June 14, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Bitcoin’s Taproot has locked in; protocol upgrade now set to activate in November.

-

Tesla to resume taking BTC payments once miners use 50% “clean energy.”

-

A New York cryptocurrency mining bill failed to pass but will be revisited in Jan. 2022.

-

State Street announced a new crypto and digital asset business unit.

-

Members of Congress’s Blockchain Caucus are calling for clearer tax policy for crypto donations.

-

Block.one to pay $27.5M settlement over its $4B ICO for EOS.

-

An Indian law enforcement agency has alleged that WazirX, a crypto exchange, violated FEMA rules.

- Hut 8, a crypto mining company, to begin trading on Nasdaq this week.

What Do You Meme?

What’s Poppin’?

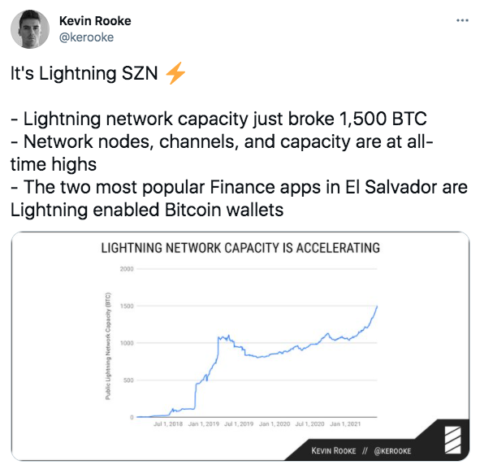

Bitcoin’s Lightning Network might be having a moment. Back in April, the Lightning Network hit 10,000 operating nodes for the first time, nearly doubling within a year. Since then, the network has steadily grown, even while Bitcoin — and crypto in general — has struggled through the doldrums of May and June.

For those readers who have yet to be introduced, the Lightning Network is a layer 2 solution built on top of the Bitcoin protocol intended to enable cheaper and quicker transactions. Put simply, the Lightning Network allows users to bundle small transactions outside of the main Bitcoin network before broadcasting the net, or final transaction, to the main blockchain (watch this video courtesy of Andreas Antonopoulos for a better explanation).

Over the past 30 days, Bitcoin’s layer 2 solution has seen growth in three major statistics:

- Number of nodes → 11,861 (+5.25%)

- Number of channels → 45,257 (+9.2%)

- Network capacity → 1,467 BTC (15%)

Zoom out even further, and the growth becomes even more substantial. As of June 11, 2020, there were only 5,916 nodes with channels and the cumulative network capacity, which is the amount of BTC locked into Lightning channels, sat at 936 BTC. (all stats courtesy of Bitcoin Visuals and 1ML)

According to Coinsquare’s Kevin Rooke, part of the excitement around Lightning Network could stem from El Salvador. On Twitter, he pointed out that two of the most popular finance apps in El Salvador are Lightning-enabled Bitcoin wallets:

El Salvador, of course, made history last week by becoming the first country to deem Bitcoin legal tender. At Bitcoin 2021 in Miami, when El Salvador’s BTC plan was initially unveiled, Jack Mallers, founder of Strike, a Lightning Network payment app, introduced President Bukele to the audience, calling the occasion “the shot heard ‘round the world for Bitcoin.” President Bukele himself emphasized the need for Bitcoin — and Lightning — stating that global remittances account for 20% of El Salvador’s GDP, demonstrating a powerful use case for BTC and Lightning to save the citizens and businesses of El Salvador “hundreds of millions of dollars a year.”

Maller’s company, Strike, launched in El Salvador back in March and is currently ranked #1 in finance applications within the country.

Additionally, over the weekend, Twitter CEO Jack Dorsey hinted at a possible integration with the Lightning Network. In reply to a tweet asking for Sphinx Chat, a Lightning Network powered chat app, to be built into Twitter, Dorsey typed out: “it is only a matter of time.”

Recommended Reads

- (3 min) Here is an excellent thread on crypto security best practices courtesy of Bobby Ong, co-founder and COO of Coin Gecko:

- (30 min+) Still not sure what Taproot is? Check out this thread for all things Schnorr, MAST, and Speedy Trial:

- (5 min) The Harvard Law Blockchain and FinTech Initiative posted its final draft of the DeFi Education Fund Proposal

On The Pod…

Want Crypto in Your 401(k)? It’s Finally Possible — With This Provider

ForUsAll recently announced a new product that will allow cryptocurrency investments to be made inside 401(k) retirement accounts. Jeff Schulte, CEO of ForUsAll, discusses why putting crypto in a 401(k) is such a game changer, how this differs from Bitcoin IRAs, and more! Show highlights:

-

how bringing crypto into a 401(k) with ForUsAll will work

-

what “guardrails” ForUsAll is placing on investors who choose to invest in crypto

-

the tax advantages of purchasing crypto within a 401(k)

-

whether ForUsAll is offering a Roth IRA

-

why nobody has offered crypto within a 401(k) before now

-

what differentiates a crypto 401(k) from a self-directed IRA

-

what are the fees for the 401(k), who it will be available to, and when it will launch

-

how security and keys are being handled

-

why ForUsAll is not offering every token available on Coinbase

-

how ForUsAll is determining which cryptos will be available to trade

-

why offering crypto ETFs through a 401(k) may cause problems regarding the fiduciary risk of employers

-

what new crypto features ForUsAll is excited to roll out

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians