Pressures on the Solana blockchain caused by a dramatic rise in the number of memecoin presales have drawn comparisons with the 2017 ICO craze that took Ethereum by storm.

As crypto markets have boomed in early 2024, tokens inspired by memes — frequently meme-friendly animals such as dogs, cats, frogs and sloths — have gained a large chunk of crypto investors’ mindshare. However, some traders have begun launching memecoins on Solana to such an extent that the network is facing challenges in performance.

As a result, some have noted how the current atmosphere and Solana’s struggles amid heightened activity closely resemble Ethereum in 2017 when initial coin offerings were all the rage and Ethereum became clogged up with congestion issues.

What Solana ecosystem is experiencing now is extremely similar to what Ethereum went through during the 2017 ICO bubble.

There is massive demand for SOL to speculate on new asset issuance on Solana

Study Ethereum ICO bubble during 2017/2018

— Arthur (@Arthur_0x) March 16, 2024

Chris Eberle, who worked in sales and marketing at Facebook until 2017 and is now an angel investor and DAO contributor, said the comparison between Solana in 2024 and Ethereum in 2017 is “totally valid.”

Similarities to ICO Boom

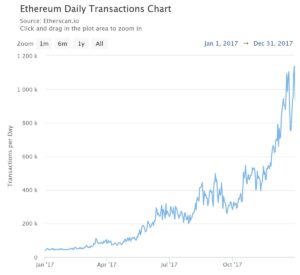

The Ethereum ICO craze in 2017 tested the network’s capacity to handle congestion. During the year, Ethereum’s daily transactions surged from 38,730 on Jan. 1 to 946,981 by the end of the year, a 24x increase, according to Etherscan.

In 2017, startup SophiaTX delayed its planned ICO by 48 hours to ensure a smoother token launch. At the time, CryptoKitties, a decentralized application where users could breed and trade digital kittens, had clogged the Ethereum network because of the number of transactions on the dapp.

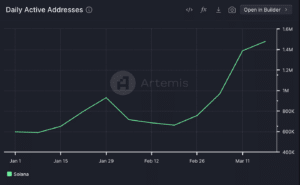

Many now see a similar situation unfolding. The number of daily active addresses on Solana has more than doubled from around 600,000 on Jan. 1, 2024 to more than 1.4 million on March 18.

Some Solana-based memecoin projects that have already conducted presales, including SMOLE and MOONKE, have delayed their token roll outs as a result of Solana’s congestion. “To keep everything fully transparent, with the current congestion of the Solana network we are going to bullishly delay our launch,” the MOONKE team wrote on X Tuesday.

Testing Performance

“The Solana network has been experiencing extremely high usage which has tested components of the network — specifically the implementation of priority fees and the transaction scheduler, both of which play important roles in block optimization,” the Solana Foundation wrote in a blog post on March 15.

Tom Wan, who works in strategy and business development at the parent company of crypto asset manager 21Shares, noted on X that the percentage of failed transactions on Solana has recently increased to 72%, although a large majority of these appear to be related to bots that are spamming the network because of the new token opportunities.

Read More: Solana at 4, Memecoins Help Drive Network to All-Time High in Market Cap Post FTX Collapse

Mert Mumtaz, the CEO of the Solana-based developer firm, Helius, also indicated that Solana is facing challenges in performance from all this memecoin activity. In a private message to Unchained on X, he acknowledged the presence of bugs and said that improvements are “coming soon” to address Solana’s challenges. Despite this, Mumtaz highlighted Solana’s performance compared to Ethereum’s rollups, noting that “We’re able to do about 20x more TPS [transactions per second] than all [Ethereum] rollups combined currently (so roughly 2,000 tps).”

Qiao Wang, founding partner of crypto accelerator AllianceDAO, wrote on X this week that “Solana right at this moment is similar to the Ethereum 2017 ICO era.” He cited the demand among Solana users to trade memecoins and “an increasing demand for SOL to participate in those imos (initial meme offerings).”

Angel investor Eberle noted that one similarity is how businesses aiding the launch of memecoins are mirroring firms that facilitated ICOs back in 2017. “It’s getting a bunch of people excited to speculate to try to get rich quick, again. We’re seeing businesses pop up in support of the memecoin ecosystem just like we saw the ‘ICO experts’ pop up back then,” Eberle wrote in a Telegram message to Unchained.

Read More: Crypto Enthusiasts Raise Nearly $690,000 to Put Dogwifhat Meme on Las Vegas Sphere

One such ICO business in 2017 was Ambisafe, a company that was founded in 2015 to help people and institutions with fundraising and capital management. In the same vein, Blockchain App Factory is now providing services to support people and entities rolling out new memecoins on the Solana blockchain.

Solving Problems Versus Producing Speculative Riches

While both memecoins on Solana in 2024 and ICOs on Ethereum in 2017 have attracted lots of attention and massive amounts of liquidity, crypto users have criticized both for their emphasis on get-rich-quick schemes. “It’s frustrating to see billion-dollar-cap memecoins overshadow hardworking teams building legit products to advance this industry,” wrote Ki Young Ju, founder of blockchain analytics firm CryptoQuant, on X this week.

Even though memecoins can show flashes of creativity and humor, Eberle noted that “we have to find more ways to lead with the power of blockchains to solve problems in new ways vs. speculative get rich opportunities.”

As Ju noted, “easy money can’t drive industry-wide progress, as shown by the 2018 ICO burst.”