in crypto M&A, adversarial strategy and the legal/social repercussions of ‘stealing’ via hard fork, forcing tough discussions across many large exchanges. … What this drama really shows is that the arbiters of reality in a practical sense are likely to remain ‘economically important nodes’ (I.e. mostly centralized exchanges) for the foreseeable future.”

Aragon Association Sues Grantee Autark

On May 22, both Autark and the Aragon Association published competing blog posts that read like a “he said, she said: DAO edition.” Autark received two grants voted on by Aragon Network Token holders, and the Aragon Association paid for all of the first grant and then for some of the second grant. In January, the Aragon Association stopped payments, which Autark says was, “for no reason.” Autark also claims that even though the community approved the grant, Aragon cofounders Luis Cuende and Jorge Izquierdo, stopped the payments themselves. In contrast, Aragon says that it did not continue funding Autark “due to breach of the grant agreement.”

Aragon also says that it became aware that Autark was working on other projects “using the Association’s funding that were not in benefit to the Aragon community at all,” and that Autark also threatened Aragon, underperformed, lacked quality in its code and breached confidentiality.

The Aragon Association is now suing Autark in Swiss court, which is ironic because Aragon’s main focus is governance and it has a court for resolving disputes. Of course prominent Ethereum players like Eva Beylin asked why Aragon wasn’t using its own court. She tweeted, “if you can’t use your own dispute resolution platform for community challenges prior to seeking legal action, then you’re basically a fraud.” Luis’s defense was, “Aragon Court handles on-chain cases for DAOs. Legal agreements made by lawyers in accordance to Swiss law should be disputed in Swiss courts, the same way that an Aragon Agreement should be disputed in Aragon Court.”

Maria Paul summed it up this way, “Regardless of who’s right on the Aragon/Autark dispute, this is a very interesting case and shows the limitations of DAOs. It shows we’re not ready to base everything on-chain and I hope more people understand the need for hybrid solutions (DAOs+ real life legal entities).”

In case you missed it, here is the Unchained interview with Luis Cuende of Aragon.

Dangers for Bitcoin in Custodial Banking

Independent crypto researcher Hasu wrote an interesting essay on the Deribit blog this week. The basic premise is that since the Bitcoin block size is limited, the incentive is for users to use custodial banks, because “they offer lower transaction cost over a variety of dimensions. These can include stronger network effect, faster payment clearing, legal recourse, lower transaction fees, or access to financial services like exchange or money markets.” He advocates for things like “pioneer[ing] ways for multiple users to share a single UTXO, so they can also bundle their interest and survive in the on-chain marketplace for blockspace with custodial banks.”

DevCon VI to Be Held in Bogota — in 2021

The Ethereum Foundation announced that it would decentralize a series of community, regional or virtual events for 2020, but stay focused on delivering a DevCon VI in Bogota, Colombia in 2021.

The excellent team at Coin Metrics is celebrating its first year and created a year-in-review of highlights. Since I know many of you are nerds who enjoy good analyses of data, I figured I’d let you know about it if you want to peruse some of the posts on your own, in addition to the ones that have been featured here on Unchained and Unconfirmed!

How This 15-Year-Old Stole $23.8 Million in CryptocurrencyIn January 2018, at the height of the crypto bubble, crypto OG Michael Terpin of BitAngels had his cryptocurrency account hacked, and $24 million was whisked away. In a recent lawsuit, Terpin alleges that Ellis Pinsky was the thief; he was 15 at the time of the theft. The New York Post describes Pinsky as a 10th-grader who ran track, played soccer and got good grades. It also says his mother is a physician at NYU Langone. However, he did at that time, write to an acquaintance, “I could buy you and all your family. I have 100 million dollars,” and the complaint alleges that an accomplice saw, in December 2017, “records indicating that Ellis had $70 million.” In case you were wondering what method Pinsky allegedly used to carry off his heists? A SIM swap. Read the full Post article for details on how he and his alleged collaborators carried out these thefts, and for details on how he lived the high life by doing things like keeping an account at the private jet company JetSmarter. The kicker? After Terpin’s lawyer contacted Pinsky’s mother at her office, Pinsky sent cryptocurrency, cash and a Patek Philippe Nautilus watch, worth over $100,000, to Terpin without any conditions. Still, Terpin is suing the kid that he’s nicknamed ‘Baby Al Capone’ for $71.4 million.