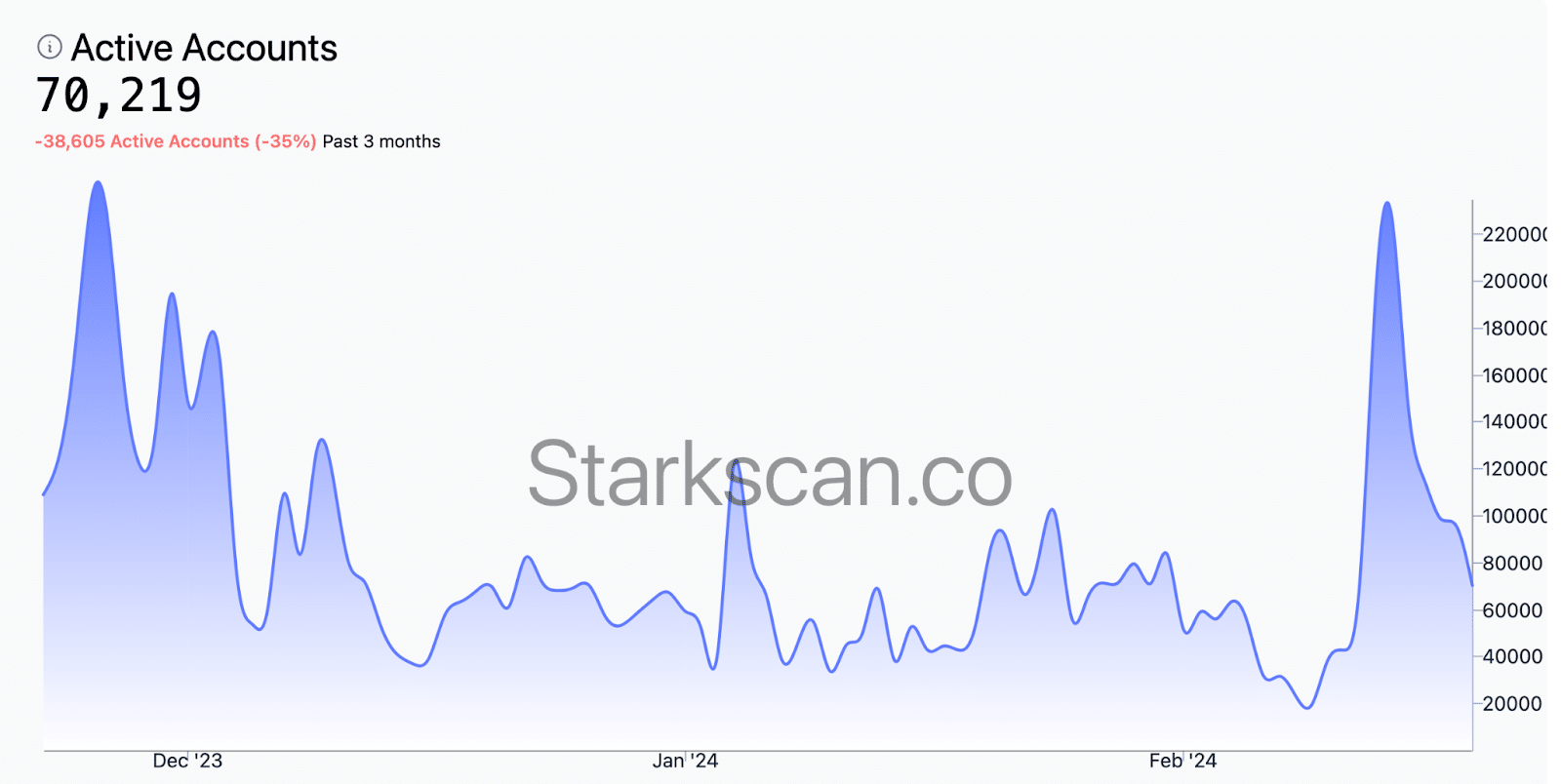

Following the Starknet airdrop announcement, active addresses on the network have settled back to their normal levels. The initial surge to 226,576 addresses on Feb. 14 was a direct response to the airdrop news, reflecting a temporary spike in user interest. However, this figure was not indicative of the network’s usual activity. By Feb. 19, the number of active addresses on Starknet had adjusted to 70,219, aligning with the average observed over the past three months. This return to normalcy comes after a period of heightened activity and places the current user engagement in a more consistent historical context.

While Starknet’s active addresses have reverted to average levels post-airdrop announcement, a broader perspective reveals a downtrend in user engagement. Historically, Starknet had maintained over 100,000 active users from August to December 2023, a benchmark higher than current figures.

Read More: What Is a Crypto Airdrop? A Beginner’s Guide

The dissatisfaction within the Starknet community, leading to the decline in active addresses, can be partly attributed to specific instances where active members were excluded from the airdrop due to not meeting the 0.005 ETH wallet minimum criteria on Nov. 15, 2023.

For example, as reported by Unchained, a user named “Umaykut” in Starknet’s Discord expressed frustration for being ineligible despite adding substantial transactions and liquidity on the network. “I added 100 [transactions] and all my money to Ekubo as liquidity. I left $3-5 ETH because I added it all as liquidity. I was eliminated from this criterion,” said “Umaykut.”

Similarly, “Gabrielwillian” voiced disappointment for being excluded after 10 months of active transactions, as his wallet did not meet the ETH threshold on the snapshot day. These cases somewhat highlight the community’s sense of exclusion and unfairness in the airdrop process.

