August 30, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

- Avanti, a Wyoming-based digital bank, applied to become to Federal Reserve Member Bank, granting it access to the Fed’s payment system.

- According to SEC filings, Morgan Stanley holds approximately $240M worth of GBTC, and Bill Miller’s Opportunity Trust owns roughly $44M worth of GBTC.

- Crypto advocates are hopeful of revising the infrastructure bill’s controversial language regarding cryptocurrency through other legislative vehicles.

- Ethereum faced a chain split last week due to node operators not upgrading Geth (Ethereum is currently running normally).

- Cuba will recognize and regulate cryptocurrencies for payment.

- The SEC signed a one-year, $125,000 deal with blockchain analytics firm AnChain.AI to help monitor DeFi and regulate DeFi.

What Do You Meme?

What’s Poppin’?

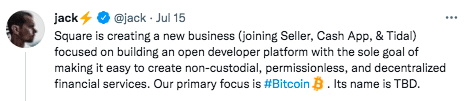

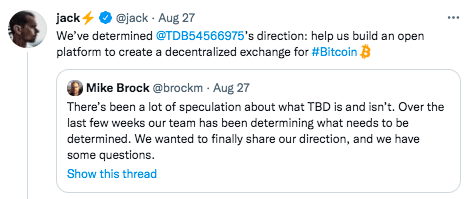

Jack Dorsey + Bitcoin + DeFi = TBD

Last month, Twitter and Square CEO Jack Dorsey left the Bitcoin community with quite a cliffhanger, teasing the launch of a new, BTC-focused company titled “TBD.”

Well, according to Dorsey and Mike Brock, the CashApp exec leading TBD, the company’s plans are no longer vague. TBD knows the problem it’s trying to solve: the project plans to build a Bitcoin-native decentralized exchange, where users can trade fiat for BTC without relying on a centralized third party.

In a tweet thread, Brock describes TBD’s purpose as such: “make it easy to fund a non-custodial wallet anywhere in the world through a platform to build on- and off-ramps into Bitcoin. You can think about this as a decentralized exchange for fiat.”

He thinks TBD is a missing piece for the crypto industry, citing Bitcoin’s reliance on centralized intermediaries and custodians.

“We believe Bitcoin will be the native currency of the internet. While there are many projects to help make the internet more decentralized, our focus is solely on a sound global monetary system for all. But including all requires a few pieces we think are missing,” Brock explains. “Getting bitcoin today typically involves exchanging fiat at a centralized and custodial service like Cash App or Coinbase. These on- and off-ramps to Bitcoin have a number of issues, and aren’t distributed evenly around the world.”

For now, the exact specifications of TBD are not finalized. The project will be completely open-sourced, without a foundation or governance model. According to Brock, “it’s permissionless or bust.” TBD plans to bring the ethos of decentralization to fiat trades, a feat yet to be accomplished in the crypto industry.

Pulling this off will require a new tech stack for Bitcoin. Unlike Ethereum, Solana, or Binance Smart Chain, Bitcoin is not natively built to handle smart contracts and DeFi. Brock mentioned Rootstock, a smart-contract Bitcoin sidechain, as a possible option for building out the BTC DEX. However, he noted, “the gaps needed to build this may be too large, which would also have us consider other chains as a bridge.”

NFT Corner: Everyone in the know, knows…

- Bored Ape Yacht Club (BAYC) had quite a weekend.

- They launched a new set of 10,000 mutant apes over the weekend, bringing in roughly $100M in 45 minutes.

- NBA superstar Steph Curry purchased a BAYC NFT for $180K.

- BAYC’s price floor, at publishing time, sits at $48K — up from $12K to start the month.

- OpenSea’s August is one for the record books.

- OpenSea sales accounted for 97% ($2.23B) of the entire NFT industry’s volume this month (The Block)

- OpenSea customers sold 1.4M NFTs in August, more than 3X the previous ATH (Richard Chen)

- NFT whales appear to be obsessed with the number 8. Why? Well, Decrypt’s Ekin Denc thinks it could have something to do with increasing Chinese interest in NFTs

- CryptoPunk #8888 sold for 888.8 ETH

- An EtherRock sold for 888 ETH

- 64 CryptoPunks are listed for 888 ETH

Recommended Reads

- Optimism’s Kelvin Fichter on Ethereum’s unplanned fork:

- Here are a few tips on buying your first NFT:

- According to research from Nansen, the NFT economy is healthy:

On The Pod…

How Another NFT Trend, .eth Names, Has Attracted the Likes of Budweiser

Nick Johnson, lead developer at the Ethereum Name Service (ENS), talks about making Ethereum human-readable, why Budweiser purchased an NFT, how purchasing an ENS works, and more. Show highlights:

-

what ENS does and why it is important

-

why Budweiser bought “beer.eth”

-

how ENS names can be used to make Ethereum easier to use

-

what business use cases ENS names make possible

-

what made Nick want to create a naming service on Ethereum

-

how people are using their ENS names

-

why people are purchasing ENS names

-

what privacy issues arise from people attaching their name to an ETH address

-

what happens when Ethereum addresses get spammed with unwanted tokens

-

how to buy an ENS name and how much it costs

-

how ENS handles squatters

-

what happens when you lose access to an address holding an ENS name

-

how ENS is integrating normal domains (ex: “.com”) to Ethereum

-

what ENS has planned for L2 launches

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians