Since last Tuesday, July 23, when spot ether exchange-traded funds (ETFs) started trading, the pace of ETH being staked has accelerated, propelling the total to a record high and helping to bolster Ethereum’s economic security.

The amount of ETH committed to securing Ethereum has crossed the 34 million mark, increasing by 407,346 tokens, worth about $1.3 billion at current market prices, since the trading debut of spot ETH ETFs, according to a Dune Analytics dashboard created by Hildobby.

The growth of staked ETH heightens the competitive dynamics among validators in being selected to add a new block to the Ethereum blockchain, reducing the likelihood of successful attacks on the network by malicious actors.

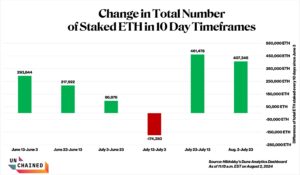

Specifically, the rate at which crypto users were staking ETH climbed by more than 405,000 ETH ten days prior and ten days after the launch of spot ETH ETFs. In comparison, between June 3 and July 13, the change in staked ETH for each 10-day period on average leapt by 108,598 ETH, a notably smaller change than the periods surrounding the ETH ETF approval.

The launch of the ETFs is likely to push the price of ETH up, as it did for bitcoin, however the ETFs themselves do not offer yield, the way that staking ether does. Recent stakers may be availing themselves of the opportunity to enjoy the value of their ETH rising while also making extra interest on top.

Read More: Ethereum ETFs Likely Protect Ether From the SEC. But What About Staked ETH?

“For many, the ETF legitimizes Ethereum as a strong investment opportunity for traditional funds,” Richard Bagshaw, the head of marketing for blockchain validator firm P2P.org, wrote to Unchained over Telegram. Second, the additional return for staked ETH plus the price impact of the launch of the ETFs makes staking “one of the strongest/most attractive investment opportunities,” Bagshaw added.

The increase in staked ETH comes as spot ETH ETFs, due to the ETH that had already been invested in Grayscale’s Ethereum Trust (ETHE) since 2017, have seen more outflows than inflows since their trading debut, according to market data curated by Hildobby and financial research platform SoSoValue.

Grayscale’s ETHE, which converted to an ETF, has the largest fee—2.5%—and is driving the outflows. Each of the other ETFs has seen positive net inflows since last Tuesday with BlackRock’s ETHA, Fidelity’s FETH, and Bitwise’s ETHW leading the pack.

“The opportunity for better rates in new ETFs, as opposed to Grayscale, where many outflows are coming from, highlights a market shift. The main point here is, there is still strong demand for these financial products,” wrote Bagshaw.

In addition to Grayscale’s massive ETF fee, another reason why investors may be rotating out of ETHE stems from the wider macro uncertainty and the “opportunity cost of not having staking as part of the package,” wrote a spokesperson for blockchain analytics firm Nansen to Unchained over Telegram. Before the US Securities and Exchange Commission approved spot ETH ETFs, issuers who had initially wanted to offer yield on their ETFs removed that feature, seemingly for the SEC, cutting their investors off from the possibility of yields that can be earned from staking.

One element of the broader macro uncertainty revolves around the US presidential election, which could create a more positive regulatory environment for crypto (and related ETFs) in the world’s largest economy. Just a few weeks ago, prediction markets platform Polymarket showed a 72% probability that Donald Trump would become the next US president following his assassination attempt, but since incumbent president Joe Biden dropped out of the 2024 race, on Polymarket, Trump’s chances have dropped 18 percentage points to 54% at presstime.

However, Bagshaw expects to see staking eventually get included with US-based ETFs, citing the Financial Innovation Technology for the 21st Century Act, a bill that passed in the House and aims to classify ETH as commodities, as additive pressure for the SEC to adapt.

The price of ETH has dropped nearly 13% from around $3,463 on July 23 when ETH ETFs started trading to $3,025 at presstime, giving it a $363.6 billion market cap, per CoinGecko.