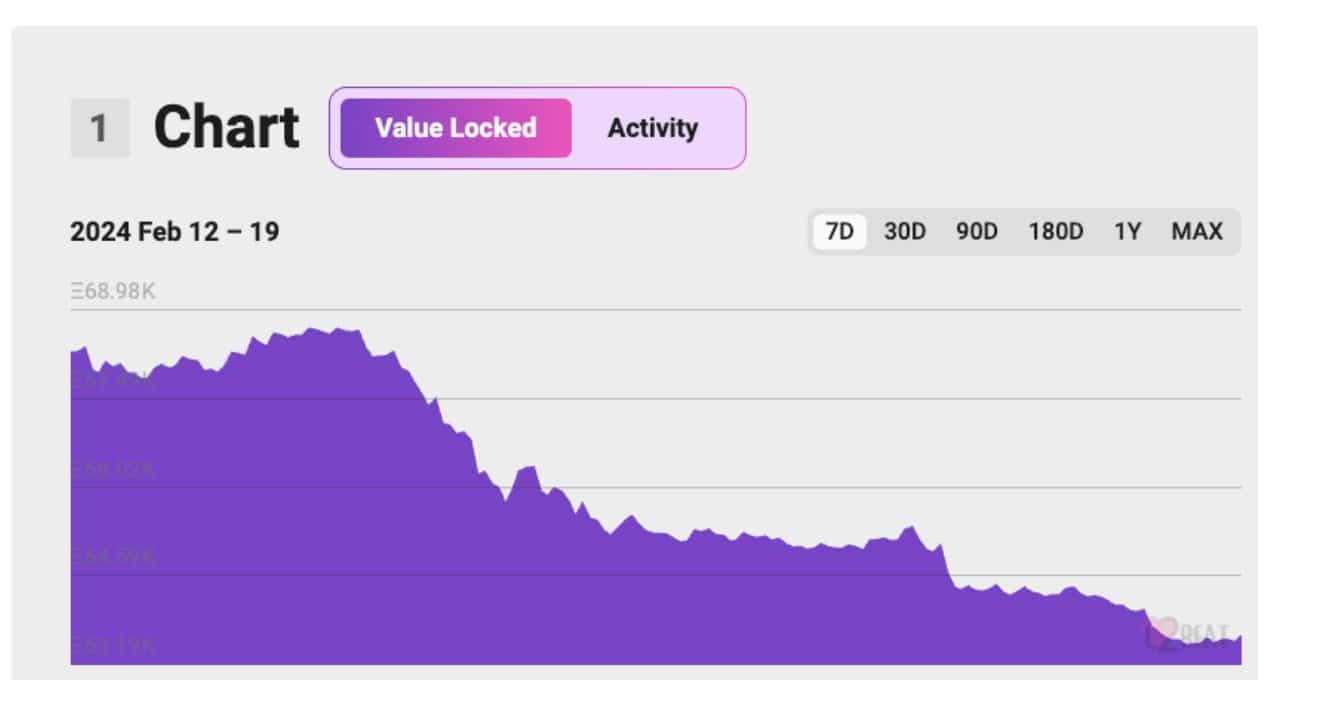

To add more context, data from L2BEAT shows Starknet’s TVL at 68,640 ETH on Feb. 14; at the time of writing, it is down to 63,580 ETH, which at today’s prices equates to approximately $14.5 million. In addition, Starknet is the 11th-largest scaling solution for Ethereum, with a market share of only 0.69%.

The backlash was further fueled by the distribution of a large portion of the STRK tokens to Ethereum solo stakers, a decision that some community members regarded as favoring wealthier and more technically capable individuals. StarkWare Co-Founder and CEO Eli Ben-Sasson’s response in the latest episode of the Unchained podcast, highlighting the challenges and intentions behind the airdrop criteria, didn’t come close to alleviating these concerns. “Whether it should be 22% or something a little bit lower, a little bit higher, I guess you have to make some call that is arbitrary,” he said.

Adding to the previous discussion, Ben-Sasson addressed the criticism regarding the short lockup period for STRK tokens for the team and investors, stating, “it may be non-standard, but it’s not about alignment.” He elaborated that this decision was influenced by early plans for governance and payment utility in the token, rather than a lack of commitment to the project’s long-term success. This statement, however, has not fully quelled the community’s concerns about the perceived misalignment of interests.

However, this reduction in active addresses isn’t solely negative. Part of this decline could be attributed to the departure of airdrop hunters, who are often viewed as parasitic users within the crypto community. Their departure, while impacting the numbers, might cleanse the ecosystem, potentially leading to a more dedicated and genuine user base. This perspective suggests a silver lining, proposing that the current situation could pave the way for a more sustainable and engaged community, aligned with Starknet’s long-term vision.

Additionally, on Monday, the Starknet Foundation announced that its committee for decentralized finance (DeFi) will distribute 40 million STRK tokens to DeFi protocols native, potentially as a way to address the criticisms.

What Is Starknet?

Starknet is a Layer 2 scaling solution for Ethereum, designed to enhance transaction throughput and efficiency while reducing costs. It employs advanced cryptographic techniques, notably zero-knowledge proofs, to enable high-scalability without compromising Ethereum’s security. Starknet operates as a decentralized, permissionless network, allowing developers to build scalable decentralized applications (dApps) with more efficiency and lower gas fees compared to the Ethereum mainnet.

Read more: What Are Zero-Knowledge Proofs?

UPDATE: Feb. 19, 3:00 pm EST: This article has been updated to provide a more comprehensive context of Starknet’s active address data. The previous headline referenced a 71% drop in active addresses, a figure that was measured against an atypical spike in user activity following the airdrop announcement. The current analysis reflects a longer-term view of Starknet’s user engagement trends.